Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC) Chief Executive Officer Darcy Marud has issued an update to shareholders and supporters on its Aura gold and silver project in Nevada.

Field activities started in mid-June, preparing for the geophysics and drilling. The geophysics program got underway on July 11, and the diamond drill arrived on-site on July 27.

"Geophysics can be an important tool for identifying extensions of mineralization and favorable geology undercover and at depth," Marud wrote. "We expect to have the (geophysics) program complete by mid-August with full results available by early September."

A 2,000-meter major drilling campaign started at the project on August 1.

"We anticipate drilling to continue through August and into September and results to be available towards the end of September and mid-October," Marud noted. "We have a lot on the go, and as always, we look to complete our work as diligently and cost-effectively as possible."

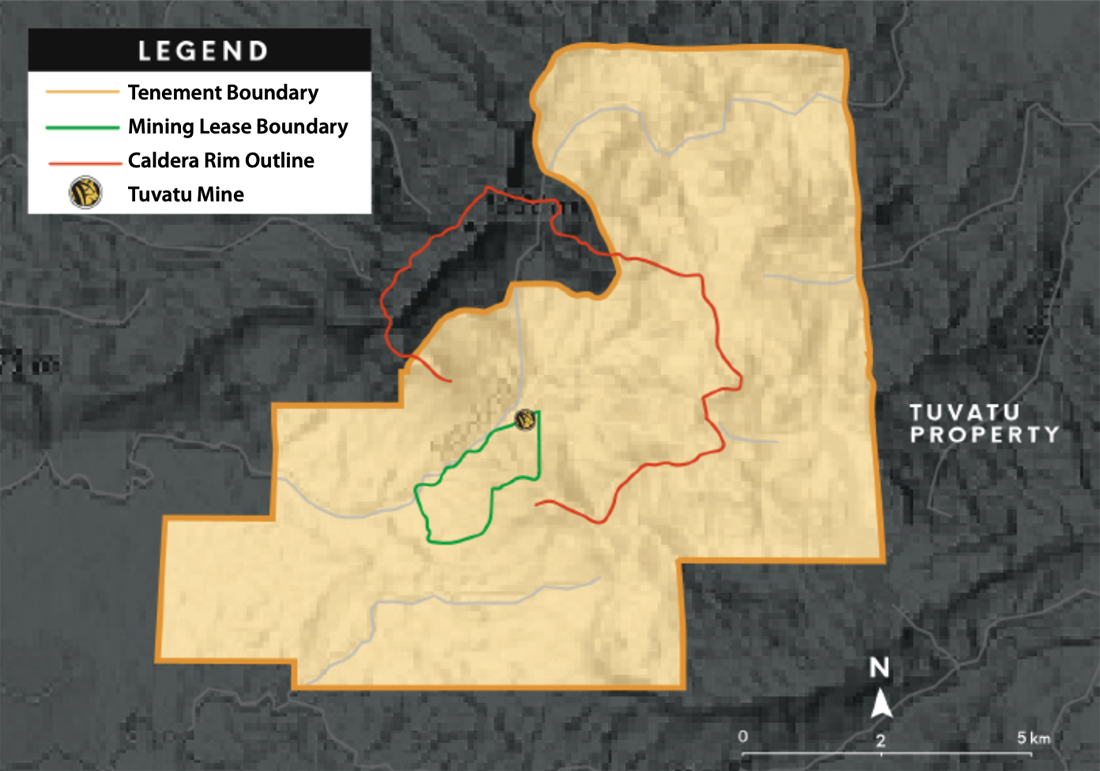

The company wants to grow Aura — comprised of the Doby George, Wood Gulch, and Gravel Creek deposits — from a more than 1-million-ounce (Moz) gold and 10 Moz silver resource.

It is also looking to complete a preliminary economic assessment (PEA) for Gravel Creek, where previous drilling found grades up to 40.05 grams per tonne gold (g/t Au) and 1,951 g/t silver (Ag), in 2025 after possibly more drilling.

The Catalyst: Expanding Aura's Resources

The induced polarization (IP) geophysics program, which uses chargeability in the soil to explore for mineralization, will help the company better define drill targets to expand the project's gold and silver resources.

The project already has the attention of at least one analyst in the sector.

"The Aura gold-silver project in Nevada (is) one of the most attractive mining jurisdictions in the world," wrote Fundamental Research Corp. analyst Sid Rajeev, who rated the stock a Buy and gave it a fair value of CA$3.48 per share.

"We believe WEX's primary strengths are its high-grade Doby George project with near-term production potential, a strong management/board, and Agnico Eagle's backing," he wrote.

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) owns 16% of the company.

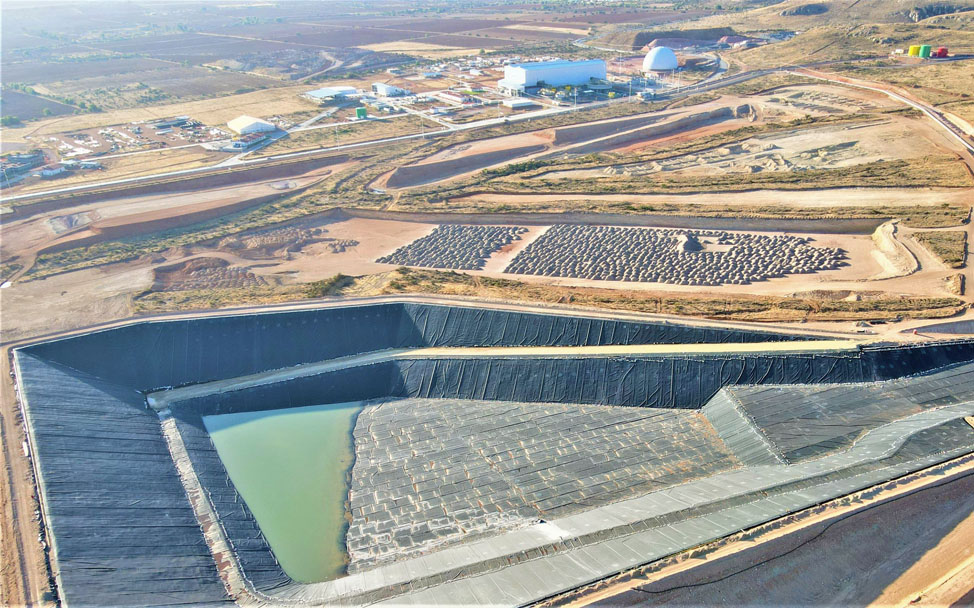

Western announced 69.3% gold extraction in metallurgical heap leach test results at Doby George in July. Technical Analyst Clive Maund rated the stock a Speculative Buy and wrote that the stock looked "like a Buy here for a reversal into a recovery."

Gravel Creek and Wood Gulch account for 60% of the project's resources, Rajeev noted. Doby George accounts for the rest.

"Doby George’s resource (40% of total resources) is amenable to heap leach processing, indicating the potential for relatively low OPEX/CAPEX," according to Rajeev. "WEX is planning a resource expansion/step-out drill program, followed by a Pre-Feasibility (study or PFS) in 2024. We believe this deposit can be advanced to production quickly at a low initial CAPEX (<US$50M). Based on its existing resource, we believe the project has the potential to operate for nine years (40-50 Koz/year) at a relatively low OPEX (US$800/oz)."

In metallurgical test results at Doby George in July, the company published bottle roll results that indicate heap leachability. Column test results are wrapping up and will provide heap leach results for the deposit, the company said.

100%-Owned by Western Exploration

Precious metals mineralization was initially discovered at the project at Doby George in the 1960s, but it wasn't until the 1980s that Homestake Mining Co. discovered the Wood Gulch deposit.

The project is 100% owned by Western and is about 32 kilometers north of the Jerritt Canyon Mine in an under-explored area of Nevada. Nevada is the largest gold-producing state in the United States, accounting for 74% of the country's output in 2021, Rajeev pointed out.

The major drilling underway is testing a northeast-trending structural corridor hosting high-grade low sulfidation epithermal veins in the Jarbidge rhyolite peripheral to the Gravel Creek resource, the company said.

Previous drilling has intersected multiple gold- and silver-bearing vein intercepts there with grades up to 40.05 g/t Au and 1,951 g/t Ag.

A cross-section through the deposit shows intercepts of more than 30 g/t Au Eq (gold equivalent) in the Jarbidge rhyolite lie between the 1,500- and 1,750-meter elevation range. None of these intercepts have been included in previous resource calculations, the company said.

Experts: Consider Average Grades

But what do those grades mean? According to Stockhead, grades of 1 g/t Au can make an open-cut project viable, with anything over 5 g/t Au is considered high-grade.

"A tip for investors, therefore, is to consider a company's average grades and look for drill cores that 'start and end in mineralization' rather than buying shares on just one excellent drill core result, as well as the scale of the deposit," the website noted.

Western announced 69.3% gold extraction in metallurgical heap leach test results at Doby George in July. Technical Analyst Clive Maund rated the stock a Speculative Buy and wrote that the stock looked "like a Buy here for a reversal into a recovery."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

"This shows that it is at least 'thinking about'" advancing, he wrote, "and despite the recent weak volume pattern and Accumulation line should do it soon, whereupon we will probably at last see the volume pattern and Accumulation improve and a breakout from this long and persistent downtrend is likely to cause an abrupt change in sentiment that leads to a significant advance."

Ownership and Share Structure

According to Reuters, about 72% of the company is owned by strategic investors.

This includes Golkonda LLC, a syndicate of dozens of high-net-worth investors, which owns about 58% of the company, and Agnico, which owns 16%.

Management and directors own about 7%, and other institutions own about 12%, the company said.

The rest is retail.

Western Exploration has a market cap of CA$35.57 million and has 34.45 million shares outstanding. It trades in a 52-week range of CA$2.40 and CA$0.83.

Sign up for our FREE newsletter

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Western Exploration Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc. and Agnico Eagle Mines Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.