Volt Lithium Corp. (VLT:TSV;VLTLF:US) has provided an operational update that confirms the company's continued acceleration of its business strategy to focus on commercial extraction of lithium from oilfield brines across North America.

In a news release, Volt revealed the pilot plant operations at the company's flagship Rainbow Lake Lithium Project in Northwest Alberta had been successfully conducted in spring 2023 at its Regina, Saskatchewan facilities.

The company has also commissioned its permanent Demonstration Plant, which is capable of testing oilfield brines from multiple basins across North America at one time.

Technical analyst Clive Maund wrote on October 16 that Volt "looks ready for renewed advance and is therefore rated an Immediate Buy here."

According to its website, Volt Lithium "is a lithium development and technology company aiming to be North America's first commercial producer of lithium hydroxide and lithium carbonates from oilfield brine."

Its project at Rainbow Lake consists of around 430,000 acres of land and over 1,300 producing wells "from which to source brine, creating a strong foundation to continue developing assets with the goal of increasing the resource estimate and further expanding high lithium concentrations."

The Current Catalyst

The aforementioned permanent Demonstration Plant incorporates technology improvements over the proven plant for the Rainbow Lake brine, which will subsequently open up "vast market opportunity to process oilfield brines from any basin across North America."

This will effectively give the company the ability to use its proprietary DLE (Direct Lithium Extraction) technology to extract lithium, whatever the brine's original lithium concentrations.

It's expected that the results from the permanent Demonstration Plant will inform Volt's preliminary economic assessment (PEA) for Rainbow Lake.

A Closer Look at Lithium

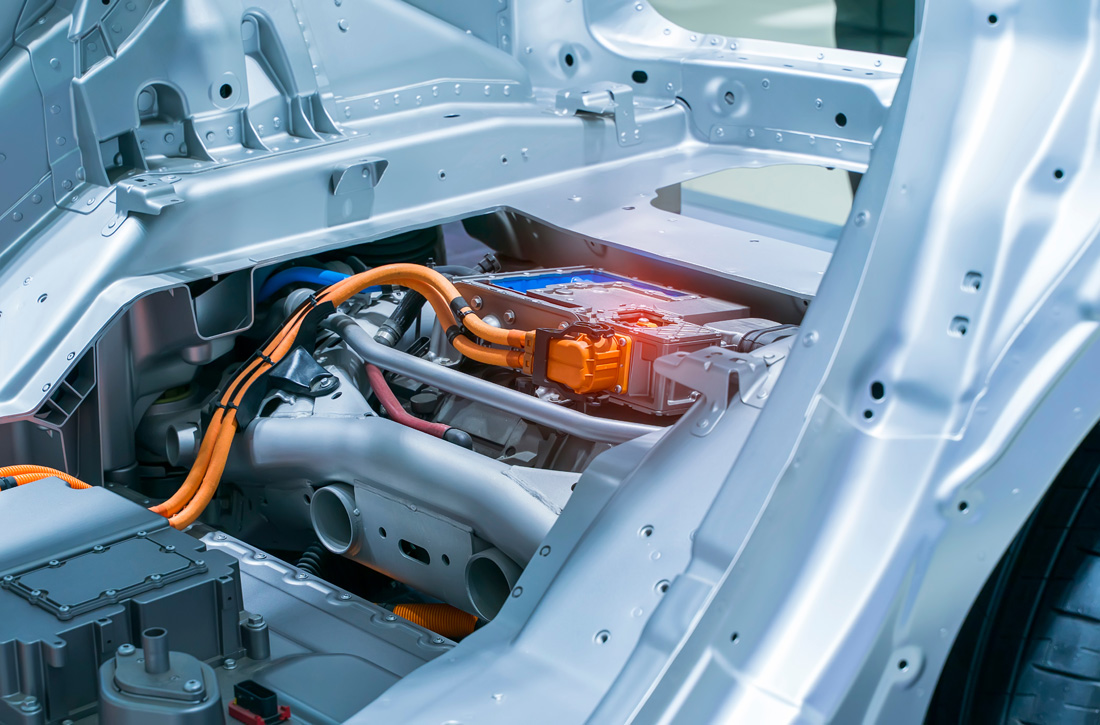

According to the Royal Society of Chemistry, lithium "has the lowest density of all metals," and it "reacts vigorously with water." It's essential in the manufacture of rechargeable batteries for cell phones, laptops, digital cameras, and, crucially, in a world that's slowly but surely moving toward a more sustainable future, electric vehicles.

The International Energy Agency predicted that "almost one in five new cars sold in 2023 will be electric." Lithium will play a huge role in meeting that demand.

Volt Surges Ahead

According to the company, it has "developed a lithium extraction technology targeting low-concentration lithium from oilfield brines" and has "successfully completed a pilot program announcing up to 90% extraction capabilities using our technology."

It purports to be the "only lithium extraction company targeting this sector that has successfully extracted lithium from oilfield brines."

It has also referred to companies like EXXON and Chevron, who have "both recently announced that lithium extraction from their oilfield brines will become a future core competency once the technology is commercialized."

Upcoming Catalysts

The company recently closed financing and will look to provide deliverables over the next two months, which will include a published PEA and the completion of the permanent pilot this month, as well as additional technology improvements further down the line.

Volt had also previously announced strategic collaborations with research labs at the University of Alberta in Edmonton. The collaborations are "designed to leverage nanotechnology and water processing expertise to remove contaminants from oilfield brine to be used for the Company's proprietary direct lithium extraction (“DLE”) technology."

Michael Ballanger proposed that "Volt will be a huge winner for all that own it because, in the current environment, proximity to cash flow generation sets it apart from any of the hard-rock developers or explorers."

Technical analyst Clive Maund wrote on October 16 that Volt "looks ready for renewed advance and is therefore rated an Immediate Buy here." He referenced its latest 6-month chart, which shows that "after a strong runup in August . . . it had a normal reaction back and in recent weeks a small base pattern has formed in the vicinity of its rising moving averages and it has started to firm up ahead of another upleg starting." He concluded by saying it "is therefore viewed as a good time to buy Volt or add to positions."

Michael Ballanger of GGM Advisory Inc. wrote that "lithium is relevant to the current and highly-popular "Electrification Movement," while gold is not." He went on to explain that he continues "to hold [his] position in GTCH/GGLDF despite being heavily tempted to switch it to Volt." He proposed that "Volt will be a huge winner for all that own it because, in the current environment, proximity to cash flow generation sets it apart from any of the hard-rock developers or explorers."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Volt Lithium Corp. (VLT:TSV;VLTLF:US)

Ownership and Share Structure

Headquartered in Calgary, Alberta, Volt Lithium Corp. has a market cap of CA $26 million. It has 130,303,604 shares, 33,739,180 warrants, and 7,765,000 options.

The company currently has CA$5 million in the bank and a monthly burn rate of CA$100,000. It trades at a 52-week range of CA$0.13 and CA$0.55.

According to the company, management and insiders own 16.65% of the company.

James Alexander Wylie owns 8.74% of the company with 11.38 million shares, Martin Scase owns 4.97% with 6.44 million shares, Warner Uhl owns 0.88% with 1.15 million shares, Morgan Tiernan owns 0.39% with 0.50 million shares, Maury Dumba owns 0.49% with 0.64 million shares, and Kyle Robert Hookey owns 1.180% with 1.54 million shares.

9% is with institutional investors.

The rest is with retail.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- Lauren Rickard wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.