Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX) has been kept under observation in recent days in an effort to determine whether it is putting in an intermediate base after its recent sharp drop or a bear Flag that will lead to another downleg.

Whilst aware that there is some chance that it could drop further short-term to touch the October lows in the CA$0.62 area, it is now thought that it is forming a base here, especially as the company has come out with a run of good drilling results in the recent past including those out this morning.

The big drop last month appears to have been associated with a heavy CA$27 million funding, yet this funding was successful, with the units being sold at 92 cents, so it is puzzling that the stock has dropped so far below this price and one reason for it and a restraining influence over the past year is that a fund had 11 to 12 million shares and has been selling during this period, but they now have no more to sell.

In any event, the selloff looks overdone, especially as the company is set to pour its first gold later this year, so this looks a good point to buy, especially as the Accumulation line has been creeping higher in recent days and momentum recovering.

If it does break to the upside after the recent tight standoff, it is likely to be with a large white candle.

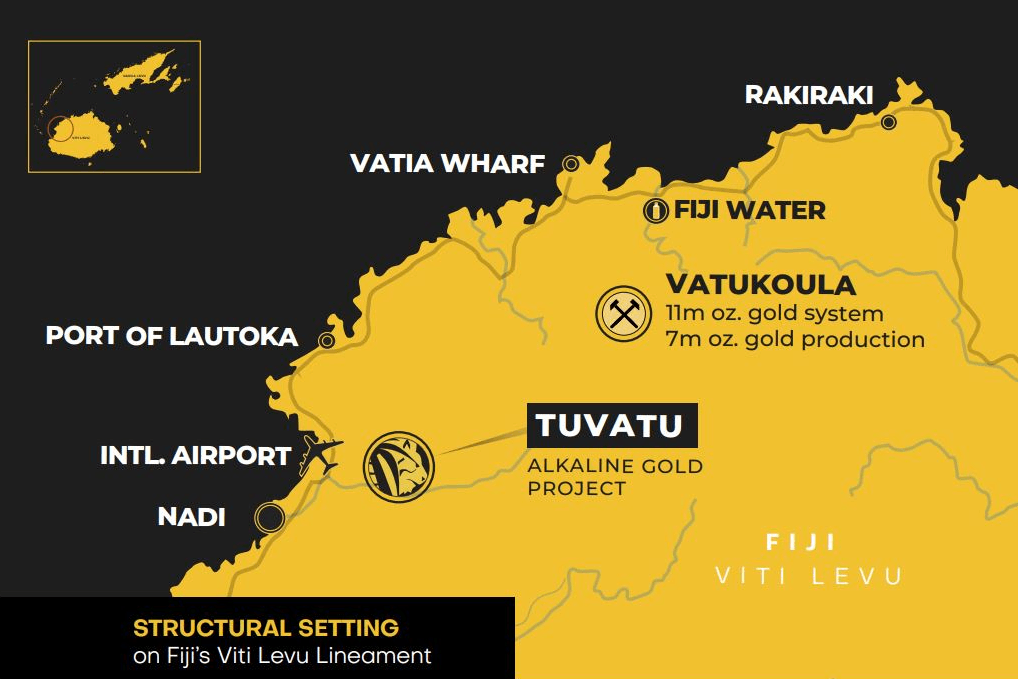

Lion One Metals' website.

Lion One Metals Ltd. closed for trading at CA$0.66, $0.50 EDT at 12.15 pm on June 14, 2023, and closed at AU$0.77 on ASX.

Originally published on clivemaund.com on June 14, 2023, at 12:30 pm EDT.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Lion One Metals is a billboard sponsor(s) of Streetwise Reports.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.