A wave of unmanned aerial vehicle (UAV) attacks on more than a dozen commercial vessels in the Red Sea by Yemen's Houthi militants have managed to divert hundreds of ships away from the Suez Canal and toward a long-winded detour around Africa's southern coast. The canal is the gateway to the Red Sea, one of the most traversed shipping routes in the world. The sea then bottlenecks into the Bab al-Mandab Strait, a sea lane as narrow as 26km in some portions, sandwiched between Eritrea and Djibouti on the west and Yemen on the East. Ships avoiding the Red Sea and its precarious strait will add about 6,000 nautical miles and 10-14 days to their transit time between Europe and Africa. Amid risks to their crewmen and spiking insurance rates, Maersk, Hapag Lloyd, Mediterranean Shipping Company (MSC), CMA CGM, Evergreen, and BP are among the firms that have announced that they will be pausing their ships' journeys in the Red Sea.

In response to the Houthi attacks, the U.S. is leading a multinational coalition meant to defend civilian vessels moving through the Red Sea. Per U.S. Secretary of Defense Lloyd Austin, Operation Prosperity Guardian will be undertaken in partnership with the UK, Bahrain, Canada, France, Italy, the Netherlands, Norway, Seychelles, and Spain. The most common weapon of choice for the Houthis is the increasingly popular kamikaze-style drone. These UAVs carry a payload of explosives and are meant to crash directly into their target.

As of December 19, U.S. Navy destroyers have shot down 38 drones and multiple missiles in the Red Sea over the past two months. However, 14 of those drone downings occurred last Saturday. That indicates that the Houthis are scaling up their attacks and, moreover, they could eventually use coordinated swarms of drones to try and overwhelm the resources of more advanced military powers. A U.S. destroyer will only be able to fire so many missiles before it needs to return to a dock to re-fit and re-arm. When dealing with drone fleets of hundreds or thousands, this could become an overwhelming burden. Ukrainian military command has recently disclosed plans to produce one million (first-person view) FPV drones, as well as more than 11,000 medium and long-range attack drones next year to aid in their defense against the ongoing Russian invasion.

In generating our in-depth coverage of the war in Ukraine and its implications for investors, MRP has viewed video footage from the battlefield dominated by clips of small kamikaze drones flying directly into armored vehicles, artillery launchers, and other expensive equipment, as well as dropping grenades into trenches and neutralizing the defensive advantage these fortifications can provide. Not only are the frequency of drone-based assaults a concern for U.S. air defense capabilities but the cost imbalance as well. The payloads of small, improvised drones can punch well above what their cost would suggest, damaging or completely destroying multimillion-dollar tanks, air defense systems, and artillery pieces. Politico reports that the cost of using expensive naval interception missiles can run up to $2.1 million a shot. Their targets in the Red Sea are typically cheaply-made drones — estimated to cost just a couple thousand dollars. We've previously noted that improvised FPV drones being utilized on both sides of the Russo-Ukrainian war can deal significant damage to armored vehicles and other critical military equipment at a cost of just $200 – $400.

Like Yemen's Houthis, Lebanon's Hezbollah militant group has received material support from Iran, a global powerhouse in the manufacturing of combat drones. Hezbollah was estimated to have access to approximately 2,000 drones in 2021, according to Israeli think tank Alma. These would not only include quad-copter-style commercial drones but augmented Shahed drones built by Iran, which have become popular weapons in the Russian military as well. Last August, the Washington Post reported that Russia is aiming for the domestic production of 6,000 Shahed variant drones (called Geran-2 by Russia) by summer 2025, compounding the impact of at least 400 drones it had previously purchased from Tehran. One of the downed drones in the Red Sea has been ID'd by U.S. Central Command as "an Iranian-produced KAS-04 system, " referred to as a Samad drone. Samads are the primary UAV line weaponized by the Houthis. We've more recently seen drone strategies picked up by the Palestinian militant group Hamas, utilizing commercial-style copter drones to target Israeli Merkava tanks with mortar rounds.

UAV technologies and counter-drone warfare are clearly set to become a much more critical pillar of all capable combat forces. As MRP noted in October, The North Atlantic Treaty Organization (NATO) is now in the process of adopting its first-ever counter-drone doctrine, which is expected to be established by the end of the year. Not only will the US military need to develop a novel strategy to weaponize FPV drone-based munitions systems, but it will also need to formulate strategies to counter them as well. Whether that means shooting down high-tech, long-range Shahed drones or disabling the use of improvised quadcopters, all efforts will undoubtedly require billions of dollars in funding from the Pentagon.

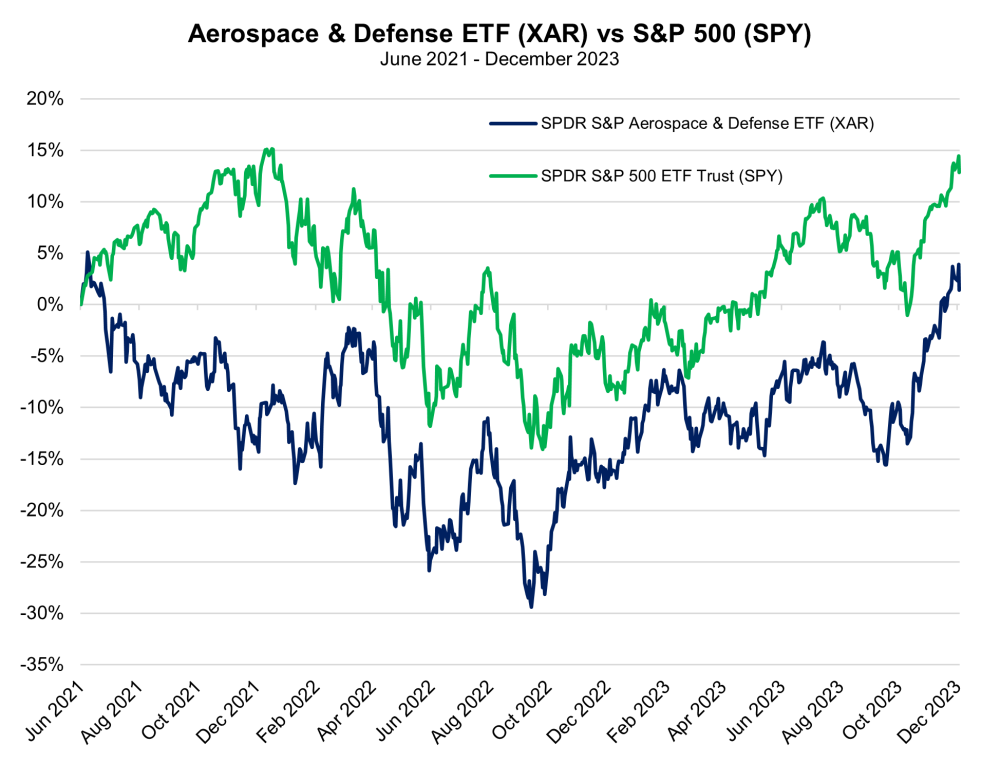

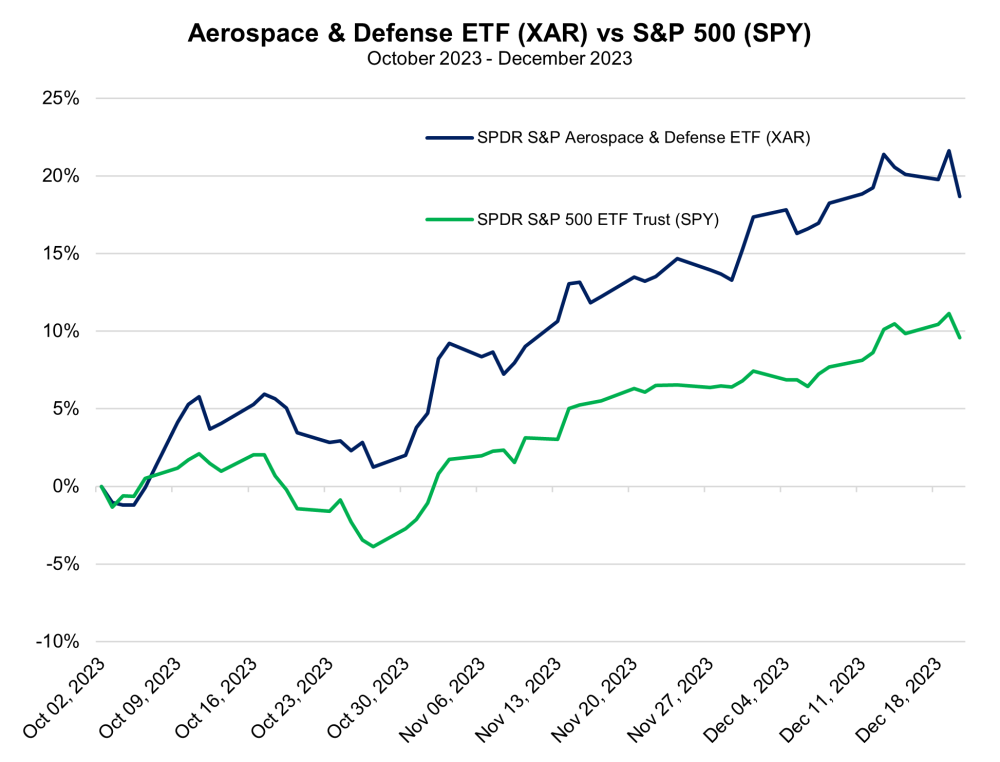

Charts

| Want to be the first to know about interesting Special Situations and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.