On January 10, we should know whether the SEC will approve applications to have Bitcoin spot ETFs listed on various U.S. stock markets.

That will trigger a bull market in Bitcoin that will last for years, taking it to US$500,000 from US$43,000 today.

Look at what happened to the price of gold when the first gold ETFs were approved back in 2003.

Gold went from under US$400 to more than US$1800 in a span of a decade.

If the market cap of Bitcoin was to equal the market cap of gold, it would be worth more than US$600,000.

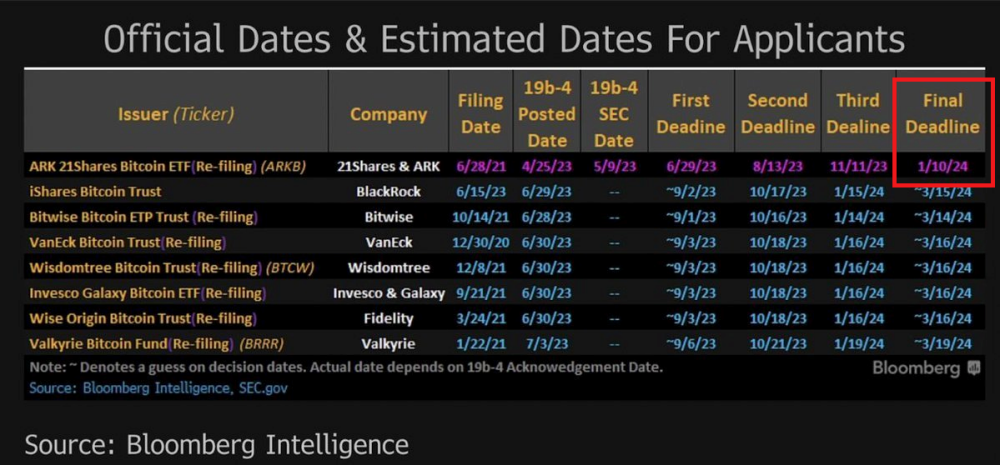

So why is next week the "deadline" for getting the SEC to approve a Bitcoin spot ETF?

Well, it has been a tortuous process, as the chart below indicates:

There are at least eight companies with an ongoing application to list a Bitcoin spot ETF.

The big one to watch is the iShares Bitcoin Trust. That's the ETF sponsored by Blackrock, which happens to have more than US$10 trillion in assets under management.

The final deadline for the SEC to rule on the iShares application is March 15. I just don't see SEC turning to reject that application just because who in their right mind would ever say "no" to Blackrock?

However, the ETF filed by 21Shares and ARK has a final deadline of January 10. In theory, the SEC could deny that application and approve it in March. But then it gets messy, especially because all the applications are almost identical.

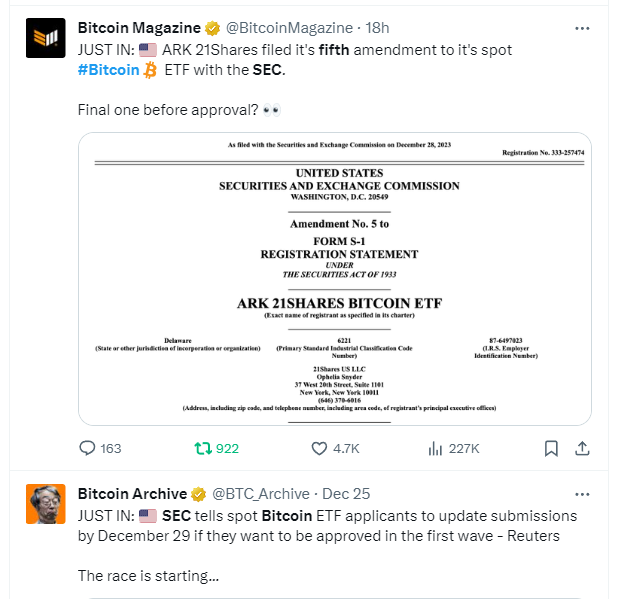

Indeed, over the last two weeks of December, there have been reports of SEC officials meeting with company representatives to go over the application and work out the finer details.

In short, everything looks set for a beautiful 2024 where we all get rich.

What could possibly go wrong?

Well, two things.

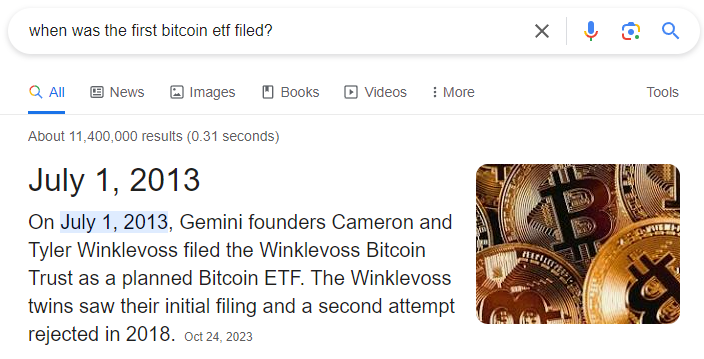

One, we have seen this movie before:

Crypto-natives have lost track of the number of times that the SEC has rejected or delayed Bitcoin spot ETFs. The process has been going on for more than 10 years!

The second problem is the head of the SEC, Gary Gensler. He is not a big fan of crypto:

"We already have digital currency. It's called the U.S. dollar. It's called the euro, or it's called the yen; they're all digital right now,"

Therefore, nobody in the world of crypto thinks this is a done deal. Everybody is nervous.

Just this morning (ed note, Wednesday, January 3), Matrixport Research released an article, "Why the SEC Will Reject the Bitcoin Spot ETFs Again," and Bitcoin tanked five percent:

What do I think?

I think it's a done deal, if not now then in March. Nobody says no to Blackrock, but I wouldn't put it past the SEC to do one final rug-pull.

But If you are an investor and in it for the long run, who cares if the floodgates open in January or March?

That's why, in November, I bought a LOT of Coinbase and told my premium subscribers all about it:

The trade has worked out very well:

Coinbase Global Inc. (COIN:NASDAQ) will be the Bitcoin custodian for most, if all, of the U.S. asset managers who will be selling Bitcoin ETFs. I predict management fees for managing the Bitcoin wallets from the start of the Bitcoin ETFs to the end of time.

I'm not planning on selling anytime soon.

Of course, one week from now, I think there could be one last big correction if the application is delayed again.

I would expect one last round of hearing the "boo-birds" on social media dumping on crypto.

Then the great big media marketing machine of Blackrock, Fidelity, and everybody else will start to ramp up, and away we go.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [DJ Dunkerley]: I, or members of my immediate household or family, own securities of: [Coinbase Global Inc.]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.