Six weeks ago, I sent out Email Alert 2023-131 that told everyone that I was adding to Norseman Silver Ltd. (NOC:TSX.V; NOCSF:OTCQB) in the CA$0.035-$0.05 range. I added another 200,000 to the 800,000 I owned in the 2023 Trading Account to arrive at a new cost of US$0.1105.

I want to remind you all of the email I sent out in late August of 2022 regarding the former Allied Copper Corp. (now Volt Lithium Corp. (VLT:TSV;VLTLF:US)) when it was trading anemically below CA$0.10 with little interest and no direction. At that time, contacts close to the deal indicated that there was a deal in the works that would change direction and install a new team. I urged all subscribers to buy the stock under CA$0.10 where it stayed briefly but then popped quickly to CA$0.165.

Tax-loss selling by non-subscribers hammered it back to CA$0.07 by late December, but shortly thereafter, the ascent began with a move to CA$0.55 by May 24. Even after a broad lithium correction since then, the new VLT/VLTLF is still up over triple its August price.

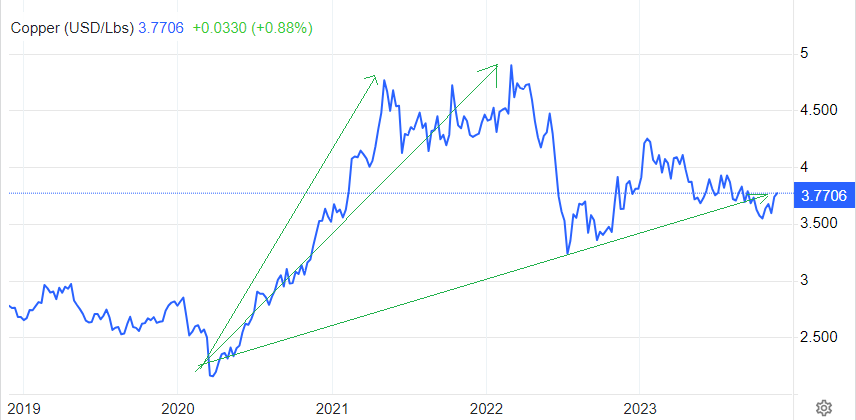

I cannot elaborate but I am on record as stating that my three favourite metals for above-average performance in 2024 are uranium, lithium, and copper. The first two have already experienced geometric advances in price since 2020 while copper is still lagging on the faulty narrative that supply is weighing down on price due to recessionary behavior in the Chinese economy. That is a false narrative.

Uranium is up over 400% in the last eight years and with fifty-seven different nuclear reactors under construction around the world, the future looks bright.

The copper price had false starts into 2021 and 2022 as the pandemic-triggered shutdowns curbed global production, but those bottlenecks were unclogged in 2022 and 2023, leading to a correction which ended in late 2022. Copper is now poised to replicate the exponential moves previously seen its other two electrification brethren.

Norseman Silver management sees this trend and is moving aggressively to take full advantage of the morass called the "junior mining market," where poor funding environments are allowing premium, advanced assets to become available at prices a fraction of where they were at the height of the pandemic-driven shortages. A much healthier environment of pure demand driven by the need for increased supply for transmission lines (wires) and electric vehicle components is creating an investment opportunity for the ages.

Many of you missed the move in Volt from the lows. I do not want you to miss the move in NOC/NOCSF from similar lows here in late November.

- Add to Norseman Silver at a CA$0.10 / US$0.075 limit.

- Target Price: CA$0.55 / US$0.40 by Q2/2024.

Want to be the first to know about interesting Cobalt / Lithium / Manganese, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Norseman Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Norseman Silver Ltd. and Volt Lithium Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Norseman Silver Ltd. and Volt Lithium Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.