Gold

Fourteen days ago, gold moved above its 100-dma around $1,971/ounce, with both MACD and MFI working solid "buy signals." It appeared that a move to test $2,000/ounce was in the cards, and I took a position on that basis, also noting that gold seasonality favored an October rally.

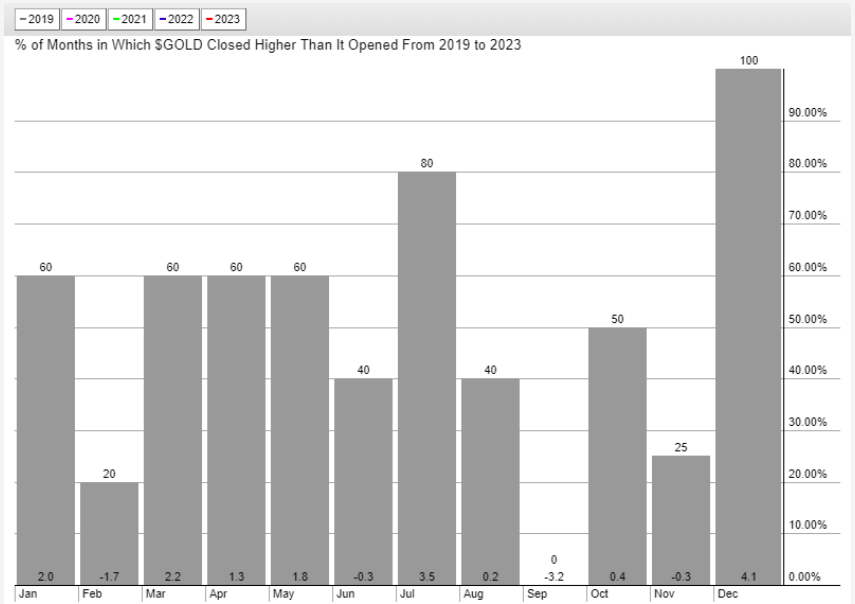

While seasonally, September is one of the weakest months for gold, I expected that it would, at the very worst, trade sideways to slightly lower until October's seasonally strong history kicks in, but it has been literally straight down all month, and now has broken the uptrend line drawn off the March and August lows.

From the seasonality chart shown above, you definitely want to be long the gold market going into December, but the question remains: From what level?

If I continue to hold all SPDR Gold Shares ETF (GLD:NYSE) positions while gold heads down to $1,900, I run the risk of a failure at $1,900 (GLD:US $175), and I wind up with a large drawdown on my hands as I await the always-dependable December rally. That rally might only get us back to a breakeven point, which is doubly frustrating.

I am not going to allow the GLD:US trade to deteriorate into another hit, so by the end of trading:

- Sell all GLD:US and December $175 calls. I will take a breakeven on the calls and a modest gain on the stock and wait for a better entry point sometime later this month or in November.

Western Uranium & Vanadium Corp.

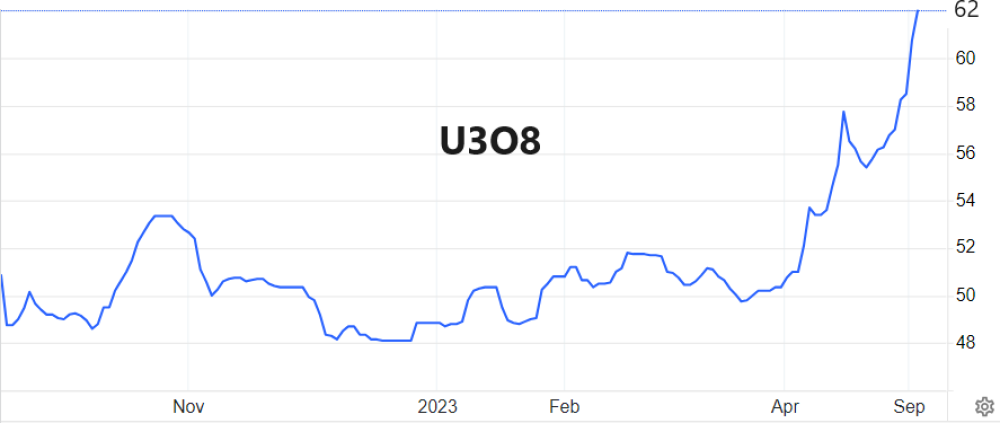

With all of the uranium stocks now catching a bid thanks to a big jump in U3O8 prices at the start of the month, Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) has once again begun an ascent to higher prices driven by buying from one of the big uranium equity funds south of the border.

First, look at the 7-year chart, which shows the crazy behavior of the uranium market, moving violently in fits and shoves from total disinterest to wild-eyed buy-side mania from out of nowhere and with little advance notice.

The moves in 2018 and 2021 saw bottoms in the early part of those years and peaks in Q4, after which they collapsed back down to earth, where prices drifted sideways month after month.

I did not trade the position because I thought then (and think today) that demand-supply conditions are tilting rapidly in favor for the uranium pricing structure where fifty-seven (57) new nuclear reactors are under construction.

From the chart shown below, you can see that there is a great deal of "room to run" for WUC/WSTRF.

Now, look at the year-to-date chart for the same company, and it tells a somewhat different story.

The stock has blasted off from under CA$0.95 to $1.71 in less than a month, taking RSI to nearly 90 (before pulling back), and both MACD and MFI are now in egregiously "overbought" territories.

Mind you, the run in 2022 saw RSI move above 70 ("overbought") six times en route to $4.30 from the COVID-19 CRASH low of CA$0.28!

E3 Lithium and Volt Lithium

Due to the stretched RSI and elevated MACD and MFI readings, I would avoid the stock, but once again, I would not try to trade it because it is my only uranium holding in a sector that could easily see new highs for U3O8 above $138 per pound once these new reactors begin taking off all available supply over the next two years.

My theme for the decade is that the electrification movement will place incremental demand-supply pressures on new, clean sources of electricity (nuclear), transmission infrastructure needs (copper), and electricity storage capacity (lithium). Solar and wind are not capable of supplying the grid with enough electricity to satisfy escalating demand, which leaves nuclear energy as the logical heir to the throne.

Uranium producers and developers should do very well in such an environment. However, I have been hearing this for over seven years since I first bought the CA$1.70 placement in WUC:CSE and have twice missed the pops to $3.40 and $4.25. My goal is to take profits at new highs in uranium prices, which has been elusive despite compelling fundamentals.

Trade accordingly.

Last Friday, with E3 Lithium Ltd. (ETL:TSXV;EEMMF:US) trading at $5.00, I put out this chart and got roasted by ETL shareholders from Fairbanks to Boca Raton such that when it hit $5.50 on Tuesday, I was getting emails and DM's and private messages explaining how I didn't "get it."

Here is the updated chart of ETL showing the impact of massively overbought conditions in RSI (above 80), MACD, and MFI, plus chatroom banter talking about a "buyout from Imperial Oil" and "short squeeze to $10 all weekend long.

Volt Lithium Corp. (VLT:TSV;VLTLF:US) is also under pressure, but RSI at 53.83 is now neutral and no longer "overbought."

Want to be the first to know about interesting Gold and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp. and Western Uranium & Vanadium Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Volt. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.