IberAmerican Lithium Corp. (IBER:NEO) is a relatively new Canada-based hard-rock lithium exploration company. The company held its IPO early last month and is currently focused on advancing its 100% owned Alberta II & Carlota properties in the Galicia region of northwestern Spain.

The Galicia region projects, sitting only 1.7 kilometers from all-weather road access, are readily accessible for exploitation. These properties are situated some 28 km east of the deep-sea port city of Pontevedra, in the ideal location for access to the European market. European demand for lithium is increasing as green directives drive a variety of new economic models across the continent and the trading block.

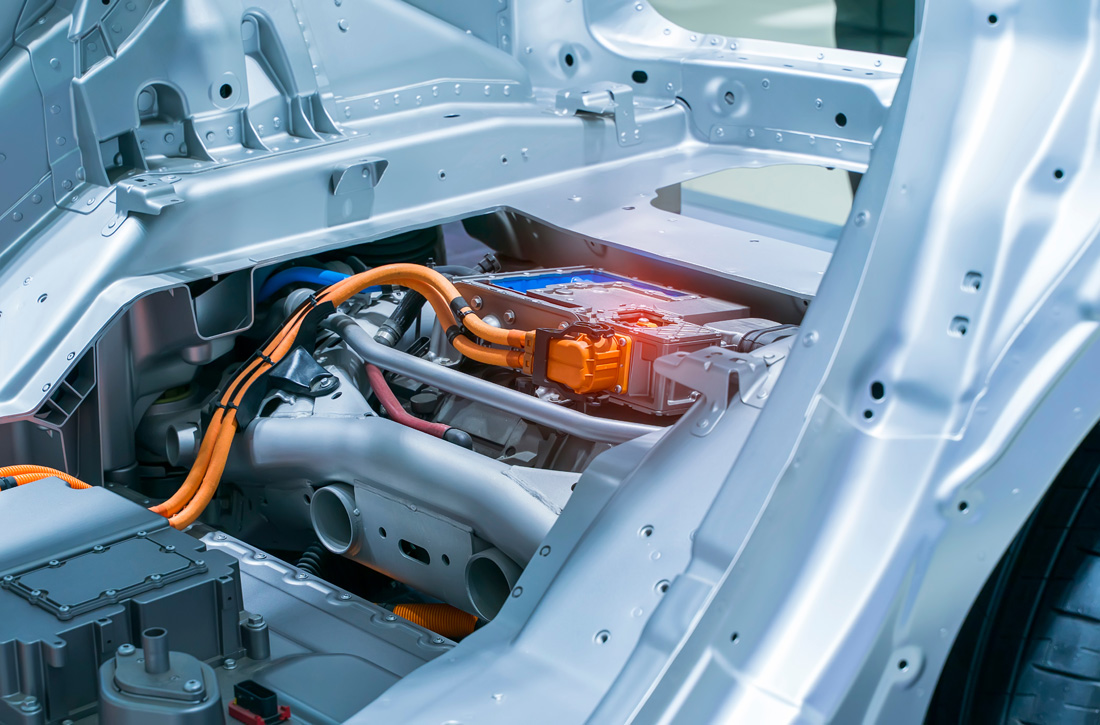

Spain has been focusing on sustainable energy growth, developing giga-factories for the manufacture of electrification and decarbonization technologies. The country has four more of these giant projects in the pipeline, putting it on the path to becoming one of the largest lithium battery producers in Europe.

The Catalyst: Promising Reassays

On October 5, IberAmerican Lithium announced the results of the re-assaying of initial core samples from its Alberta II project. Using a sodium peroxide fusion to obtain the assay results, the company found 25 samples showing greater than 1.00% concentrations of lithium oxide.

This represents an increase of approximately 20% from the number of samples previously reported from the exploration campaign conducted in 2011.

According to company CEO Campbell Becher, the IberAmerican team members "are very pleased with the re-assay results. [They] confirm our thesis that, with the use of proper, more modern technology and with a new focus on lithium shows, the existing samples would provide greater lithium content than originally thought in 2011, when the exploration focus of the owner at that time was on tin and tantalum."

Globally, the lithium market was some US$37.8 billion in 2022. According to a report by Fortune Business Insights, it's expected to grow to US$89.9 billion by 2030.

"These results also give us better information on the areas on which to concentrate our exploration program at Alberta II."

According to the press release issued with the findings, "The re-assays confirm the company's initial plans to focus its Q4 2023 diamond drilling program, of approximately 40-50 holes, in the northern section of the Alberta II permit area, targeting the continuity of spodumene-pegmatites, specifically expanding the drilling previously performed on the permit area in 2012."

IberAmerican Lithium will also be undertaking an extensive geological sampling program in the south section of Alberta II. As CEO Becher explains, "Receipt of these results are the first step in commencing our robust exploration program; we expect to be able to announce preliminary results from initial drilling and survey activities in Q1 2024."

The re-assays used a more pertinent assay method — sodium peroxide fusion — for lithium-bearing spodumene pegmatite, as the samples taken in 2011 had previously been analyzed using the 4-Acid Digest method, which is known to under-report lithium contents.

The release explains that "As part of the re-assay program, samples were collected from the nine drill holes from 2011. Quarter-core cuts of the historic intervals were sent for reanalysis. The drill-hole samples were prepared at ALS laboratory in Sevilla, Spain, located approximately 750 km from Alberta II, and then sent to their laboratories in Ireland for assaying."

"We are excited to be commencing this robust exploration program and expect to be able to announce preliminary results from initial drilling and survey activities in Q1 2024."

This release came close on the heels of the announcement that IberAmerican Lithium had secured 100% control over the Galicia projects.

As CEO Becher explained on September 28, "We are very pleased to now hold 100% of the rights to the Lithium Projects. This will make future financing easier and obtainable and gives us sole control over the exploration and development of the projects."

"We are excited to be commencing this robust exploration program and expect to be able to announce preliminary results from initial drilling and survey activities in Q1 2024."

Why This Market? Lithium is King of the Battery Metals

Lithium is a major component of many electric vehicle batteries, where it's used as both a cathode and an electrolyte. The white metal, with its highly reactive and flammable properties, is also used to strengthen alloys and as a high-temperature lubricant. It also has its place in pharmacology, where it's used to treat bipolar disorder.

Recent reporting in Intereconomics explains that "In her State of the Union address in September 2022, European Commission President Ursula von der Leyen recognized how raw materials like lithium and rare earths are increasingly 'replacing gas and oil at the heart of our economy and that the EU, faced with growing demand and high market concentration, should avoid 'falling into the same dependency as with oil and gas.'"

One key element of avoiding such dependency will involve processing known caches of lithium already in Europe, including the Galacia projects that IberAmerican Lithium is currently developing.

The article goes on to explain that "In the EU alone, the European Commission's Joint Research Centre expects lithium consumption to increase 9 to 12 times by 2030, and up to almost 21 times by 2050, driven almost entirely by the uptake of e-mobility."

Reporting for Reuters earlier this year, Andy Home noted that "The European Union has unveiled the accelerator in its drive to reduce the bloc's import dependency for critical minerals and metals. The Critical Raw Materials Act (CRMA) 'will significantly improve' Europe's domestic extraction, processing, and recycling capacity for metals such as lithium and rare earths, according to Ursula von der Leyen, president of the European Commission."

"The Act comes with targets for production and for reducing dependency on any single third country. China currently dominates the supply chain for many of the entries on Europe's list of 'strategic' metals."

Globally, the lithium market was some US$37.8 billion in 2022. According to a report by Fortune Business Insights, it's expected to grow to US$89.9 billion by 2030.

Why This Company? Growing Lithium Holdings in the EU

IberAmerican is well positioned to take advantage of the coming green revolution across the EU. The company has an experienced management team built around an undervalued (and previously underassayed) asset. Spain is a great mining jurisdiction; it experiences little conflict and offers the type of first-world infrastructure required to rapidly bring extracted lithium to market. It's also already part of the EU economic block, providing unrivaled access to this important market.

Additionally, the company is primarily focused on mining lithium from spodumene, which has become the most popular source of the metal. "Hard rock spodumene mines have taken the mantle as the largest source of lithium raw materials thanks to the speed with which they've been able to ramp up in response to fast-moving prices and market enthusiasm," according to an article on Stockhead.

Why Now? New and Growing

Shares in IberAmerican only became available recently. On September 19, the company began formal trading on the Neo Exchange, the result of a reverse takeover transaction with IberAmerican Lithium Inc., a privately held lithium exploration and development company.

At the time, Director and CEO Becher said, "We are very excited to be listed on Cboe Canada, an innovative exchange that aligns seamlessly with our mission to drive clean energy. The public listing of IberAmerican not only demonstrates our commitment to advancing sustainable solutions but also reflects the growing importance of electrification in furthering the global energy transition."

Some important upcoming catalysts include drilling at six veins that have only been sampled at the surface, infill drilling, detailed mapping, and a further 15,000-meter drill program of approximately 43 drill holes with two rigs. The initial results of the wider drill program are coming early in the new year.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

IberAmerican Lithium Corp. (IBER:NEO)

Ownership and Share Structure

IberAmerican has a starting market of CA$27,375,122, with 109,500,488 shares outstanding, 9,450,000 options, and 18,225,244 warrants expiring September 1, 2026.

About 36% of the company is held by insiders, including CEO Becher, Director and Chairman Eugene McBurney, and Director Miguel del Campa.

About 25% of the company is in institutions, including Delbrook Resource Opportunities Master Fund LP (Grandy Cayman Islands), Jayvee & Co., CI Resource Opportunities Class, and Delbrook Resources Opportunities Fund (Vancouver).

The rest is retail.

The company is currently trading, at the time of writing, at a market cap of ~CA$22 million, with about 110 million shares outstanding.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- IberAmerican Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of IberAmerican Lithium Corp.

- Owen Ferguson wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.