Gold is escaping from the 48-month box.

Expect a sharp move into 2024.

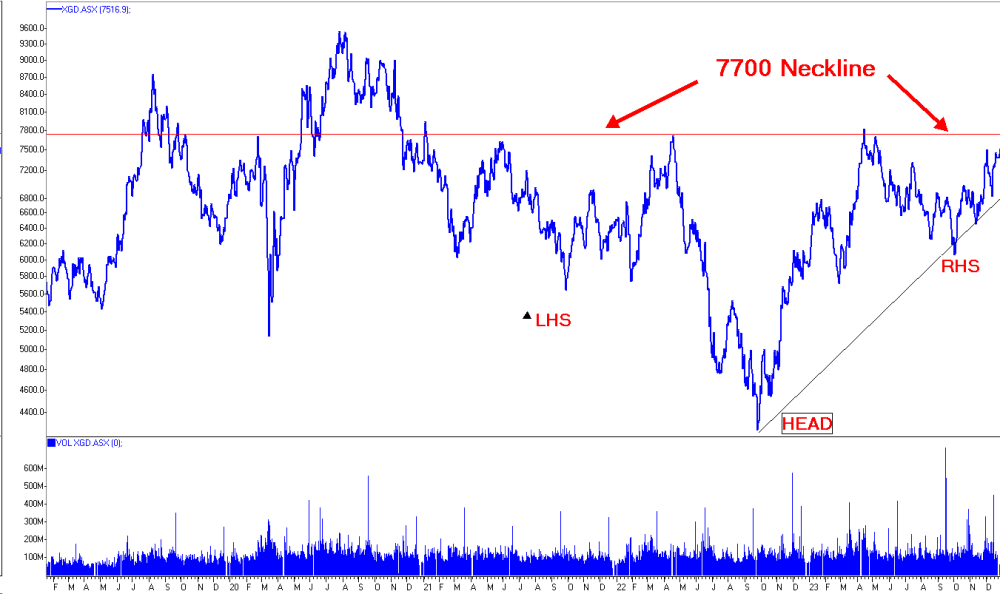

ASX Gold Index close to 7700 Neckline

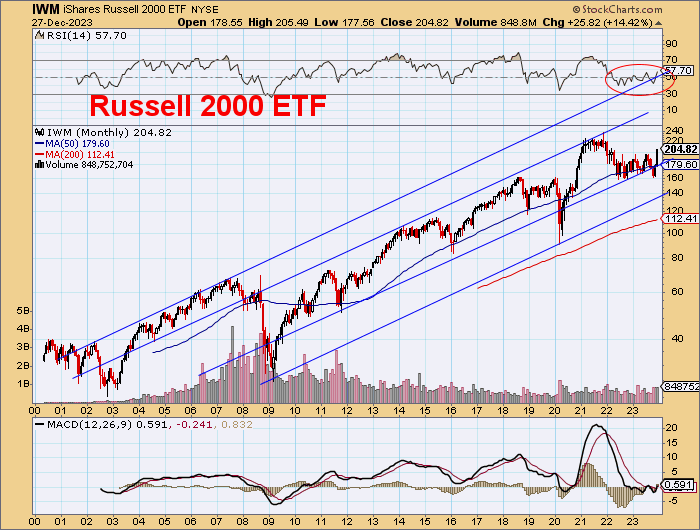

Small Caps are running again!

Gold

- US$2090 tested again

- Should soon have an out-of-the-box experience!

Gold Stocks

- XAU breaking out

- Short-term

- Medium-term

- Long-term

- Leaders in lift-off mode

- Northern Star

- Newmont

- Barrick

- Agnico Eagle

- Kinross

- Gold stocks surging against gold bullion

ASX Gold Stocks

- XGD is ready for 7700 this week

- 9000 by the end of 2023?

- New highs in January?

- Ready to break 16-year downtrend vs. AU$ gold

US Bonds

- Big fall in yields again

- Bond prices still to rise another 5% soon

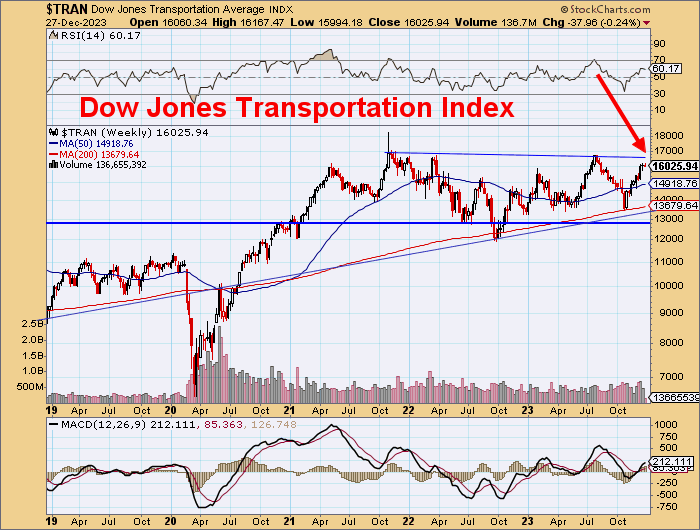

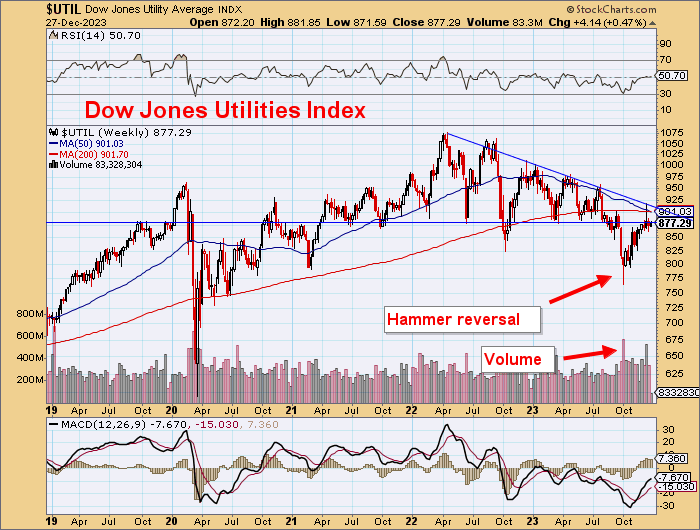

US Stocks

- DOW 30 making new highs

- Transports above to follow

- Utilities still dragging

- Real Estate ETF breaks the downtrend

- Russell 2000 Small Caps up 14% in December

Copper

- Close to US$4/lb

Gold

Historic times.

Gold has tested US$2090 today and is now 'out of the box'! Four years of constriction and suppression, but we are now away. Kitco still doesn't have its full system up again yet, but this one will do nicely for now.

Up US$30 intraday. And just note that Small Caps are finally running: Russell 2000, Biotechs, and small resources stocks.

This pattern really is working out well.

Resistance here about 190 ( ~US$2050) should break through. It should be a US$50-70 jump. Well, we got that US$50-70 jump.

The pattern here is in Wave 3, which should be accelerating from now on.

Gold is jumping out of the box after four long years.

Gold Stocks

That H&S was completed.

Now, it is consolidating at the neckline ~129 before heading much higher. This index is in Wave 3 as well, BIG Wave 3.

A nice pennant continuation pattern has developed here.

Part of the slingshot move is underway.

ASX Gold Stocks

Not long before, the Neckline and previous highs at 7700 tested.

Just 2.5% to go!

Then quickly to 9888 and new highs.

The long-term downtrend of XGD vs. Au$ gold is being broken.

Gold Stocks For You

NST – perennial – from many Christmases ago

RRL - Big rerating coming will at least double in 2024

CHN – Palladium and Nickel bottoming - massive short covering to come here – make the shorts squeal! (a precious metal stock, really!)

NVA - 10moz now (AU$6/oz) and 20moz in the next few years - already up 70% from its recent cycle low

SXG – The next DEG - >5moz coming here – stock up 245% from recent lows

TOK – 0.5moz @ 10g/t on its way to >2moz and resumed gold production

SNG - 1.3moz on its way to 3moz and more (just AU$6/oz)

ICL - Another tiny gold explorer that just might deliver something very special

TRM – Even tinier explorer looking for several million oz deposits @ 15-30g/t

LGM - NSW Epithermal gold explorer just might hit the jackpot in 2024

Copper

Close to US$4/lb.

US Stocks

Heading higher.

Get ready here.

Still waiting for this.

Small Caps

But no need to wait here.

Going ballistic!

Up 14% this month.

Head the markets, not the commentators.

| Want to be the first to know about interesting Gold, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Agnico Eagle].

- [Barry Dawes]: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.