Fireweed Metals Corp. (FWEDF:OTCMKTS;FWZ:TSX.V), previously known as Fireweed Zinc Ltd., has recently completed a geophysical survey at its Gayna project in Canada's Northwest Territories.

The low-impact ground gravity survey took three weeks to complete and provided infill coverage of the 2022 grid, covering targets A, B, C, F, and L. The grid was also expanded in order to include additional reef-margin targets.

The survey found that exploration was targeting reef-margin high-grade massive sulfide mineralization. The 2022 geophysical program identified two areas containing gravity anomalies, consistent with Kipushi-style targets.

It's hoped that this most recent survey will expand the gravity coverage in order to identify new anomalies and refine existing ones for future drill testing.

In its October 2023 issue, The National Investor named Fireweed as the exception to "most everything/everyone" remaining in "wallflower status."

According to its website, Fireweed is "a Canadian mining exploration and development company focused on advancing the Macmillan Pass and Mactung Projects." Its vision is to "explore and develop critical minerals assets to support the transition to a low-carbon economy."

As well as the company's zinc project at Gayna, other projects include Macmillan Pass and Mactung, which focus on zinc and tungsten, respectively.

The company is "leveraging [its] local and regional knowledge to create a new world-class critical metals district in Yukon, Canada."

Why Zinc?

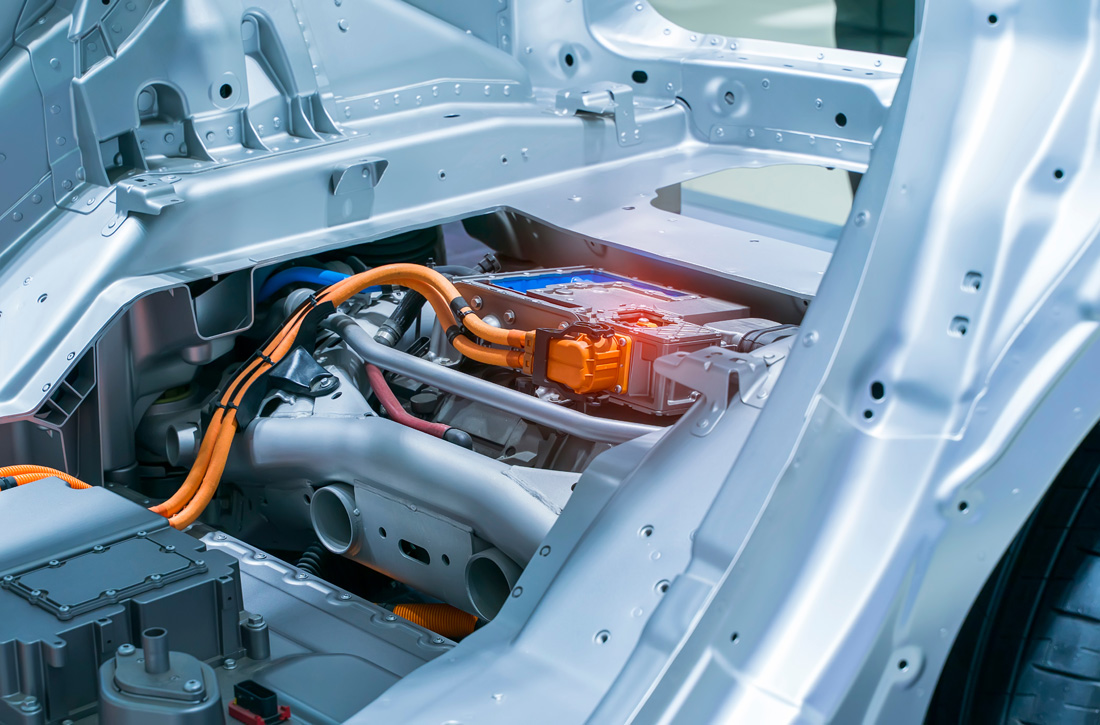

As well as being a key element in the galvanization of other metals to prevent rust, zinc is also crucial in the manufacturing of batteries, which is why it's so important in the fight for a low-carbon future and the transition to renewable energy.

The Assay reported that zinc is "the world's fourth-most widely consumed base metal."

According to a report by Fireweed, "geopolitical conflict and resource nationalism are fueling critical metals focus."

The Catalyst

Of the recent survey, the company's CEO, Brandon Macdonald, said, "We are very excited to continue work on Gayna; the new interpretations of historical data combined with our geophysical and geochemical surveys show that the project has significant potential to host a similar style of mineralization to the world-class Kipushi deposit."

Teck Resources Limited and the Lundin Mining Corporation have both invested in Fireweed. The company states that its projects have "grade, scale, economics, and upside potential."

Fireweed's Mactung Tungsten project may help to "create a reliable western source of tungsten." Tungsten has now been listed as a critical metal by Canada, the U.S.A., and Europe.

The Gayna project is a "highly underexplored area" and is located in a "well-renowned but forgotten zinc district."

Earlier this month, Jefferson Research reported that Fireweed was showing "strong Cash Flow Quality and Earnings Quality, and Valuation suggests a lower amount of price risk, but Operating Efficiency and Balance Sheet Quality are both weak." The report states that the reason for the overall rating drop from last quarter is "a decrease in the Operating Efficiency Rating due to weakening returns."

In a peer valuation comparison, Fireweed was rated as "least risk" but as "most risk" in terms of peer operating comparison.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Fireweed Metals Corp. (FWEDF:OTCMKTS;FWZ:TSX.V))

In its October 2023 issue, The National Investor named Fireweed as the exception to "most everything/everyone" remaining in "wallflower status."

Ownership and Share Structure

Headquartered in Vancouver, British Columbia, Fireweed has 144,640,313 shares outstanding. It has 12,261,000 shares issuable under the stock option plan and 3,700,000 performance shares.

According to Reuters, 17.58% of the company's stock is owned by management and insiders. Chairman John Robins has 3.63%, with 5.26 million shares, and CEO and Director Brandon Macdonald has 0.89%, with 1.28 million.

26.59% is with strategic investors. Zebra Holdings and Investments SARL has 9.58%, with 13.88 million shares. Lorito Holdings (Guernsey) Ltd. has 8.22%, with 11.90 million. Ibaera Capital Canada Investment LLC has 6.78%, with 9.82 million, and Nemesia SARL has 2.02%, with 2.92 million.

1.94% is held by institutional investors. Sprott Asset Management LP is the largest institutional investor at 1.86%, with 2.70 million shares.

The rest is in retail.

The company trades at a 52-week range of CA$0.55 and CA$1.26.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Lauren Rickard wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.