TAG Oil Ltd. (TAO:TSX.V; TAOIF:OTCQX) has released an update on the productivity of the BED 1-7 well on the Abu-Roash F reservoir.

The company has also discussed its plans for a new horizontal well on the site, which is expected to start drilling in July.

Production Update

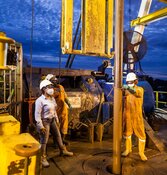

TAG Oil has provided an update on the production of the BED 1-7 well. Since the initial flowback of the BED 1-7 well on April 23, 2023, the well has unloaded to surface completion fluid from the fracture simulation and formation oil under natural flow. The company temporarily shut down the well in order to install certain pieces of infrastructure, such as production tubing and a downhole electric submersible pump (ESP).

The well began production in May of 2023. It is located on the Abu-Roash F (ARF) reservoir. With the ESP pump running at 150 barrels to 200 barrels per day, it continued to unload the remaining fluid with a gradual increase of formation oil over the first week.

Research Capital maintained its Speculative Buy rating and CA$1.35 price target on TAG, currently trading at about CA$0.70 per share."

Over the past two weeks, downhole pump intake pressure and production leveled to an average rate of 140 barrels per day, with an average of 5% water content.

The company intends to maintain the same pump speed of 10/64 inches to monitor performance for the next 30 to 60 days. Cumulative oil production from the well to date is over 4,000 barrels of 23-degree API oil.

The performance of the BED 1-7 vertical well test met the company's objectives, including the diagnostic fracture injection test pressure leak-off for indications of reservoir parameters, fluid samples from the ARF, successful large single-stage fracture treatment on the ARF and inflow performance testing of the stimulated well. The company also gathered new information on operations in the Western Desert of Egypt, improving the company's future plans, especially for a new horizontal well.

The T100 horizontal well is the company's newest plan for the ARF. The company successfully secured a suitable drilling rig for the well and designed a multistage fracture stimulation completion of the ARF formation. The rig will be transported by mid-July and is scheduled to start drilling shortly after.

A Complicated Market

At the end of May, oil prices slid back by 5%. West Texas Intermediate crude fell to US$69.02 per barrel, and Brent crude fell to US$73.16 per barrel.

According to Reuters, Iran's exports have increased to new highs despite sanctions meant to prohibit its production of nuclear materials. At 1.5 million barrels per day last month, Iran produced more oil than it has since 2018.

The industry was unsettled by unrest in the political sphere, as dissent in the Republican party almost caused a default for the United States, according to Business Insider.

According to Reuters, Iran's exports have increased to new highs despite sanctions meant to prohibit its production of nuclear materials. At 1.5 million barrels per day last month, Iran produced more oil than it has since 2018.

However, according to Sara Vakhshouri of SVB, "All of these supply volumes are in the dark market, where there is no transparency, and so they are not reflected in formal global supply and export data." This rise has also come at a time when OPEC+ is trying to make cuts.

Anticipating the Future

On June 20, 2023, analyst Bill Newman of Research Capital Corp. noted that TAG represents a possible 93% return for investors: "Research Capital maintained its Speculative Buy rating and CA$1.35 price target on TAG, currently trading at about CA$0.70 per share."

TAG is focused on the exploration and development of later-life conventional assets, and its utilization of advanced technologies and unconventional experience to drive production makes it unique in the oil and gas industry.

The company's future plan is to focus on producing oil and generating cash flow off of larger, more complex assets. TAG has a history of building companies to sell, such as Bankers Petroleum, Rally Energy, and Kuwait Energy.

The company is expecting the completion of its second horizontal well to be completed in December 2023 or January 2024.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

TAG Oil Ltd. (TAO:TSX.V; TAOIF:OTCQX)

Ownership and Share Structure

Askar Alshinbayev owns 10.89% of the company with 16.99 million shares, Abdel Fattah Z Badwi owns 2.04% with 3.19 million, Shawn Reynolds owns 1.52% with 2.38 million, Suneel Gupta owns 1.02% with 1.59 million, Barry MacNeil owns 0.87% with 1.35 million, Toby Robert Pierce owns 0.81% with 1.26 million, and Gavin Hugh Lothian Wilson owns 0.74% with 1.15 million shares.

YF Finance, Ltd. owns 8.34% with 13.01 million shares, Purpose Investments Inc. owns 1.11% with 1.73 million, and Novum Asset Management AG owns 0.65% with 1.02 million.

The company reports that it has CA$24 million in the bank and a monthly burn rate of CA$400k per month.

The company reports no potential sellers. There are 6.25 million warrants which represent 4% of the shares.

There are 155.99 million shares outstanding, and 114.62 million free-float traded shares. The market cap is CA$82.96 million, and it trades in the 52-week range between CA$0.25 and CA$0.79.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- TAG Oil Ltd. is a billboard sponsor(s) of Streetwise Reports and has paid SWR a sponsorship fee between US$3,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of TAG Oil Ltd.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.