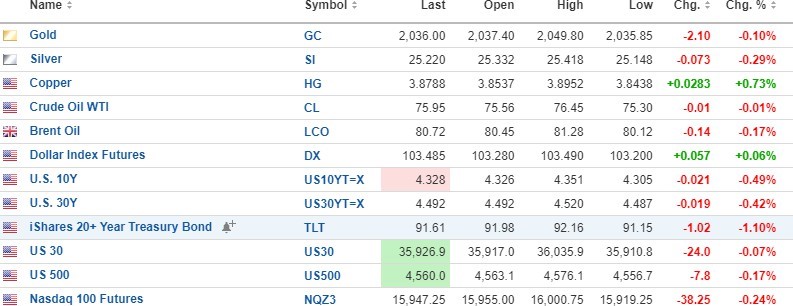

The first trading day of the last month of 2023 begins with gold and silver lower, copper and oil slightly higher, bond yields lower, and equities called lower. The U.S. Dollar index is slightly higher. The Institute of Supply Management ("ISM") manufacturing report comes out at 10:00 a.m. and is usually a good thermometer (as opposed to a barometer) of economic activity in the U.S.

If this number comes in lower than October's 46.7 reading, it could spark "hard landing" fears, sending stocks reeling after the best monthly performance of the year in November.

Stocks are now solidly in the overbought category and could be vulnerable to a correction. Typically, the first two weeks of December are on the weak-ish side, with the bulls returning around the end of the third week of the month. The first part of the month tends to be weaker as tax-loss selling and year-end portfolio restructuring begins. December's first trading day has been bearish for the S&P 500 and Russell 1000 over the last 21 years.

I am currently long a few special situations like Cameco Corp. (CCO:TSX; CCJ:NYSE) and Energy Select Sector SPDR Fund (XLE:NYSEARC) by way of March calls, but I am sitting on an extremely large cash position thanks to profits in the SPY and TLT calls sold late last month at or near the top of the move.

I let recency bias affect my judgment on the VanEck Gold Miners ETF (GDX:NYSEARCA:) and VanEck Junior Gold Miner ETF (GDXJ:NYSEArca) trades back in mid-November and am now sadly sidelined with only Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) as my proxy for gold prices, excluding, of course, my physical gold and silver holdings that are never more than a few feet from my Remington 870.

If you go back to Email Alert 2023-127 sent out on October 5, it included the same CNBC Fear- Greed Indicator shown above but was registering a reading of "21" <EXTREME FEAR> versus this morning’s reading of "67" <GREED>. Cameco Corp. (CCO:TSX; CCJ:NYSE)

The buying opportunity I identified in October is no longer present here at the start of December, so while everyone and their pet canaries are now bellowing "YEAR-END RALLY" (followed by twenty-seven exclamation marks), it is time to be either very modestly long a few special situations or standing aside.

The best individual stock trade for the year may turn out to be Cameco Corp. (CCO:TSX; CCJ:NYSE), whose performance after the last earnings report has been shockingly good.

I normally use "blowout earning" as an excuse to take profits but as I said back in October when they last reported, I had never seen a CEO of a miner ever talk of "the best condition he has ever seen" as forward guidance for the company.

So far, as the stock probes prices at all-time highs, he is being proven absolutely correct, as am I in owning the CCJ March $40 and $45 calls.

Sign up for our FREE newsletter

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp. and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Cameco Corp. My company has a financial relationship with: Cameco Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.