Reyna Gold Corp. (REYG:TSX.V; REYGF; OTCQB) along with Reyna Silver Corp. announced in a press release that it has released the exploration report for the company's Gryphon Summit property, which is comprised of 10,300 hectares in Nevada. The report will include thirty years of data collected on the property and include strategic assay results, including the Agnico Eagle 3,090 drill program.

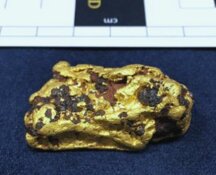

Data points included in the report, which totaled 3,070 rock samples, were collected between 1999 and 2021. The report stated that the company found 24.2 grams per tonne (g/t) of gold (Au) in this time frame, and six rock samples reported greater than 10 g/t Au. Drill hole GG22-007 found 8.60 g/t Au along 1.52m at a depth of 11.43m and 5.50 g/t Au along 2.90m at a depth of 10.05m.

Jorge Ramiro Monroy, the CEO of Reyna Silver and Executive Chairman of Reyna Gold, commented," The major's shallowly focused programs succeeded in finding strong indications of Carlin-type gold mineralization but did not follow them to depth, while CRD type mineralization encountered in these gold programs was largely ignored despite the district's history of silver-dominant CRD mining."

Gold Prices At US$2,150 Per Ounce

McAlinden Research released a report on December 5, 2023, focused on the surging gold market, which recently reached highs of US$2,150 per ounce, representing an increase of 16.5% since January.

According to McAlinden, gold could be developing a relationship with cryptocurrencies as both are seen by some investors as safe-haven investments, and share characteristics of scarcity.

Stockhead released a report on the gold market the day before, on December 4, 2023, and reported that gold prices had been driven up by international tensions and conflict in the Middle East, as well as the anticipation that the U.S. Federal Reserve could cut rates in 2024.

A Zero Brainer

In January of 2022, Bob Moriarty of 321 Gold reviewed Reyna Gold and commented that "Reyna Gold is a zero-brainer. The greatest geologist in Mexico backs it. That's all you need to know. With an enterprise value under CA$11 million, what else is important."

Technical Analyst Clive Maund reviewed the company on April 13, 2023, and spoke very favorably about the company. Maund stated, "The conclusion is that Reyna Gold is starting a major bullmarket… If you didn't buy it close to the open in response to this morning's email, then it is considered to be worth buying on any short-term pullbacks or after it has stopped to consolidate in a satisfactory manner, such as in a bull Flag."

Reyna has several catalysts to report, according to its investor presentation, including an exploration program and a drill program planned for 2024, as well as an initiative to re-log the entirety of its existing core.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Reyna Gold Corp. (REYG:TSX.V; REYGF; OTCQB)

Reuters provided a breakdown of the ownership and share structure, where management and insiders own approximately 6.46% of the company. According to Reuters, CEO Michael Andrew James Wood owns 2.66% of the company with 1.78 million shares, Executive Chairman Jorge Ramiro Monroy owns 2.60% of the company with 1.74 million shares, Director Alexander Langer owns 0.60% of the company with 0.41 million shares, Director Peter Rhys Jones owns 0.30% of the company with 0.20 million shares, Director Stephen Blake Robertson owns 0.15% of the company with 0.10 million shares, and Director Castulo Molina owns 0.15% of the company with 0.10 million shares.

Strategic investors, in the form of Reyna Silver Ltd. own 6.71% of the company with 4.50 million shares, stated Reuters.

According to Reuters, there are 67.11 million shares outstanding with 58.28 million free float traded shares, while the company has a market cap of CA$2.73 million and trades in the 52-week period between CA$0.04 and CA$0.18.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Reyna Gold Corp. and Reyna Silver Corp.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.