First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) has released the latest production figures for Q2 of 2023. During the quarter, the company's total production was 6.3 million silver equivalent (AgEq) ounces, consisting of 2.6 million silver ounces and 45,022 gold ounces. Around 94% of production came from First Majestic's three mines, all located in Mexico; San Dimas, Santa Elena, and La Encantada.

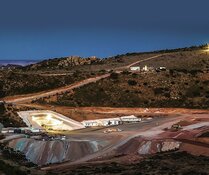

The majority of the company's other production came from its fourth operation at the Jerritt Canyon mine in Nevada, USA. Activity at Jerritt Canyon ceased as of April 24, 2023, when the company announced a temporary suspension of operations on March 30.

So far this year, the company has produced 5.2 million silver ounces and 105,616 gold ounces, which equates to approximately 14.0 million AgEq ounces.

Additional highlights from Q2 of this year include a four% increase in silver production from Q1, with the San Dimas mine enjoying higher tonnes and Santa Elena having slightly higher silver grades and recoveries.

The company also completed 42,285 meters of drilling across all sites in the second quarter of the year, a 15% increase from Q1. It has 19 drill rigs currently active. Production at the Santa Elena mine was record-breaking due to strong operational performances at the company's dual-circuit plant.

Predictions for the second half of the year include the production of between 5.3 to 5.9 million silver ounces and 86,000 to 95,000 gold ounces, or approximately 12.4 to 13.8 million AgEq ounces.

President and CEO Keith Neumeyer said, "San Dimas and La Encantada have been steady producers in the first half of 2023, and Santa Elena is now well positioned for significant production growth in the second half of 2023 as we traverse back into a higher grade area of the Ermitano mine."

Barry Dawes of Martin Place Securities wrote that gold is "heading to US$2000," explaining that "Given the seasonal influences, it could be expected that August might be relatively quiet until the end of the North Hemisphere summer, but the power of gold and its relative strength might push it much higher anyway."

He also went on to note that the company plans to continue "exploration efforts at Jerritt Canyon following the recent drill results, which demonstrates the robust exploration potential of this project."

First Majestic is a gold and silver mining and exploration company. It owns 100% of its three producing mines in Mexico. According to the company's website, it has a vision "to be the Largest Primary Silver Producer." It focuses on using "ethical, innovative and sustainable practices" to produce profitable ounces and grow their mineral resources.

As well as President and CEO Keith Neumeyer, First Majestic's management includes COO Steve Holmes, CFO David Soares, and Corporate Secretary and General Council Samir Patel.

Mr. Patel's role has recently been combined from two separate positions. Mr. Patel is a securities lawyer with over 14 years of experience in securities and corporate law. He previously served as Corporate Secretary and General Council for the Canadian gold development company First Mining Gold Corp.

Technical Analyst Clive Maund wrote that "this looks like an excellent time to load up on a wide range of silver stocks which even at this late hour are largely out of favor and ignored."

Stockhead recently reported, "It's all gold."

Barry Dawes of Martin Place Securities wrote that gold is "heading to US$2000," explaining that "Given the seasonal influences, it could be expected that August might be relatively quiet until the end of the North Hemisphere summer, but the power of gold and its relative strength might push it much higher anyway."

Technical Analyst Clive Maund reported that both gold and silver have recently been experiencing a breakout.

Multiple Upcoming Catalysts

First Majestic is looking forward to several exciting upcoming catalysts. Throughout 2023, it plans to ramp up production at the Santa Elena mine to 2,500 tpd. The company also plans to continue exploration potential at the Ermitaño Mine.

The Ermitaño Mine is also expected to produce higher silver grades during the second half of the year.

Global Analyst Adrian Day credits First Majestic with providing growing revenues for Orogen Royalties Inc.

While activities have ceased at Jerritt Canyon, First Majestic will utilize the time to optimize operations and carry out processing plant improvements there. It also hopes to carry out improvements to metallurgical recoveries by implementing fine grinding and additional research and development.

It also expects higher silver prices as the year continues.

Future exploration will focus below the upper plate and will include detailed surface mapping and rock chip sampling, moving into drilling in 2024.

Technical Analyst Clive Maund wrote that "this looks like an excellent time to load up on a wide range of silver stocks which even at this late hour are largely out of favor and ignored." He went on to postulate that "the really big action will occur once silver succeeds in breaking out not just above the top of this pattern but then above the resistance at the 2020 and 2021 highs, and of course, that's when we can expect the silver stocks to accelerate to the upside."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE)

Global Analyst Adrian Day credits First Majestic with providing growing revenues for Orogen Royalties Inc. (OGN:TSX.V).

Ownership and Share Structure

According to Reuters, 1.81% of the company is held by management and insiders. President Keith Neumeyer has 1.45%, with 4.05 million shares.

0.66% is with strategic investor Sprott Mining Inc., with 1.85 million shares.

35.99% is with institutional investors. Van Eck Associates Corp. 10.59%, with 29.51 million shares. ETF Managers Group LLC. has 4.63%, 12.90 million. The Vanguard Group Inc has 2.83%, with 7.90 million, and Mirae Asset Global Investments Ltd. has 1.74%, with 4.84 million.

The company has cash to the value of US$104.8 million, as well as US$131.1 million of unrestricted cash.

First Majestic is headquartered in Vancouver, Canada. It has a market cap of US$2 billion, with 287 million shares outstanding. It trades at a 52-week range of US$5.24 and US$9.81.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of First Majestic Silver Corp. and Orogen Royalties Inc.

- Lauren Rickard wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.