I have made reference several times in this publication to a junior Canadian lithium developer called Volt Lithium Corp. (VLT:TSV;VLTLF:US), and I draw your attention to their recently completed CA$6.8m financing, which closed on August 4, in the middle of the summer doldrums and in a period where nobody — and I mean nobody — is raising a dime.

I had a long discussion with CEO Alex Wiley this week, and after over forty years in the corporate finance world interviewing CEO's in need of money, I have to tell you that the one thing that always torpedoed a pitch was if and when the CEO stopped discussing his business opportunity and started to talk about his stock price. If I ever heard the word "undervalued," the interview would be terminated.

Alex Wiley spent the entire forty-five minutes answering my queries about extraction, deal formats, government support, and U.S. expansion opportunities, and nary once did he talk (let alone whine) about the stock price. I found that incredibly "telling" and told subscribers that at CA$.18, the stock price was "ridiculous."

Suffice it to say, I spent forty-five minutes discussing the business of "direct lithium extraction" ("DLE"), and to say that Alex Wiley "knows his business" is an understatement.

The company announced on May 24 (with the stock at an all-time high of CA$0.55) the results of their pilot plant tests on brines located in the Leduc field of Alberta in an area called Rainbow Lake. They told the world that their cost of producing a tonne of lithium from brines at 120 mg/L was under CA$4,000 per tonne.

hey also confirmed recoveries at 97% from said brines. When asked to describe in detail the "secret sauce" used in the extraction process, the company simply smiled and declined. That was when the naysayers — mostly Volt's lithium competitors — started the anti-credibility campaign that lasted until August 4, when Volt closed the Canaccord-Paradigm-led deal. It was an oversubscribed offering that was not the first choice for the Volt CEO, but pressure from regulators regarding their CA$100 million shelf prospectus filing made it a "must-do" deal.

With Volt, there are many other developments that are under lock and key right now, but with the PEA coming out in late September, I see fireworks on the horizon.

And good on them for doing it.

The May 5 news release had a sign-off from world-renowned Sproule Inc. and was approved by the normally picky people at IIROC, so to say that the press release had "credibility problems" was a complete joke. As this is being written, Sproule is completing the Preliminary Economic Assessment ("PEA") which will confirm the model surrounding the processing of over 99 million barrels of brines from Rainbow Lake, beginning with a 1,000-tonne extraction process to commence in June 2024.

With their DLE process able to achieve the milestones already approved by Sproule and blessed by IIROC, the company can generate over CA$38 million of pre-tax cash flow by June 2025, assuming lithium prices hold up.

This week, the company announced that former Chairman Warner Uhl has stepped aside to allow Lt. General Andrew Leslie to assume the role. His extensive background, which includes the head of the Canadian Armed Forces as well as numerous academic and career accomplishments, puts Volt in a class by itself in terms of board-level clout and executive competence. Warner Uhl stays on as a director, which in itself is a testimonial to the veracity and upside potential of the deal.

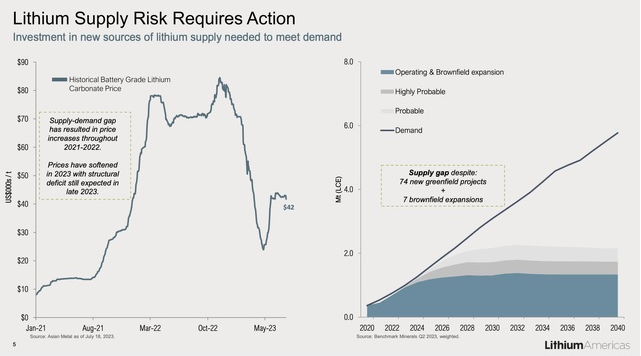

I urge all followers to take the time to do some serious due diligence on the outlook for lithium over the next decade.

I have been telling subscribers that this is the worst junior market in twenty years, but even in poor markets, companies that execute can yield enormous capital gains for shareholders. With Volt, there are many other developments that are under lock and key right now, but with the PEA coming out in late September, I see fireworks on the horizon.

Technically, it is important to remember that "volume precedes price," and with the recent massive volume since the August 4 financing closed (12.76 million shares) and buy signals from the MACD and MFI indicators, the stock has broken out above the downtrend that began when the envy-laden chatrooms began their bashing efforts so with it up 25% on the week, I urge all followers to take the time to do some serious due diligence on the outlook for lithium over the next decade.

It is next-generation lithium suppliers like Volt that will fill the supply void, and if you are able to trust the judgments of both Sproule and IIROC, then you have the foundations for a multi-bagger of staggering potential.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Volt Lithium Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.