September is a major month in the gold mining sector, with two back-to-back industry conferences in Colorado, first, up in the magnificent mountains at Beaver Creek for the juniors and exploration companies, and then on to the beautiful Broadmoor in Colorado Springs for the major producers. I had over 40 one-on-one company meetings as well as numerous presentations and dinners. Needless to say, it was an exhausting ten days, but with many valuable insights. In Beaver Creek, the conference was full, with investor attendance up from even the pre-COVID record, with close to 1,500 attendees and a waiting list of companies wanting to attend.

Many of the juniors were looking to raise funds; at least eight of the companies with whom I met were looking to raise money now or before the end of the year. That's a lot, and I had already self-selected many of the better companies. It was also clear, in general terms, that there was not a lot of money around, with mutual funds and many other funds having experienced ongoing redemptions for several months.

Nonetheless, the general attitude was, I thought, somewhat more upbeat than one might have thought, with many exploration companies fielding numerous meetings with major producers looking for projects. In Colorado Springs, on the other hand, attendance looked down, if not from last year, but certainly from the pre-covid levels.

Unlike in previous years, where one theme or another seemed to dominate — returns to shareholders or new-found fiscal discipline, for example — this year showed many senior companies espousing different approaches: Newmont favored M&A while Barrick emphasized organic growth and in contrast with both, Agnico emphasizing a small group of jurisdictions rather than the global approach of its larger peers. It's reasonable to say that the sentiment among the companies was far better than among the smaller companies at Beaver Creek, even if the investor sentiment was more subdued.

Why Are the Stocks So Cheap Relative to Gold?

One theme discussed by many of the investors at both conferences was the widening gap between the gold price — up 6% year to date — and the gold stocks, down 4%. With a handful of exemptions, everyone just assumes the gap would be closed by the gold stocks, trading at low valuations and moving up. But of course, the gap could be closed by declining gold.

I would argue that in a global environment that has seen interest rates shoot up rapidly with continuing tightening in the outlook as well as a deteriorating economic environment, gold "should" be lower and has actually held up well. At last year's conferences, gold was priced at just over $1,600, so that's a pretty good one-year return.

In non-U.S. currencies, the performance is even greater. However, the demand has been fairly well concentrated, led by central banks, which have bought record amounts of bullion; the gold ETFs have seen net outflows for most of the past year. So the possibility for gold to fall in the next few months, if the central banks pause buying for even a short period, is very real. As we go into next year, with stubborn inflation and a declining economy (as well as an election year in the U.S.), the outlook for gold increases.

The "Lassonde Curve" Gets Elongated

In a lunch chat among industry legends, with a thoughtful Pierre Lassonde, a lively Frank Giustra, and an uncharacteristically subdued Robert Friedland, Lassonde noted that the traditional time frame between exploration success and production, when stock prices typically dip in the famous "Lassonde Curve," has extended from one or two years to five or six.

This only emphasizes the need for junior single-asset companies to have strong financial backing in the barren phase. One theme highlighted by most companies was "ESG" with one company CEO even making the idiotic comment that "the most important thing we do is ESG."

Talk about the cart before the horse! The most central thing you, as a mining company, do is produce metals at a profit. Interestingly, a few brave souls knocked the current faddish "box ticking" ESG exercise and emphasized the things they have done for years, including having safe operations and good relations with the communities in which they work.

Franco More Flexible on Transactions

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) CEO Paul Brink noted the need to be more creative in the current financing environment, referring to the company's debt and equity along with a stream on the Tocantinzinho project in Brazil. If debt or equity can help Franco get a stream, they are open to it. Higher global interest rates have helped the company by making streams relatively more attractive than debt.

They are also open to doing smaller transactions, noting a recent sub CA$7 million royalty transaction. Brink, noting that most of the value in the industry is created by the drill bit, emphasized the exposure that Franco has to exploration. In addition, royalties and streams are not affected by cost inflation.

In addition to its well-known oil and gas portfolio, Franco also has exposure to long-dated copper and nickel projects. There is $1.3 billion in cash, with no debt. Separately, board member and former Barrick CEO Randall Oliphant died unexpectedly earlier in the month. Franco is a core holding for us, one that all investors should have in their portfolios. Down from $160 in May, Franco can be bought at a good price here if you do not own it.

Barrick Has Top Assets, Growth, and Exploration Focus

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) emphasized its focus on Tier One assets — with six of the top ten gold mines in the world — and its 10-year growth plan, driven by both gold and copper. Barrick now calls itself "the gold and copper company." It is projecting a 30% increase in production by the end of the decade, with gold production stable and copper providing the upside.

There is tremendous leverage in the copper assets to higher prices. Both Reko Diq, the new copper project in Pakistan, and Lumwana will be in the world's top ten copper producers by the end of the decade.

Barrick is on track to deliver feasibility for Reko Diq by the end of next year, far more rapid development progress than could be achieved in most other countries.

Most of the Problems Fixed, but Assets Still Undervalued

Another theme was that Barrick did not see the need to acquire other companies in order to replace reserves and grow. Rather, it looks to exploration, both brownfields and greenfields, as it has in recent years. CEO Bristow also noted that the stock was underrepresented in U.S. portfolios and was going to make a push to change that via a new Investor Relations hire in New York.

Bristow noted that Barrick was the largest miner in the U.S. He also said that analysts undervalue many of its assets, and he aims to change the perception. Since the merger of Barrick and Randgold, when Bristow took over as CEO, he has fixed most of the problems at the company, including underperformance in Nevada and political issues in Tanzania, Papua New Guinea, Pakistan, and the Dominican Republic.

The large Pascua Lama deposit, shut down by Chile, is the only major problem outstanding. A preliminary economic assessment is planned for next year. Bristow reiterated that the Nevada assets would have a weak 2024 but recover thereafter. The company has a strong balance sheet and strong cash flow, so it does not need money.

At today's price of under $16, Barrick is a very Strong Buy.

Agnico Is More Geographically Focused

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) CEO Ammar Al-Joundi reiterated that, rather than striving to be a global company, it was a regional company, focusing on a few key areas it saw as having strong mining potential with political stability.

Other than Australia — where Agnico's Fosterville mine was acquired when it bought Kirkland — Agnico aims to be the best miner in its regions, having strong government and community relations, strong supplier relationships, and leading geological knowledge.

Al-Joundi said the coming year would be a period of optimization following a recent period of consolidation. Because Fosterville is such a good mine —generating around $1 million a day — with meaningful optionality, Agnico is inclined to keep it despite its lack of other presence in the country in a competitive environment.

In Mexico, as in Australia, it believes that it generates more value from its mines than it could realize via sales.

Malartic Mill Capacity Offers Low-Cost Opportunities

The company talked again about the move from open pit to underground at its large Malartic mine, which would see a dip in production in 2026 and 2027, with the mill having 40k tonnes per day of spare capacity. This would be filled by nearby deposits, initially, the Upper Beaver and Wasamac deposits, which would produce 400,000 ounces annually but utilize only one-quarter of Malartic's spare capacity.

Trucking ore would require about 30% lower capital than a standalone operation, so expect several nearby deposits to be developed to fill the Malartic mill. Al-Joundi said Agnico was "getting to know the juniors in the region." He also said again that the company would look at other metals, including copper, nickel, and lithium if it could find strong deposits in areas where it already operates.

Buy.

Osisko Expects More Deals and New CEO by End of Year

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) interim CEO Paul Martin said the search for the next CEO is underway, with an announcement expected by year-end. He also expects additional transactions this year, with the market being "extremely strong" in the sub-$100 million segment.

He also said that divesting its stake in Osisko Development was a lower priority, given the latter is advancing financing for the Caribou project. The company's large equity holding in Osisko Development was a major cause of the weak performance prior to ex-CEO Sandeep Singh, and the market will be looking for continued reductions in the exposure.

We are holding.

After Deals, Royal Is Focused On Debt Reduction

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) CEO Bill Heissenbuttel, noting that recent acquisitions had been funded from the company's revolver, said reducing the debt was now a priority.

Although, the company's focus is firmly on precious metals, if would look at a copper transaction, if it was a good asset with a good operator. However, he indicated the company likely would not go into lithium or other smaller resources, noting the company's lack of expertise in those areas.

Hold.

Wheaton Also Flexible in Deals

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) said the new global minimum tax, to be enforced by Canada starting in the New Year, would have an 8-10% hit on Wheaton's NAV, which is more than other Canadian companies.

CEO Randy Smallwood said the tax would not change the way the company does business through offshore subsidiaries; he even teased that it would more likely have the opposite effect and have the company move its headquarters offshore. Like Franco, Wheaton is also looking at debt and equity and also looking at small transactions; earlier this month, it invested $5 million into a private placement offered by Liberty Gold, in addition to a $3.6 million royalty.

Buy.

Pan American Streamlining After Yamana Acquisition

Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) CEP Michael Steinmann discussed the company's recent take-over of Yamana, noting the 10 million oz of additional silver production that came with the deal; the synergies of $40 million to $60 million ("on track"); and the asset sales ("very serious about streamlining the portfolio").

Pan American acquired a lot of exploration ground as well as mines when it bought Yamana, and the company said it was going to focus exploration on brownfields. He also discussed Escobal, the halted mega-project in Guatemala, where the consultation process between the government and the local people is nearing an end.

The next step is for the company to discuss mitigation and compensation for any local disturbances, such as trucks passing through villages. Escobal, when back online, will nearly double the company's silver production. He also mentioned the La Colorada skarn deposit, which will likely have a 30-50-year mine life. A preliminary economic assessment ("PEA") is expected by year-end. It is anticipated that 60% of the revenue will be from zinc, and most of the rest silver.

Pan American is a Buy.

Things Going Right for Fortuna, Though Stock Lags

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) said it was hopeful that Argentinean exchange controls would be lifted with the new government, to be elected next month. Currently, it can repatriate the capital costs of its Lindero mine, but they will be repaid by the second quarter of next year.

CEO Jorge Ganoza noted that its new Séquéla mine represented about 40% of the company's cash flow, and, given its low cash costs, reduced the company's overall cost profile. Its priorities from cash flow are to pay down debt and increase exploration, both brownfields and greenfields. Earlier, Fortuna announced very strong drilling results in exploration at its San Jose Mine in Mexico, including 1,299 g/t gold equivalent over a true width of 9.9 meters.

The company has a debt of $240 million against cash of $100 million. The stock is fundamentally undervalued relative to peers, the result of a series of issues and production misses, as well as concern about the expansion into West Africa. Another quarter or two of solid operating performance will see a re-rating in the share price.

Fortuna is a Strong Buy.

Orogen's Major Royalty Keeps Getting Bigger

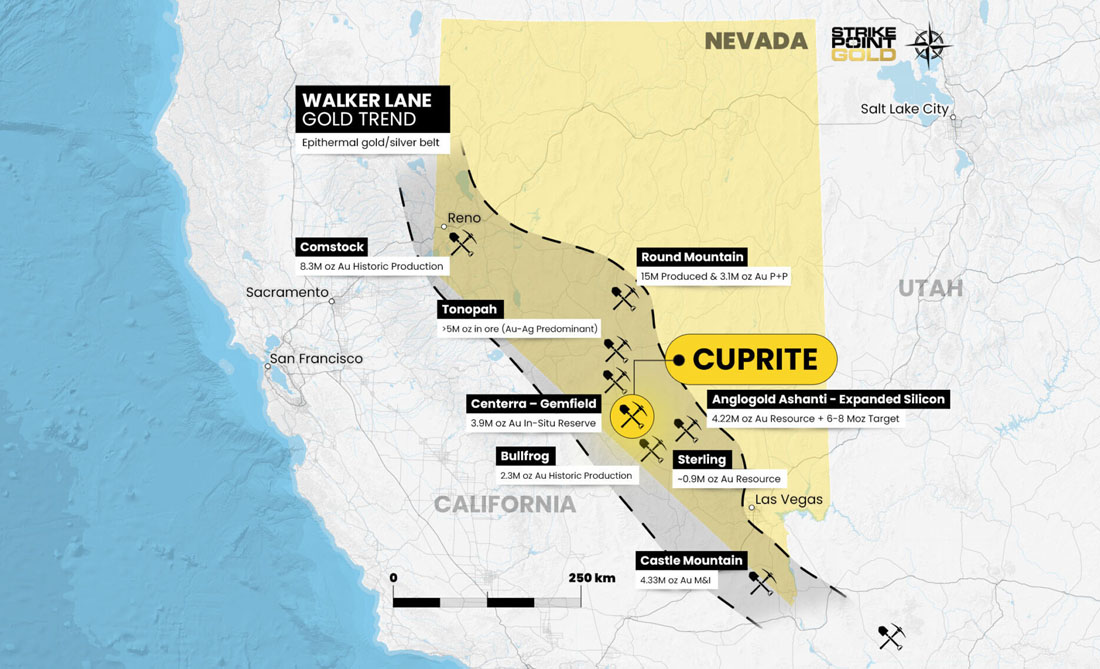

Orogen Royalties Inc. (OGN:TSX.V) received big news delivered by AngloGold, who said its Merlin deposit had an "exploration target" of eight million ounces, higher than the six to eight million announced just last month. Together with the Silicon resource of 4.2 million ounces, this makes the area covered by Orogen's royalty at over 12 million ounces . . . and growing.

Anglo's CEO Alberto Calderon emphasized that this is "not where we will stop." Silicon and Merlin are likely to be a single open pit. A concept study, short of an Economic Assessment, is on track to be finished this year. The entire region, Anglo said, has the potential for 350,000 to 450,000 annual production, higher than the previously stated 300,000 oz per year, while many observers think this may get to 500,000 ounces production.

Initial regional production will come from North Bullfrog, with a feasibility study planned for this year and targeted initial production in late 2025. Although Orogen's royalty does not cover this ground, Altius Minerals Corp. (ALS:TSX.V) has a contested royalty over the entire region, currently under arbitration, due in April next year. Meanwhile, First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE)is having exploration success at the extension to the main Ermitano deposit, also on Orogen royalty land, with indications the mine could continue for a decade or more.

Orogen is a Buy.

No Deal Yet for Vista

Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX) is approaching a decision point as, it would seem, no offers for Mt Todd have been received that fully value the project, although there continue to be site visits and discussions. Most of the discussions seem to revolve around equity interests or joint ventures rather than outright sales, with an outright sale looking increasingly unlikely.

With $6 million cash, as of the end of June, Vista has less than one year before it would be running out of cash. Current thinking includes additional drilling north of the main Batman deposit as well as upgrading its earlier scoping study on a smaller-scale mine plane to a full Pre-Feasibility Study. The estimated cost of the new study and drilling is up to $6 million and would take another year plus.

Hold.

Midland Finds Lithium?

Midland Exploration Inc. (MD:TSX.V) announced the identification of a series of spodumene-bearing pegmatite dykes, which are indicative of lithium, of its Galin e project, under option to Rio Tinto. These are the first results from the Rio venture, signed in June but with exploration delayed until the end of August because of the Quebec fires. Rio has said that it wants to be a "meaningful" lithium producer and wants to discover and build mines rather than acquire since current lithium companies are "very expensive."

Several lithium discoveries are along strike of Midland's James Bay properties, including those of Patriot Battery and Brunswick. With CA$6 million cash, Midland does not intend to finance this year.

For all of 2023, some $15 million is being spent in exploration on Midland's lands, only $4 million of which comes from the company, the rest from partners. Six joint projects are being actively explored now, with drilling now or near term at three.

Buy.

Nova Deal Near Completion

Nova Royalty Corp. (NOVR:TSX.V) expects to mail its circular on the proposed merger with Metalla early next month, with the shareholder vote a month later. Indications are that the merger will be approved by Nova shareholders; Metalla does not vote on the issue. The weakness in the stocks seems to be driven by selling from some Metalla retail shareholders who do not like the dilution of the pure gold focus as well as the normal arbitrage one sees in such transactions.

Once the merger is complete, Metalla will have a strong balance sheet and be cash flow positive. It has three new royalties starting next year (on Tocantinzinho, Cote, and Amalgamated Kirkland, all three strong, long-life mines). Metalla's royalty income will start low on all three but grow as mining ramps up into Metalla royalty ground.

Nova is a Buy.

TOP BUYS THIS WEEK in addition to the above include Gladstone Investment Corp. (GAIN: NASDAQ), Hutchison Port Holdings Trust (HPHT:Singapore), and Lara Exploration Ltd. (LRA:TSX.V).

| Want to be the first to know about interesting Gold, Critical Metals, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada Corp., Barrick Gold Corp., Altius Minerals Corp., Agnico Eagle Mines Ltd., Osisko Gold Royalties Ltd., Pan American Silver Corp., Fortuna Silver Mines Inc., Orogen Royalties Inc., Midland Exploration Inc., Nova Royalty Corp., and Lara Exploration Ltd.

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.