Newly trading company North Shore Uranium Ltd. (NSU:TSXV), with projects near mills and mines that produce 100% of the uranium in Canada, is looking to become a "major force" in the exploration of the important uranium deposits in Saskatchewan's world-class Athabasca Basin.

The company is fully funded to start drilling for uranium in Q1 2024 on its highly prospective Falcon project as analysts call for a growing supply-demand deficit, with uranium prices hitting their highest levels since 2008 — US$80 a pound today.

"The existing uranium supply shortage will only get worse in the coming years and anybody who makes a new discovery in uranium, especially in Saskatchewan's world-class Athabasca Basin, will be well-positioned to capitalize. Our highly prospective Falcon and West Bear properties, with high-quality drill-ready targets at Falcon, are located near extensive infrastructure, including active uranium mills. Important discoveries in settings like this can become very, very valuable assets," noted North Shore President and Chief Executive Officer Brooke Clements, a geologist with more than 35 years of experience in the industry.

According to a recent report by the World Nuclear Association, demand for uranium for nuclear reactors is expected to climb 28% by 2030 and nearly double by 2040 as governments work toward meeting zero-carbon targets.

According to a recent report by the World Nuclear Association, demand for uranium for nuclear reactors is expected to climb 28% by 2030 and nearly double by 2040 as governments work toward meeting zero-carbon targets.

"From the beginning of the next decade, planned mines and prospective mines, in addition to increasing quantities of unspecified supply, will need to be brought into production," the report said.

In general, global nuclear power-generating capacity is expected to rise 82% to 792 gigawatts by 2050 as the world transitions from fossil fuels, the International Atomic Agency said.

"Uranium is the one energy source that could satisfy every Millennial and Gen-Xer on the planet; zero pollutive impact anywhere and a reliable, cost-effective means of heating the planet and recharging Elon Musk's vehicles," industry observer Michael Ballanger wrote. "Handled properly, nuclear power is truly the alternative for coal and oil and natural gas."

The Catalyst: With Neighbors Like These

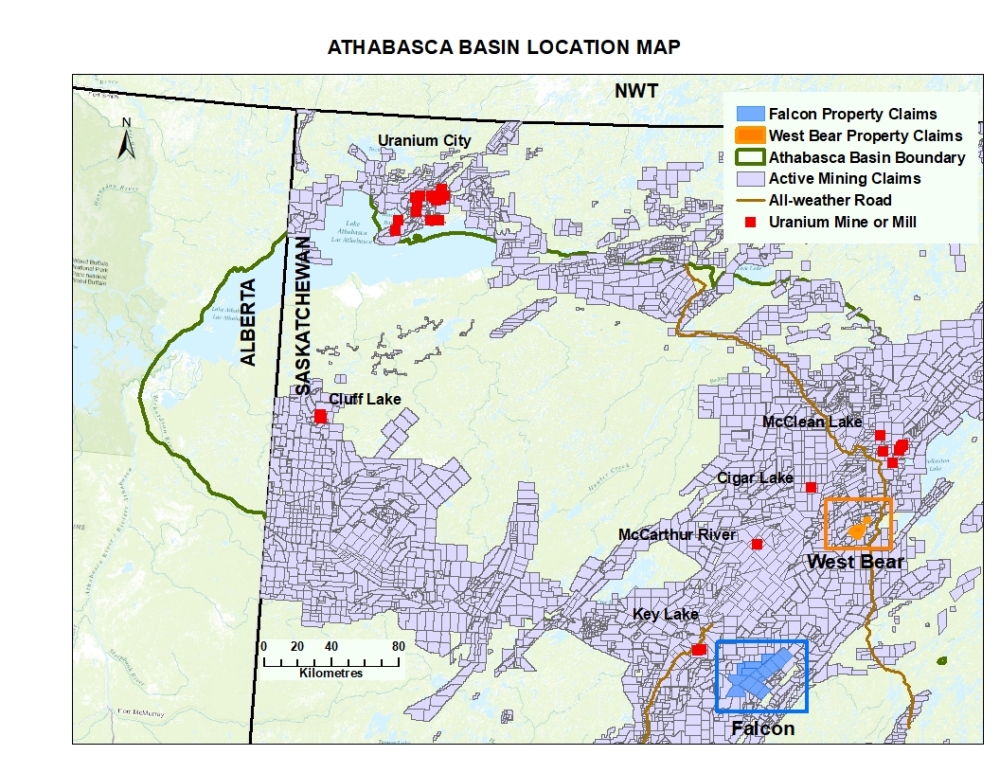

North Shore's uranium projects abut the eastern edge of the Athabasca Basin, near Cameco Corp.'s Cigar Lake and McArthur River mines and the two mills that serve them.

McArthur River and Key Lake are the world's largest high-grade uranium mine and mill complex, Cameco said, collectively producing 535 million pounds of uranium since 1983. Cigar Lake is the world's highest-grade uranium mine and has produced 105 million pounds of uranium since 2015.

Two of the company's other neighbors on the eastern margin of the Athabasca Basin that have made high-profile uranium discoveries are: 92 Energy Ltd. and Baselode Energy Corp.

Multiple highly prospective targets have been selected at both Falcon and West Bear using new geophysical data and publicly available electromagnetic (EM) and geological data.

Drilling at 92 Energy's Gemini project intersected thick zones of mineralization, including 17.5 meters at 0.38% U3O8, including 2 meters at 0.82% U3O8, and 0.5 meters at 0.94% U3O8.

Baselode's results at its ACKIO discovery on its Hook property included 10.5 meters at 0.28% U3O8, 3.6 meters at 0.69% U3O8, and 7.5 meters at 1.67% U3O8, including 5 meters at 2.45% U3O8.

North Shore controls more than 60,000 hectares at its Falcon and West Bear projects. Holes drilled at Falcon in 2008 showed elevated uranium values up to 0.235% U3O8, according to the company. However, the company is now focused on evaluating high-quality drill-ready targets that were not previously tested.

"We've got lots of new proprietary and publicly available geophysical data, and we've defined a lot of conductors," Clements told Streetwise Reports. "We're working hard with our consultants . . . to optimize our first drill program to drill test the best possible spots and position ourselves for future programs."

Multiple highly prospective targets have been selected at both Falcon and West Bear using new geophysical data and publicly available electromagnetic (EM) and geological data.

"Falcon is a property with over 60 kilometers of well-defined EM conductors that have not been tested and uranium-bearing boulders and structures that have not been adequately explained. We are very excited to start our first drilling campaign in Q1 2024." Clements said.

Nuclear Power's Resurgence

Uranium from mining is used primarily as fuel for nuclear fission in power plants, but it is also used in the medicine, food production, and space industries. There are currently about 440 nuclear reactors operating worldwide, with about 60 under construction and a further 430 planned or proposed, according to the World Nuclear Association. In 2022, they provided about 10% of the world's electricity.

The sector suffers from the stigma surrounding the risk of radiation and accidents — like those at Chernobyl and Fukushima — and the element's use to power nuclear bombs. However, new studies show other energy-producing sectors are more dangerous than nuclear energy.

In fact, the coal industry accounts for as many as 120 deaths per year compared to less than 0.01 deaths per year in the nuclear industry, according to the World Nuclear Association.

Critically, nuclear power plants produce carbon-free baseload energy 24/7, which is essential for achieving emission-reduction targets. Investors are hoping nuclear power will have a resurgence as governments attempt to turn away from fossil fuels.

Ownership and Share Structure

Insiders, management, and strategic investors account for 50% of the company's shares, according to the company. CEO Brooke Clements owns 3.08%, with 1.13 million shares.

The rest, about 50%, is retail.

North Shore's market cap is about CA$5 million, with 36.81 million shares outstanding. Since October 31, it has traded in a range of CA$0.30 and CA$0.13.

Sign up for our FREE newsletter

Important Disclosures:

- North Shore Uranium Ltd. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of North Shore Uranium Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.