Back in mid-September, I was riding the wave of the 2022 correction, trying desperately to get a sense of when stocks would seize upon an event and turn back upward. I had called for a downturn in early 2022 after the 2021-2022 Santa Claus Rally fizzled, followed by a negative "First Five Days," a negative mid-month print, and finally a down January. On the heels of several rate hikes by the U.S. Fed, stocks in 2022 went out with nearly a 20% annual drop, but not before registering an important low in October.

In all markets, there are quite often what I call "seminal events" that lead to the exhaustion and end of either bull or bear trends. In 1982, it was the sudden drop in the Fed Funds rate by then-Fed-Chairman Paul Volcker that triggered the stampede back into stocks.

I wrote then and continue to believe now that the move by the BoE was the "seminal moment" that gave stock investors some solace that despite the tight monetary conditions of the prior nine months, central bankers would NOT allow the capital markets to move into "unstable" conditions.

In 2000, it was the US$350 billion takeover of Time Warner by America Online that allowed a little internet start-up company to use its bubble-inflated paper to acquire a company that had been around for decades with billions in sales. That event crystallized the zenith of the internet bubble and tech stock mania leading to the 2000-2002 bear market.

The 2022 correction — I use the term "correction" because despite the nanosecond that the SPX traded under the 20% correction level, thus qualifying it as a "bear market" — lasted until October 13, a mere two weeks after I first read about the Bank of England coming to the rescue of its pension funds.

I wrote then and continue to believe now that the move by the BoE was the "seminal moment" that gave stock investors some solace that despite the tight monetary conditions of the prior nine months, central bankers would NOT allow the capital markets to move into "unstable" conditions.

Since the equity markets were discounting Armageddon by then, the BoE move was the first acknowledgment of stress in the fixed-income markets that was followed up by increased liquidity injections. The second "seminal moment" jump-starting stocks was when the regional banks had their deposits guaranteed in March after Silicon Valley Bank went under, followed by the fire-sale of Republic National Bank to JP Morgan.

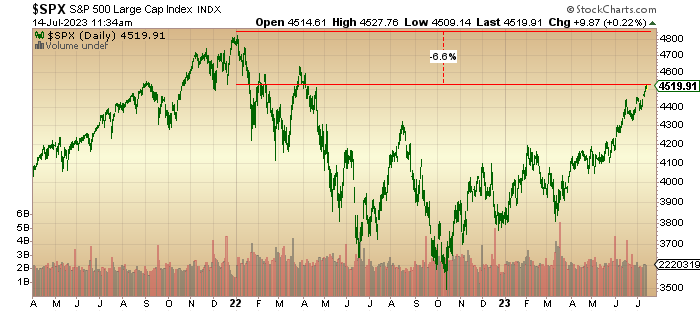

S&P 500

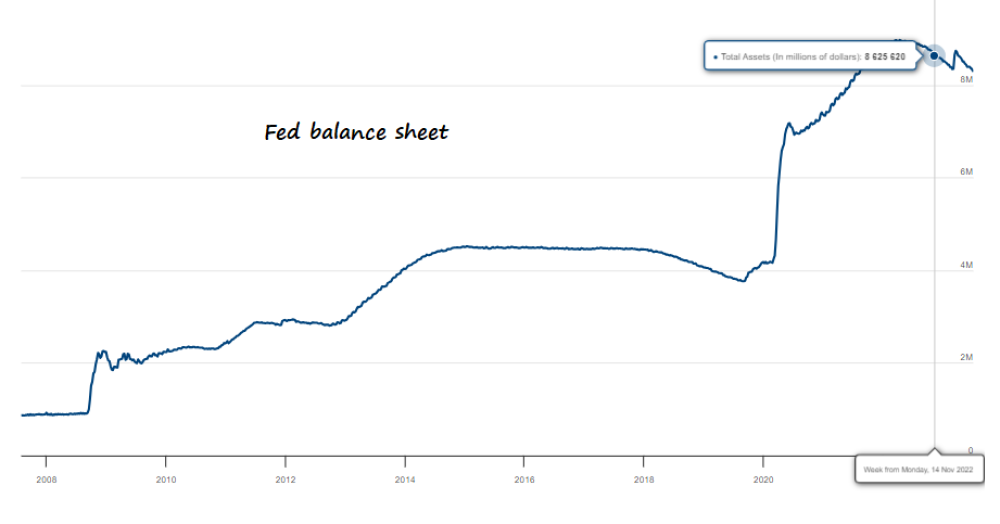

The S&P 500 has advanced over 26%, with the tech-heavy NASDAQ up over 35% since the October lows, and while Fed rhetoric continues to be "hawkish," Fed actions are anything but. The Fed balance sheet, which was supposed to be "normalized" as part of the "quantitative tightening" process, remains elevated from the US$4 trillion level pre-pandemic to over US$8 trillion today, down a couple of hundred billion since the start of the anti-inflation battle.

Anyone trading from a short position in today's markets has been mesmerized by the Fed rhetoric but unaffected by the Fed actions resulting in big losses.

Anyone thinking that the US$32 trillion national debt (forget unfunded liabilities like Social Security and Medicare) would cause grief for stock investors due to the crowding out of private borrowers by government funding needs had better take another deep look at the liquidity driver of a weaker dollar.

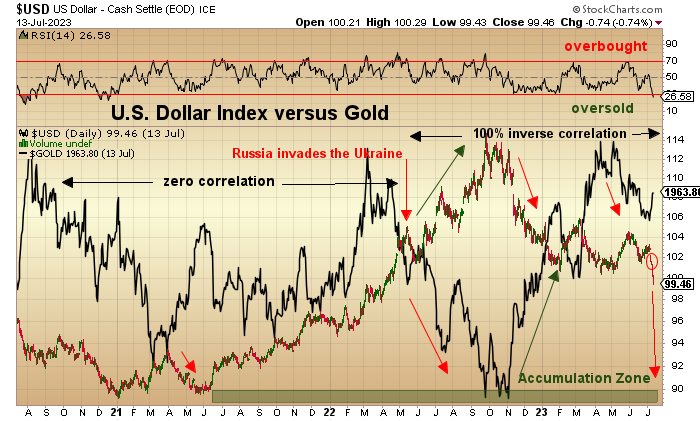

The Dollar

The U.S. Dollar Index this week broke down amidst moderating inflation numbers and declining bond yields going out at the lowest level since the Russians invaded Ukraine in January 2022.

Typically, a weak dollar will invite all sorts of speculation in commodities as they are all denominated in USD. One would think that foreign investors would lighten up on U.S. stocks, but as you can see, the S&P 500 (SPX) is going out at a new high for the year and a mere 6.6% from all-time highs.

Gold and Silver

As for gold and silver, the U.S. dollar index just broke the 100 level, which is merely a psychological barrier but from a technical perspective, it completes a long rounding top formation from a peak in mid-2022. Stop-off points are at 98, 95, and 92, all en route to a major low sometime next year at around 90.

From the August 2020 peak in gold prices until May of 2022, when the sanctions hit, gold and the dollar were neither positively nor negatively correlated, but when that ended, a strong dollar meant weak gold, and until that stops, this recent dollar breakdown should — operative word being "should" — send gold and silver (and most commodities denominated in dollars which is almost everything) higher.

However, these are rules well-ingrained into my personal psyche since the 1980s and 1990s which means they are a) probably outdated and b) meant to be broken.

The gold chart looks to be very positive and appears to have completed a reversal of the downtrend line that began at the US$2,085 peak last May. After trying to break US$1,900 several times in the past two weeks, it gathered its forces and finally crept back above the US$1,930 level, which negated the downtrend and triggered "buy signals" for both MACD and MFI.

With an RSI in the mid-50s, there is plenty of room to surpass US$2,000 where there is minor resistance, but heavier barriers exist on the probe to all-time highs, which has been rejected three other times since 2020.

The first was in April 2020, with US$5 trillion in pandemic relief thrown into the banking system; the second was the Russian invasion of Ukraine which sent oil to US$130 in a few short weeks from under US$70/bbl.; the third was in March when it appeared as though the U.S. regional banks were about to blow up because the woke-addled CEO's forgot to hedge their bleeding bond portfolios against rising yields/crashing prices all brought on by central bank (Fed) tightening. Each time gold had ample justification for exploding to all-time highs, the "Invisible Hand of Reserve Currency Management" swung into action, with the highly-predictable result being no new highs and a new maddening downtrend.

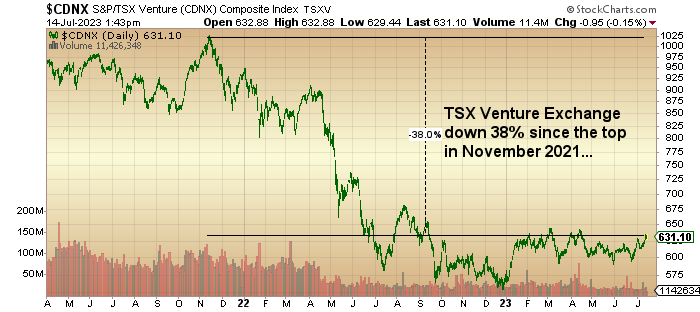

From a sentiment perspective, if the junior miners are any indication of precious metals enthusiasm, then we must be at "Generational Lows" because my inbox (which is normally full of "pitches" from all of the junior miners and explorers asking me to "get behind them") has gone very, very quiet and that is always a surefire sign that the market is about to turn.

The Twitterverse is rife with the usual suspects all chirping about the runaway NASDAQ and the moribund precious metals sector, so all that is needed is a Peter Schiff podcast reminding us of his failed Puerto Rican bank just one more time, and the circle will be complete.

Getchell Gold Corp.

The TSXV is down 38% since the November 2021 peak above 1,000, with 2022 a particularly nasty year from which it has yet to mount even the feeblest of recovery attempts. To wit, there are companies out there with large mineable resources like Getchell Gold Corp.'s (GTCH:CSE; GGLDF:OTCQB) whose Fondaway Canyon gold deposit in Nevada is valued at under US$10 per ounce. This type of mispricing is so typical of major market bottoms, but in the case of many junior developers, since 2020, they have been forced to undergo pandemic shutdowns, rising interest rates, rising input costs, and apathetic funding markets while prices for most metals are well off their respective highs for the post-pandemic period.

If there is one attribute of major market events, it is that they never ring a bell at the top. Bear markets usually arrive under a cloak of darkness, using stealth and subterfuge as a weapon with which to relieve you of your net worth.

"Like a thief in the night" is the phrase loosely used to describe in retrospect all of the reasons that you elected to hold on to your 500 shares of Nvidia that you knew was overpriced at 100 times earnings (US$232) but were still adding at 200 times (US$464). There was a great chart out on Twitter the other day of the "Magnificent Seven" stocks that are constituting the bulk of the advance for the S&P in 2023, showing prices rising 45 ̊ versus their earnings dropping 45 ̊ creating a graphic image of the "Jaws of Death."

In closing, one of my dear friends from decades ago sent me an email this morning in which he described the current market mania in which we are embroiled: "This market feels like watching someone with a few drinks in them pulling an RV, and a boat swerve into the passing lane just before sundown . . . all you can do is pull over."

Amen to that.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.,

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.