Last week, MRP noted that an expansion of the UAW's picket line was imminent, with threats to add even more strikers by Friday. The United Auto Workers (UAW) union strike began on September 15, with 12,700 of Detroit's Big Three automakers' 146,000 workers taking to the picket line. The first stage of the strike impacted just three facilities. However, upon expansion to 18,300 employees, 41 facilities have now been targeted by the UAW.

The threat of further expansion is on the table once again this week. A decision is expected tomorrow from UAW President Shawn Fain. Only one Ford plant has been affected by the strike, owing to some progress that has been made in negotiations with the union, while the other 40 are GM or Stellantis facilities. Deutsche Bank estimated that GM, Ford, and Stellantis lost production of more than 16,000 vehicles in just the first week of the strike. The big three are countering work stoppages by laying off and furloughing thousands of workers and draining inventories, but the UAW entered the dispute with $825 million in its strike fund to help workers make do without pay should they walk off the job.

The Washington Post notes that full-time employees at the Big Three make an average of $18 to $32 per hour, or $720 to $1,280 per week. This would have put a rough estimate of the UAW's weekly expenditure of strike pay somewhere between $9.1 million – $16.2 million for the first week, rising to a range of $13.2 – $23.4 million for the second. However, Reuters now reports that strikers are getting just $500 per week from the strike fund. That suggests that the UAW has only paid out roughly $15.5 million thus far (ignoring temporary benefits payments the union may also be doling out) and has funds available to sustain payments to the current number of striking workers for at least 88 weeks (619 days) further — immensely longer than the most protracted UAW strike in U.S. history at just over 16 weeks (113 days) back in the 1940s. The glut of cash suggests that the UAW has significant capacity to scale up its action against the automakers if common ground cannot be found soon.

Leverage seems to be weighted towards the UAW. The costs that automakers must absorb on a daily basis from strikes are immense and tally up to billions of dollars in a matter of days. A strike against GM in 2019 during the last round of contract negotiations lasted 40 days and cost the automaker $3.6 billion, the equivalent of $90 million per day, in earnings that year. Economic consulting firm Anderson Economic Group LLC estimated total economic losses at over $1.6 billion following just one week of the current strike.

It must be noted that the losses automakers are willing to eat today are being weighed against the future costs the Big Three would incur as a result of unfavorable terms. Cost inflation has become a major concern for all industries over the past several years, but mainstay vehicle manufacturers are quickly creeping up on an electrified transition that would be made even more difficult by rapidly rising labor expenditures. Cox Automotive estimates that EV sales will rise to 8.0% of total US vehicle sales in Q3 from about 6.5% a year ago. The American electric vehicle (EV) market is already dominated by a non-unionized company, Tesla, which could very well enjoy the spoils of virtually any outcome in the ongoing UAW strike against its competition. In the first six months of this year, Tesla sold more than 325,000 EVs in the U.S. market, more than 9x the EV sales of second-place Chevrolet. Over the past decade, Tesla has focused on gradually cutting the sticker prices of its vehicles in order to make EVs more affordable.

Competing with Tesla could be made even more difficult by increasingly expensive union contracts. Wedbush Securities estimates that the average EV vehicle will go up in price by $3,000 – $5,000 to pass rising labor costs onto the consumer. In the midst of the strike, Ford's electrification projects are being idled — specifically, a $3.5 billion battery plant in Michigan that is slated to use technology licensed from Chinese battery maker Contemporary Amperex Technology Co. Ltd (CATL). GM's existing battery plant, a joint venture with LG, is non-union, but the UAW wants Ford's incomplete battery facility to eventually fall under an eventual "master contract" agreement, which would make all employees in the plant subject to the union. Ford has said the construction halt on the battery facility is temporary, but it remains to be seen how negotiations with the UAW may ultimately impact its future. U.S. EV sales at Ford were only up about 6.0% YoY through August, while Tesla's domestic sales increased 30.0% from a year earlier in the first half of 2023. Internally, Ford estimates that its labor costs are already 25% higher than Tesla's when accounting for wages and benefits.

Tesla CEO Elon Musk, watching the drama from the sidelines, weighed in on the labor dispute via X earlier this week, writing, "They want a 40% pay raise *and* a 32-hour workweek. Sure way to drive GM, Ford, and Chrysler bankrupt in the fast lane."

While President Joe Biden joined the picket line and bolstered the auto workers' strike efforts, Former President and current frontrunner to receive another nomination as the GOP's candidate, Donald Trump, unleashed a harsh prediction for the future of the Big Three, claiming their ongoing negotiations matter little, as they may "all going to be out of business" in a matter of years due to the EV transition.

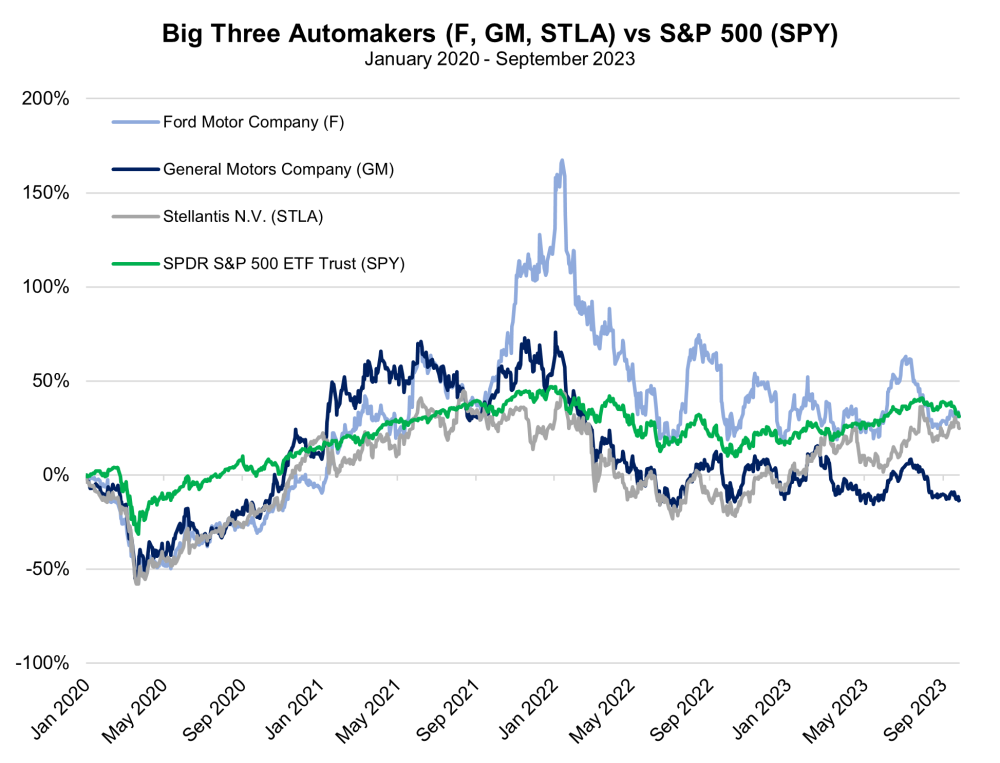

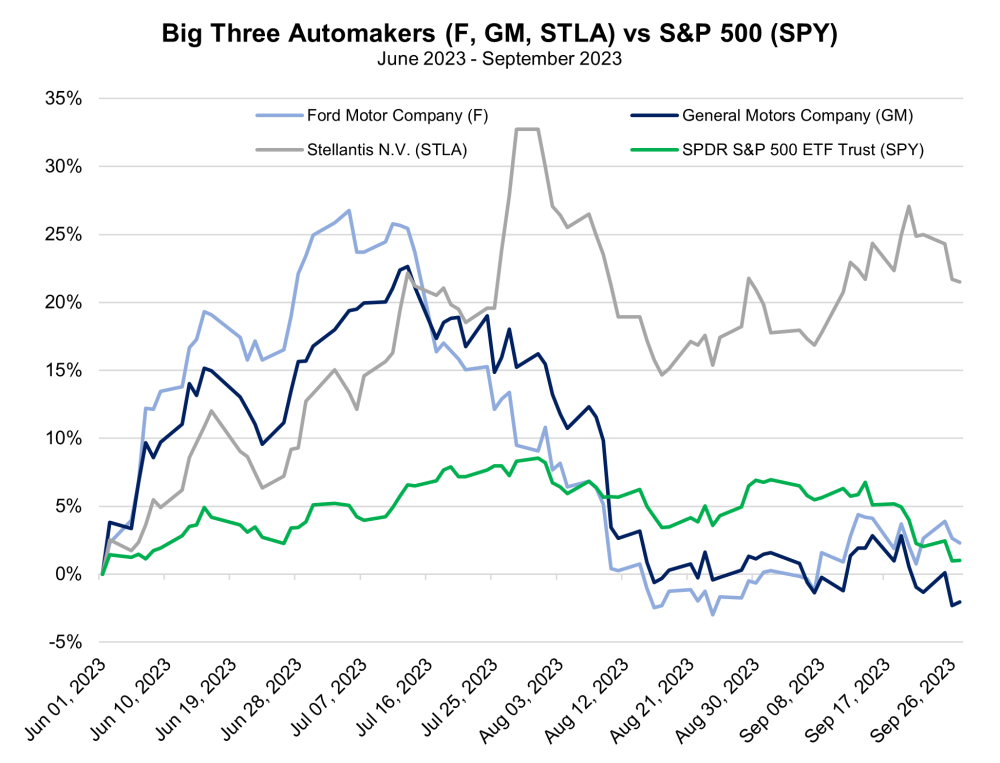

As MRP wrote in earlier coverage of the UAW strike, American automaking productivity has only declined over the past decade. Per The Wall Street Journal, motor-vehicle manufacturing productivity plummeted -32.0% from 2012 to 2022. In a broader scope, employee productivity in the U.S. has remained stagnant for more than two years. While the U.S.'s Employee Cost Index is up by 11.5% since Q1 2021, the gauge of the economy's nonfarm productivity has actually declined by -0.6% over the same period. Massively increasing the cost of labor amid declining productivity from that labor could become cumbersome costs when evaluating share prices of Detroit's Big Three down the line.

Charts

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.