Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC; JLM:FSE) announced that two of its associated hydrogen hubs have been selected for the U.S. Department of Energy's Regional Clean Hydrogen Hubs (H2Hubs) program and up to US$1 billion in funding each.

The Midwest Alliance for Clean Hydrogen (MachH2) and the Pacific Northwest Regional Hydrogen Hub (PNWH2) were among 33 of 79 proposals invited to proceed with the final application for funding. Seven were chosen.

"We are thrilled that the DOE has selected the MachH2 and PNWH2 coalitions, of which we are proud members," Jericho Chief Executive Officer Brian Williamson said. "We are poised to contribute to this initiative with our patented, zero-emission hydrogen-fueled boilers, enhancing clean industrial and commercial steam production. … Our aspiration aligns with DOE's vision of a nationwide clean hydrogen infrastructure, and we are hopeful that JEV's green hydrogen-focused industrial decarbonization projects will be a contender for inclusion across all H2Hubs."

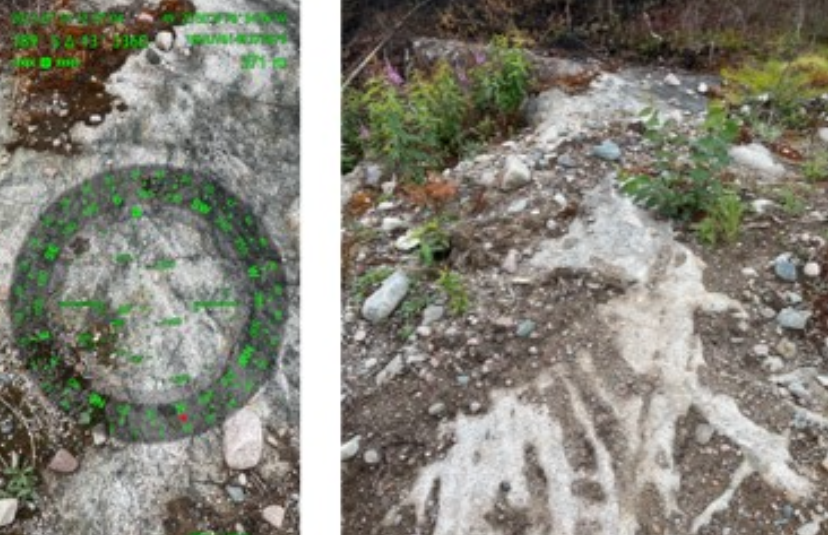

Jericho subsidiary Hydgrogen Technologies' Dynamic Combustion Chamber™ boiler burns hydrogen and oxygen in a vacuum chamber to create high-temperature water and steam with no greenhouse gases or other pollutants.

The only by-product is water, which is recycled. It's meant to replace existing boilers that burn coal, natural gas, diesel, or fuel oil.

The Catalyst: 'A Buying Opportunity' for Clean Energy Stock

The boilers are being considered for deployment at major facilities around the world, with feasibility studies being conducted or considered at dozens of locations, the company has said.

Marina Domingues, a senior analyst on independent Norwegian research house Rystad Energy's Clean Tech team, told Hydrogen Insight that the hubs should encourage more investment in clean hydrogen, a sector where banks have been reluctant to shoulder risk.

Over the past month, Jericho has "reported several promising updates which reaffirm our investment thesis and target price," analyst Nicholas Cortelluci of Atrium Research wrote in a September 26 research note.

"The hubs will show the financial community where they can invest their money and get their return," Domingues said. "It reduces the technical risk because the government is investing, and because demand is baked into the proposal, it makes hydrogen projects more bankable."

Over the past month, Jericho has "reported several promising updates which reaffirm our investment thesis and target price," analyst Nicholas Cortelluci of Atrium Research wrote in a September 26 research note.

The stock was at CA$0.23 per share Wednesday after hitting CA$0.33 this summer. Since that time, the company "has only reported progressively strong announcements," including strong test results for a new iridium-free catalyst, a memorandum of understanding (MOU) to supply hydrogen to a leading supplier in Europe, and a new patent for Hydrogen Technologies' DCC™ boiler, Cortelluci noted.

The analyst put a Buy rating on the stock with an unchanged CA$0.50 per share target price.

"We view the pullback as a buying opportunity ahead of boiler sales orders," Cortelluci wrote. "We continue to elect to value the investment at cost given the lack of visibility and await a value-creation event (i.e., takeout). Our estimates and valuation remain unchanged."

'Faster Action Is Required'

Funded by President Joe Biden's Infrastructure Law, the seven hubs are meant to help start a network of hydrogen producers, consumers, and infrastructure while supporting the production, storage, and delivery of the element. The winners were announced on October 13.

The H2Hubs are expected to produce 3 million metric tons of hydrogen every year, reaching nearly one-third of the 2030 U.S. production target and lowering carbon emissions.

Hydrogen is the most plentiful element in the universe, but it doesn't occur on its own naturally on Earth. It needs to be separated from water or hydrocarbon carbons using electrolyzers.

But in order to meet a net-zero emissions goals, the world needs more hydrogen technology and projects, the International Energy Agency wrote.

"Faster action is required on creating demand for low-emission hydrogen and unlocking investment that can accelerate production scale-up and deployment of infrastructure," the agency wrote.

The hydrogen market has the "potential for near-zero greenhouse gas emissions," the DOE said. "Hydrogen generates electrical power in a fuel cell, emitting only water vapor and warm air. It holds promise for growth in both the stationary and transportation energy sectors."

It's also a "uniquely versatile energy carrier," according to a report by the Hydrogen Council.

"It can be produced using different energy inputs and different production technologies," the council noted. "It can also be converted to different forms and distributed through different routes — from compressed gas hydrogen in pipelines through liquid hydrogen on ships, trains or trucks, to synthesized fuel routes."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC; JLM:FSE)

The company is also collaborating with a "leading global alcoholic beverage company" to study using the boilers at production facilities in four countries and recently announced it was partnering with two other companies to manufacture, implement, and service a new DCC™ boiler-based hydrogen steam plant called the HSP3000 that will come pre-assembled in container-sized units and eliminate the CO2 equivalent of about 5,000 cars.

Ownership and Share Structure

Around 35% of Jericho's shares are held by management, insiders, and insider institutional investors, the company said. They include CEO Brian Williamson, who owns 1.25% or about 3.1 million shares; founder Allen William Wilson, who owns 0.79% or about 1.97 million shares; and board member Nicholas Baxter, who owns 0.46%, or about 1.14 million shares, according to Reuters.

Around 10% of shares are held by non-insider institutions, and 65% are in retail, the company said.

JEV's market cap is CA$57.07 million, and it trades in a 52-week range of CA$0.44 and CA$0.21. It has 248.14 million shares outstanding, 178.38 million of them floating.

Sign up for our FREE newsletter

Important Disclosures:

- Jericho Energy Ventures Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Energy Ventures Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.