Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX) reported more high-grade gold results Wednesday from grade-control drilling at its flagship Tuvatu project in Fiji, including 7.14 grams per tonne gold (g/t Au) over 21.6 meters and 18.61 g/t Au over 5.1 meters.

Grade-control drilling is being conducted at the site, 100% owned by Lion One, to give a better understanding of the mineralization of the lodes and optimize mine development and extraction.

Some analysts and newsletter writers have said investors could have an opportunity with the stock, which sank 17% when the company announced a private placement on May 3. On Wednesday, it was still CA$0.66 per share, compared to CA$1.05 on May 2 before the announcement.

The drop prompted Eight Capital analyst Felix Shafigullin to write that Lion One presented "a buying opportunity for investors to get exposure to one of our Top Picks among the precious metals explorers/developers" in a May 23 research note.

"We view Lion One as undervalued relative to other gold developers under our coverage," he added.

Eight Capital rated the stock a Buy with a CA$2.60 per share target price, a potential return of nearly 300%.

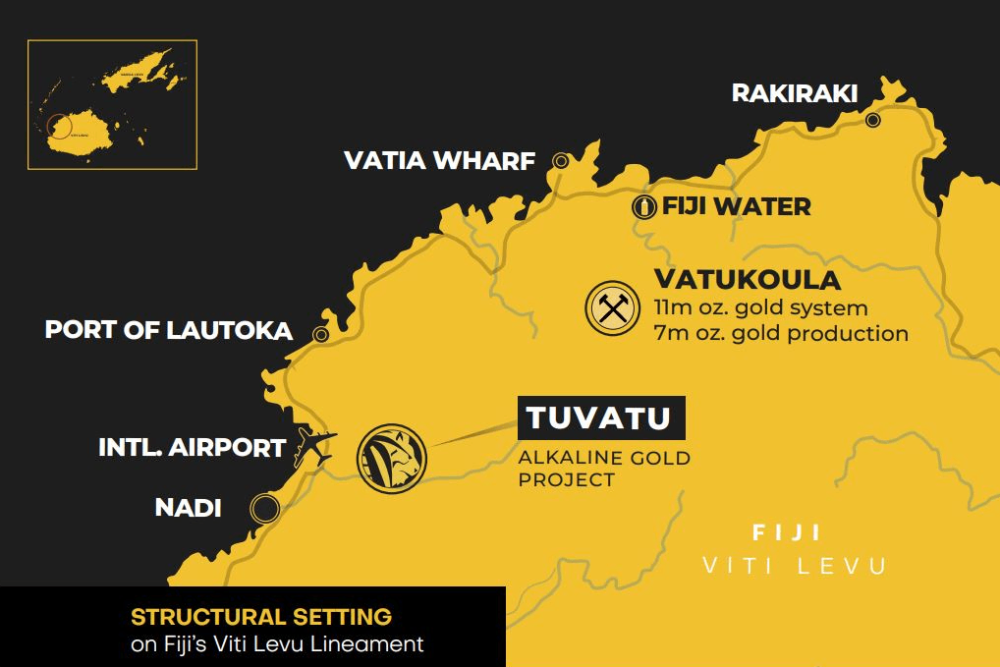

Tuvatu is just miles away from Fiji's highest-producing gold mine, Vatukoula, and could promise comparable riches, Bob Moriarty of 321gold.com said in a recent interview.

"We view Lion One as undervalued relative to other gold developers under our coverage," Eight Capital analyst Felix Shafigullin added.

"Lion One is my biggest position. I am going to go into the placement because absolutely, if you're buying Lion One at these prices, you're stealing," Moriarty said. "But what everybody's missing . . . there's an identical mine 40 miles to the northeast" that has produced more than 7 million ounces (Moz) Au over nearly nine decades.

Vatukoula, which means "gold rock" in Fijian, shares the same geological setting as Tuvatu, an alkaline-epithermal gold deposit. Vatukoula has a resource of 3.8 Moz Au.

Technical analyst Clive Maund of CliveMaund.com wrote Wednesday that "it is now thought that it is forming a base here, especially as the company has come out with a run of good drilling results in the recent past, including those out this morning."

He said the selloff looked "overdone, especially as the company is set to pour its first gold later this year, so this looks a good point to buy," wrote Maund.

'One of the Biggest Sleepers in the Business'

Other highlights of the drilling results released Wednesday include:

- 52.06 g/t Au over 2.1 meters (including 345.3 g/t Au over 0.3 meters)

- 23.11 g/t Au over 3.6 meters (including 125.31 g/t Au over 0.3 meters)

- 19.43 g/t Au over 3.3 meters (including 80.87 g/t Au over 0.6 meters)

- 21.15 g/t Au over 2.7 meters (including 67.59 g/t Au over 0.6 meters)

- 9.39 g/t Au over 4.2 meters (including 67.30 g/t Au over 0.3 meters)

- 10.13 g/t Au over 3.9 meters (including 38.58 g/t Au over 0.6 meters)

- 33.99 g/t Au over 0.9 meters (including 100.89 g/t Au over 0.3 meters)

- 78.03 g/t Au over 0.3 meters

On May 3, Lion One announced a "bought deal" offering of 29.35 million units of the company with a syndicate of underwriters at CA$0.92 per unit, which would be used for development and exploration at Tuvatu, working capital, and general corporate purposes.

Moriarty said company Chief Executive Officer Walter Berukoff knew he needed to finish construction of the mine and processing plant.

"He has to build 100% of the mine so it can be in production in Q4; he cannot build 98% of the mine," Moriarty wrote on 321gold.com.

"Lion One is one of the biggest sleepers in the business," Moriarty wrote. "One of these days, investors will see the opportunity that exists in resource stocks."

The Catalyst: Abundant Free Gold

Workers have begun extracting material from one of two new lodes at Tuvatu, URA1, and will begin extracting from the other, URW1, soon, the company has said. The results released Wednesday are from URW1.

Tuvatu's narrow vein deposit excluded many bulk mining techniques. Airleg mining using compressed-air-powered cylinders lets workers get at high-grade veins with widths as small as 1.8 meters with minimal dilution of the ore by waste.

The mineralization consists of "abundant free gold," the company wrote, often associated with light to dark gray chalcedonic quartz and roscoelite, locally accompanied by minor amounts of pyrite, sphalerite, galena, and lesser chalcopyrite.

"Lion One is one of the biggest sleepers in the business," Moriarty wrote. "One of these days, investors will see the opportunity that exists in resource stocks."

Earlier results from grade-control drilling included 88.07 g/t Au over 5.7 meters, including 1,396 g/t Au over 0.3 meters; 27.52 g/t Au over 5.55 meters; 20.93 g/t Au over 7.2 meters; 16.12 g/t Au over 9.3 meters; 16.48 g/t Au over 9.6 meters; 14.6 g/t Au over 6.6 meters; 14.97 g/t Au over 5.4 meters; and 10.85 g/t Au over 6.9 meters.

Visible gold was also seen in several drill holes, the company said.

"Tuvatu gold deposit is emerging into a very large high-grade alkaline gold deposit," wrote newsletter author Jay Taylor of J Taylor's Gold, Energy & Tech Stocks. "The company is fully permitted for production as it continues to add incredibly high-grade ounces of gold at depth."

Drilling "appears to be confirming even higher grades than had been anticipated," Taylor continued.

Another K92?

Tuvatu is on the island of Viti Levu in the archipelago nation. A September 2020 Preliminary Economic Assessment (PEA) outlined an indicated resource of 1,007,000 tonnes grading 8.48 g/t Au for 274,600 ounces Au and an inferred resource of 1,325,000 tonnes grading 9 g/t Au for 384,000 Koz Au. The study used a cut-off grade of 3 g/t Au.

ROTH Capital Partners analyst Mike Niehuser also compared Tuvatu to Vatukoula, calling Tuvatu "one of the highest-grade gold mines in the world."

ROTH Capital Partners analyst Mike Niehuser also compared Tuvatu to Vatukoula, calling Tuvatu "one of the highest-grade gold mines in the world."

ROTH has a Buy rating and a CA$2.50 per share target price on the stock, which would be five times its current price.

Lion One plans to operate the new plant at Tuvatu at an initial production capacity of 300 tonnes per day for the first 18 months before increasing capacity to 500 tonnes per day in mid-2025. Initial mining will focus on the near-surface resource while advancing underground development.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX; LY1:FSE)

Asset manager Chen Lin, author of the What's Chen Buying? What's Chen Selling? newsletter, compared Tuvatu to another lucrative high-grade gold project, K92's Kainantu mine in Papua New Guinea, which was able to recover more than 5 million Au equivalent ounces (oz Au eq) of resource.

"If they can execute, LIO can be the next K92 as it has a very high grade," Chen wrote.

Ownership and Share Structure

About 14% of the company is held by insiders, about 6% by institutions, about 20% by other investors, and about 60% is retail.

The CEO, Berukoff, owns about 11.8% or 20.9 million shares, according to Reuters. Franklin Advisers Inc. owns 4.27% or 7.56 million shares.

Lion One's market cap is CA$114.69 million, with about 206 million shares outstanding, about 185 million of the free-floating. It trades in a 52-week range of CA$1.53 and CA$0.59.

Sign up for our FREE newsletter

Important Disclosures:

- Lion One Metals Ltd. is a billboard sponsor(s) of Streetwise Reports.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.