Founded in 2007, Smith-Weekly Research is an independent market research firm, with a focus on the natural resource sector.

Smith-Weekly prides itself on research with a focus "characterized by terms including cyclical, volatile, contrarian, high-risk, high reward, illiquid, underappreciated, small capitalization, overlooked, complex, material moat, and network critical market focus."

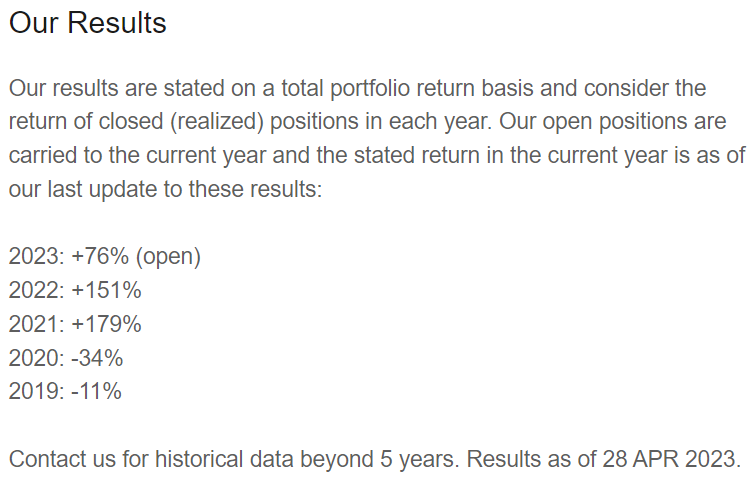

While this may seem like a tall order, Smith-Weekly has been reporting on stocks in the natural resource sector with impressive results.

In light of these results, we sat down with Andrew Weekly, the founder and CEO of the company, to go over his method and what companies he believes will be worth your while in 2023.

Andrew Weekly has 18 years of experience in the investment space and ten years in analysis.

While Weekly's experience is eclectic, for the past seven years, he has put his time and energy into the natural resource market, specifically uranium.

Uranium is Compelling

Weekly told Streetwise Reports that Smith-Weekly began research on the uranium sector in late 2015/early 2016, not sending out an official report on the sector until 2017. They prided themselves on doing a year of prep before making any decisions and have been bullish on the sector ever since.

Regarding uranium, Weekly said, "It is one of the most compelling areas in the market to look at. It has quite a wide moat. It's a very small sector compared to places like the gold or copper sector, precious metals, and even a lot of base metals." This is one of the reasons Smith-Weekly has centered itself within the sector for so long.

When asked what companies Weekly would recommend, he said, "I think it's important for your audience to understand that some of these companies that we've been following and been a part of for a number of years, we own at a level much lower than today's prices."

He specified that this doesn't mean you shouldn't consider the companies in their portfolio. However, it must be understood that things within the sector ebb and flow.

With that in mind, Weekly did share a few companies that are in the sector.

Cameco Corp.

*Insert info on Cameco Corp.*

Deep Yellow Ltd.

The first Weekly touched on was Deep Yellow Ltd. (DYL:ASX). Deep yellow Ltd. is a uranium exploration company, focused on developing one of the largest global inventories to establish a +10Mlb per annum, multi-mine producer and provide security and certainty of long-term supply into a growing market. Deep Yellow has two projects. One is in Namibia, and one is in Western Australia. Weekly said that while they are a development-focused company, it is very likely they could be a producer in the future.

According to Reuters, 5.65% of the company's stock is with management and insiders. CEO John Borshoff has the most out of management at 1.99%, with 15.01 million shares, and Executive Director Gillian Swaby has 1.29%, with 9.76 million.

23.70% is with institutions and strategic investors. Paradice Investment Management Pty. Ltd. has the most at 8.04%, with 61.01 million shares. Alps Advisors Inc. has 6.27%, with 47.58 million. Mirae Asset Global Investments (USA) LLC has 4.70%, with 35.61 million.

3.83% is with strategic investors. Lexband Pty. Ltd. has the largest in this category at 2.50%, with 18.96 million shares.

The rest is in retail.

Deep Yellow has a market cap of AU$955.57 million and 758.39 million shares outstanding. It trades in the 52-week range between AU$0.475 and AU$1.395.

You can view Deep Yellow's corporate presentation here.

enCore Energy

Next, Weekly recommended enCore Energy Corp. (EU:TSX.V; ENCUF:OTCQX). enCore is a uranium development company based in the United States. According to the company, "enCore is focused on becoming the next uranium producer from its licensed and past-producing South Texas Rosita Processing Plant by 2023."

Weekly explained, "enCore energy is a U.S.-focused ISR company and has our meeting in situ recovery. So they have 100% Focus on United States ISR production and development. And they have projects both in Texas and Wyoming and some other jurisdictions as well."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

EnCore Energy Corp. (EU:TSX.V; ENCUF:OTCQX)

According to Reuters, 2.13% of the company's stock is held by management and insiders. Executive Chairman William M. Sheriff. MSc has 1.36%, with 2.03 million.

24.60% is with institutions and strategic investors. Mirae Asset Global Investments (USA) LLC has 3.63%, with 5.38 million shares. Commodity Capital AG has 1.35%, with 2 million shares, and State Street Global Advisors (US) has 1.28%, with 1.90 million.

The rest is in retail.

EnCore Energy has a market cap of CA$604.96 million and 144.38 million shares outstanding. It trades in the 52-week range between CA$2.42 and CA$4.75

You can view EnCore Energy's corporate presentation here.

Ur-Energy

Keeping focus on the United States development and restart segment, Ur-Energy is on his list. He said, "Despite Ur-Energy being a frequently overlooked ISR restart company in Wyoming, notable expansion potential exists via the development of pipeline projects at Shirley Basin and Lost Soldier.

Additional capacity at the Lost Creek facilities can be filled out with these satellite projects as well as through toll processing from peer companies in the region. As work progresses and initial cash flows start coming in, we expect expansion work to follow shortly after, bringing the potential of 1.5-2 million pounds of production from Lost Creek in the next 24 to 36 months and potentially more thereafter once the local pipeline is developed. Timing and aggressiveness based on uranium pricing underpinned by term contracts to back up the capital expenditures. The team at Ur-Energy has very good ISR expertise and has a proven production center around them with attractive cost profiles. Ur-Energy. (URE:TSX; URG:NYSE.MKT)."

While we covered some of the companies we are focused on within this article, we’ve not discussed all of them, and we encourage interested parties to consider SmithWeekly Research to obtain all information about the sector as well as the opportunities we are looking at. We also remind readers that this is only a small starting point for you to do your own review and research on the sector. We encourage you to do your own work and make your own decisions.

*Insert ownership and share structure*

Cosa Resources

Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe