As we wrap up 2024 and head into 2025 there are many opportunities presenting themselves within the commodities sector. What stands out most prominently is the significant disconnect between precious metals equity valuations contrasted against the performance of the gold and silver price performance. The market currently offers numerous undervalued opportunities across gold and silver companies, spanning from junior producers to developers and early-stage explorers.

While reviewing overall sector trends and evaluating my portfolio's prospects for 2025, I found junior silver stocks particularly compelling. However, I'm struck by the puzzling disparity between current market valuations and those companies demonstrating consistent value creation and positive development catalysts. After recent productive conversations with various management teams and thorough analysis, I continue to find the current valuations of junior silver stocks difficult to reconcile with their fundamentals.

Applying fundamental analysis to investments can be deeply frustrating when market prices move contrary to logical expectations. While this disconnect creates opportunities for profit through market inefficiencies, I'm also cognizant of the classic John Maynard Keynes adage that "Markets can remain irrational longer than you can remain solvent."

many investors historically struggle to "buy low" during market downturns, when they are being presented with an improving risk/reward ratio. I consistently embrace opportunities to acquire high-quality companies at substantial discounts, to get in front of their eventual rerating higher.

This recent tax loss selling season has presented compelling opportunities in silver stocks, which have paradoxically declined amid positive company developments. During my year-end portfolio rebalancing, I sold positions in underperforming companies where management failed to deliver on promises. These strategic sales offset my year's trading gains while generating capital for reinvestment in existing holdings showing strong execution but lacking market recognition or in turnaround stories still being judged by their past rather than their future potential.

As we often emphasize, "the past does not equal the future," or, as hockey legend Wayne Gretzky wisely noted, "Skate to where the puck is going, not where it has been."

Optimistic Despite Price

While precious metals outperformed the elevated U.S. equity markets for much of the year, they retreated in the final two months. Though quality precious metals stocks saw substantial gains earlier, they relinquished much of these advances from October through December. Junior precious metals sentiment has deteriorated during tax loss season despite an overall positive year — presenting an excellent accumulation opportunity.

In my discussions with junior silver producers and developers, they acknowledge recent poor share price performance with a mix of frustration and puzzlement at the intense selling pressure. However, they remain confident about their operational progress and their upcoming 2025 catalysts. Their optimism at current $30 silver prices is notable, with widespread expectations of silver prices running into the mid-to-high $30s or low $40s in the coming year.

Clearly, higher prices are better, but it isn't like silver is back at $11.77 like it was during the pandemic crash of 2020, or even back down at $17.40 like it was in September of 2022. Silver is hovering on either side of $30, after having been as high as $35 briefly back in late October. This is not a terrible underlying price environment by any stretch, and the companies know that, even if retail investors have lost perspective. While management teams' optimism could be biased, fundamental and technical factors support silver spending more time in the $30s than $20s next year, with potential moves into the $40s.

Dolly Varden

I recently spoke with Shawn Khunkhun, President and CEO of Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX), about their 2024 achievements and upcoming 2025 catalysts at their Kitsault Valley Project in British Columbia's Golden Triangle.

During our pre-recording conversation, Shaun expressed genuine enthusiasm for 2025 and satisfaction with their 2024 achievements despite their stock's dramatic 41% decline from $1.46 in mid-October (when silver peaked above $35) to $0.86 last week (as silver dipped below $30).

As a Dolly Varden shareholder sitting on healthy gains, I hadn't fully grasped the severity of this recent correction until he mentioned it out loud in our conversation. The magnitude of the decline over such a brief period was particularly shocking given their consistent stream of positive news.

After this revelation, I began reviewing other silver stocks in my portfolio to assess the extent of the recent downturn.

Blackrock Silver

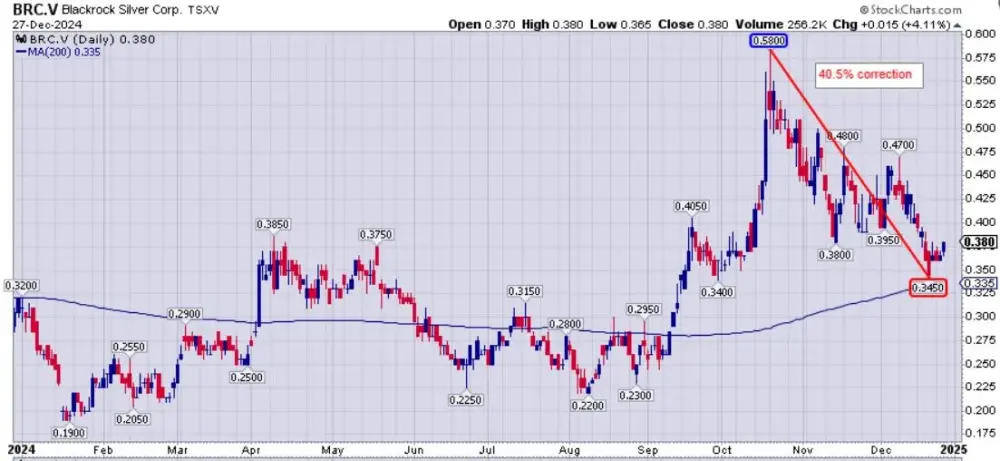

In this context, I also recently spoke with Andrew Pollard, President and CEO of Blackrock Silver Corp. (BRC:TSX.V; BKRRF:OTCQX), who shared their 2024 accomplishments and upcoming growth initiatives for their wholly-owned Tonopah West Project in Nevada.

Blackrock Silver reported positive developments in recent months, including high-grade results from their extensive 22,000-meter M&I conversion and expansion drilling program in 2024, showing both resource growth and grade improvements.

Despite that good fundamental news, their share price also sold off by just over 40%; from the recent October peak at $0.58 down to a recent low of $0.345 last week.

Why in the world are these silver exploration stocks getting creamed on the back of positive newsflow? While silver's 14% decrease from $35 to $30 during this period is significant, the magnitude of these share price declines appear excessive for advanced explorers successfully executing their development plans.

AbraSilver

Looking to see if this pattern extended beyond a few isolate cases, I examined AbraSilver Resource Corp. (ABRA: TSX.V; ABBRF:OTCQX) another prominent advanced silver explorer.

In my December 3 conversation with John Miniotis, President and CEO, and Jeremy Weyland, Senior VP of Projects and Development of AbraSilver Resource Corp, we discussed their updated Pre-Feasibility Study for the Diablillos silver-gold project in Argentina's Salta Province. The study showed markedly improved economics after incorporating the new RIGI law incentives - undoubtedly positive news for the company.

As a long-term AbraSilver shareholder, I hadn't fully registered the extent of the recent decline, as my position remained profitable, just less so. The revelation that their stock had plunged 37.4% from October's peak of $3.58 to last week's low of $2.24 was startling, especially considering their recent positive drill results and enhanced PFS economics. This continued the worrying pattern emerging across the silver sector.

Silver Tiger

Reviewing my portfolio and past conversations, I recalled my early November KE Report discussion with Glenn Jessome, CEO of Silver Tiger Metals Inc. (SLVR:TSX.V; SLVTF:OTCMKTS), about their El Tigre Project's open-pit PFS. Our conversation covered their upcoming underground PEA targeted for H1 2025 and Mexico's recent positive political shifts that could streamline mining permits.

Their positive open-pit PFS, upcoming underground drilling program for the PEA, and Mexico's improving political climate for mining permits should have supported the stock price. Instead, Silver Tiger plunged 43.6% from $0.355 in October to $0.20 last week — a decline far exceeding silver's 14% pullback. This disconnect between fundamentals and market reaction defies logic but reflects our current market environment.

Similar excessive declines are evident across other quality silver explorers and developers like Discovery Silver Corp. (OTCMKTS:DSVSF), Vizsla Silver Corp. (VZLA:TSX.V; VZLA:NYSE), GoGold Resources Inc. (GGD:TSX), Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA), and Defiance Silver Corp. (DEF:TSX.V; DNCVF:OTCBB) — all experiencing sharp selloffs despite positive fundamental developments.

Santacruz Silver

Initially, I wondered if this selling pressure was limited to pre-revenue companies. However, examining producing companies revealed equally severe declines. I reflected back on my late November discussion with Arturo Préstamo Elizondo, CEO of Santacruz Silver Mining Ltd. (SCZ:TSX.V; SZSMF:OTCQX; 1SZ:FSE), where we reviewed their Q3 2024 results from their Mexican mine and substantial Bolivian operations, including five mines, three mills, and their metals trading business.

Santacruz's Q3 2024 results showed impressive mid-tier production of 4.64M silver equivalent ounces, with a 2% increase in silver output from Q2. Despite producing more silver equivalent ounces than Silvercrest, Gatos Silver, Aya Gold, and Silver, or Endeavor Silver, Santacruz trades at just 5-10% of their market cap valuations; presenting a compelling opportunity just to rerate more in line with peer companies.

Their Q3 financials demonstrated remarkable growth: 21% revenue increase, 242% adjusted EBITDA growth, and a 505% increase in cash position year-over-year. CEO Arturo expressed even greater optimism for Q4 results.

Despite these strong fundamentals, the stock plummeted 43% from October's peak of $0.45 to December lows of $0.255.

Avino Silver & Gold

During our mid-November discussion at the New Orleans Investment Conference, Nathan Harte, CFO of Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE), shared their Q3 2024 results and outlined their strategic plan to become an intermediate Mexican silver producer through the development of the La Preciosa and Tailings Projects over the next five years.

Nathan highlighted their strong financial performance with current commodity prices, reporting a 13% production increase and 19% revenue growth from Q3 2023 while expressing optimism about Q4. Yet despite these positive indicators, ASM's stock dropped 43% from October's $1.56 peak to $0.89 — a puzzling market response to solid fundamentals.

This market reaction defies logic — a 14% drop in silver price doesn't justify nearly halving the company valuation in two months. The Q3 results don't even reflect peak silver prices from Q4, making the selloff even more irrational. There is no logic here folks… just indiscriminate selling pressure as the sentiment has hit the basement once again.

Sierra Madre Gold and Silver

This market reaction defies logic — a 14% drop in silver price doesn't justify halving company valuations in two months. The Q3 results don't even reflect peak silver prices from Q4, making the selloff even more irrational. It appears to be pure sentiment-driven selling.

In my recent conversation with Alex Langer, CEO of Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX), we discussed their milestone achievement: the start of industrial production at La Guitarra Mine, with commercial production targeted for Q1 2025. Despite this significant news and other positive developments, the market has remained unresponsive.

La Guitarra, a previously producing underground mine with a 500 t/d processing facility operated by First Majestic until 2018, was acquired by Sierra Madre in 2023. After beginning test mining in June 2024, the plant has exceeded commercial production standards by operating at 86% capacity (516 tonnes daily) for two months — well above the 80% threshold needed for industrial production status.

Typically, this pre-production phase brings share price appreciation as companies approach commercial production. Instead, Sierra Madre's stock dropped 27.5% from October's $0.70 to December's $0.425, caught in the broader silver sector decline despite hitting key operational milestones.

Guanajuato Silver

In my December 3 discussion with James Anderson, CEO of Guanajuato Silver Co. (GSVR:TSX.V; GSVRF:OTCQX), we reviewed their Q3 performance and operational updates across their extensive Mexican portfolio of five silver-gold mines and three processing facilities. The conversation covered developments at multiple sites: exploration at Pinguico and Valenciana, new filter presses at Topia, El Cubo's upcoming resource estimate and mill optimization, and the San Ignacio Mine's ore sorter commissioning.

James reported decreasing costs, improved silver production, and loan repayments, with two of their three production loans now cleared. Their El Cubo resource update showed a strategic transition — while measured and indicated resources decreased 23% after three years of mining, inferred resources surged 85% to 35.6M silver-equivalent ounces, with inferred tonnage up 179%. Despite these improvements, the stock followed the sector's pattern of steep declines.

Here is an updated interview on the expanded resources at El Cubo.

The market's response to Guanajuato's operational improvements—- lower costs, debt reduction, and significant resource expansion -—was a 47.6% decline from October's $0.315 to $0.165 last week. This severe drop contradicts rational market behavior.

From a technical standpoint, silver juniors have declined roughly 40% in two months, breaking below their 200-day moving averages — a bearish signal that may keep conservative and momentum investors sidelined until prices recover above this level. While continued weakness is possible, it seems increasingly unlikely.

Despite waves of positive news and fundamental improvements across companies, valuations have been slashed. However, Q1 historically brings strength to precious metals stocks, particularly January-February, though last year proved an exception.

Eventually, solid operational execution — good drill results, expanding resources, and improving production metrics — should attract sophisticated investors and analysts. This recognition typically leads to price improvements that then draw momentum from traders.

While I can't provide investment advice, I've been accumulating during this disconnect between valuations and fundamentals, and I plan to continue as long as this gap persists.

To read more from Shad Marquitz, you can follow him on his Substack account here.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp., AbraSilver Resource Corp., and Sierra Madre Gold and Silver Ltd., are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp.

- Shad Marquitz: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Dolly Varden, Blackrock Silver, AbraSilver, Silver Tiger, and Guanajuato Silver. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.