Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) has recently completed its acquisition of the 12,282-hectare South Dufferin Uranium project from Denison Mines Corp. through share and cash payments.

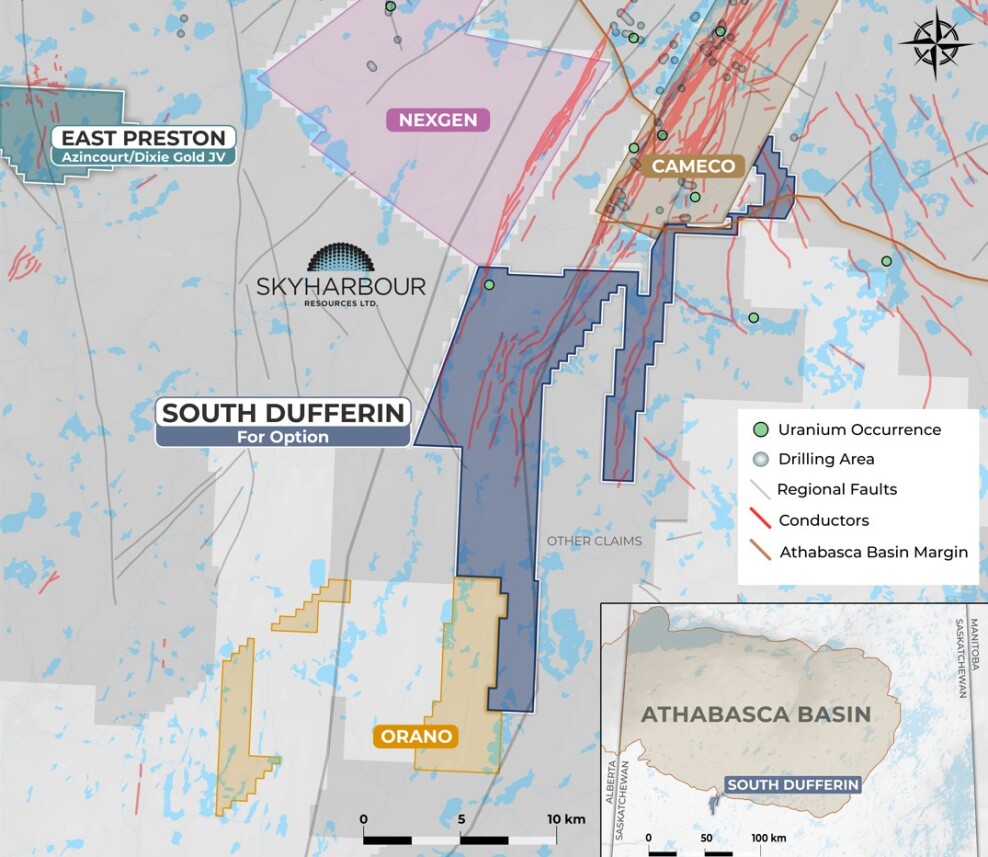

The South Dufferin property has nine claims and is located at south of the Athabasca Basin, which hosts the highest-grade uranium deposits in the world. The premium uranium region is situated in northern Saskatchewan, Canada.

Skyharbour is a uranium explorer and miner in Canada's Athabasca Basin. With this acquisition, Skyharbour now has a total land ownership of 504,356 hectares across 24 projects — ten of which are drill ready. The company has one of the largest project portfolios in the Athabasca region.

Aside from the exploration of new mineral properties in the Athabasca Basin, the company is also into long-term partnerships by offering earn-in option agreements to partners. These agreements can partly fund exploration expenditures per project.

This hybrid prospect generator business model will allow a company to invest in a Skyharbour project and be a direct stakeholder in the project, while the company will use the fresh funds to finance the project's exploration operations.

Catalyst: Drill Ready With More Drilling Programs To Come

Previous exploration in the South Dufferin Project included airborne electromagnetic, magnetic, and radiometric surveys, lake water and sediment sampling, prospecting and ground-truthing of airborne anomalies, geological mapping, and diamond drilling.

Exploration potential in South Dufferin is in the basement-hosted uranium mineralization within the Dufferin Lake fault and parallel faults within the Virgin Lake Shear zone.

Fagan of Resource Stock Digest pointed out that amid the remarkable project portfolio and acquisitions, there is a lot of upside potential for the uranium-focused stock.

The South Dufferin Project is now discovery-ready and "drill ready" as several mineralizations are observed at the northern part of the project. Some prospective targets in the property also need follow-up work.

Skyharbour also owns a 922-hectare claim adjacent to South Dufferin, connecting it to the project and bringing the entire project's cumulative land total to 13,204 hectares (32,628 acres) over ten claims.

The company considers Denison Mines as a large strategic stakeholder, with the recent cash-and-shares acquisition effectively increasing Denison's stake in the company. Skyharbour also acquired one of its flagship projects from Denison — the Moore Uranium project — which is now in the advanced stages of high-grade uranium exploration.

Now having 24 uranium projects under its belt, the company has a few drill programs in the pipeline for 2023 onwards:

- The company earlier announced its 10,000-meter (m) drill program for its flagship projects in 2023. This includes the 8,000 to 9,000m planned drilling at the Russell Lake Project across 18-20 drill holes, while the rest will be at the Moore Lake Project, particularly in the Maverick East and Grid Nineteen target areas.

- Partner Basin Uranium is currently completing its 3,000 to 4,000m Phase 2 drilling program at the Mann Lake Project.

- Partner Azincourt is planning to start a 6,000m drilling at East Preston Project in December.

- Partner Medaro will be on the Phase 1 drilling at the Yurchison Project in the new year of 2024

- Recently announced option partners Yellow Rocks Energy and Tisdale Clean Energy will be working at the Usam/Wallee and South Falcon East Projects. Skyharbour expects Tisdale to start drilling activities this year.

"(We are) tentatively expecting a minimum of approximately 25,000 to 30,000m of combined drilling across six to seven projects — two of our core projects and four to five partner-funded projects," Skyharbour commented.

The Growing and High-Potential Nuclear Energy Market

The uranium industry is primarily in nuclear energy generation, which solves three critical issues, including electrification, decarbonization in power generation, and energy security and independence.

With nuclear energy being an increasingly accepted type of clean energy generation, the global nuclear energy industry is calling for more sources of uranium to sustain their operations in order to veer away from the world's reliance on Russian natural gas and energy generation.

In an interview with Resource Stock Digest, Skyharbour President and CEO Jordan Trimble said the uranium industry has experienced notable developments in recent months, which include:

- Demand for uranium is soaring, with year-to-date contracted volumes already close to the 125 million pounds (lb) of contracted uranium volume in 2022. Global contracted volumes of uranium are seen to reach 180 million lbs this year.

- There is progress in the United States' sanction of Russian uranium and nuclear fuel. The market has been anticipating this, and a bill that will ban Russian uranium from 2028 onwards is expected to be passed and implemented this year. This is seen to have a positive impact on the Western uranium industry.

- In a recent G7 summit, member nations formed a nuclear alliance to promote and foster the nuclear industry in the West, carving out Russia in the equation.

Trimble also pointed out that uranium spot prices have been rising steadily. Uranium is currently priced at US$41.76/lb, growing since the latter quarters of 2021.

The Skyharbour CEO said that if uranium prices continue to move higher despite the weak global economic conditions, this uptrend can later influence the rise in uranium equities, "playing catch up" to the "deep value proposition" that uranium brings. He was referring to the growth potentials in uranium amid strong demand from the nuclear energy market.

Strong Position with 24 Uranium-Rich Project Portfolio

After the acquisition of South Dufferin, Mike Fagan of Resource Stock Digest said Skyharbour is now seeking a joint venture or option partner for the advancement of the project as part of its earn-in option business model.

Fagan pointed out that amid the remarkable project portfolio and acquisitions, there is a lot of upside potential for the uranium-focused stock, which is only trading around CA$0.40 per share at present. Skyharbour will benefit from the bright prospects in the uranium sector once the prices of uranium-focused equities follow suit with the uptrend in uranium prices.

Capital Cube noted that Skyharbour has a "strong capital position."

Fagan also mentioned Skyharbour's attractive fund flows. The company has option agreements with partners amounting to over CA$34 million in partner-funded exploration expenditures, over CA$22 million in issued stocks, and just under CA$15 million in cash payments coming in, assuming the company's partners earn in the full amount at their respective uranium projects.

"Speculators can anticipate a steady stream of news flow over the coming quarters (for Skyharbour), including forthcoming assays from Russell Lake and East Preston," he added.

At the end of last year, Capital Cube noted in a research report that Skyharbour has a "strong capital position," which is greater than the operating expenses in the past four quarters of 2022, with cash that is 7.48 times the operating expenses. The working capital is CA$7.22 million, which is 12.97% of the company's market cap.

"Skyharbour has enough money to finance their operations in a year and does not need to raise capital in the immediate future," Capital Cube said, adding that companies like Skyharbour, "which have a low burn rate and relatively high market capitalization, are able to raise capital, but only to the extent that their valuation is reasonable amongst their peer group."

The company can still maintain strong financials with its hybrid model of getting earn-in option agreements from partners, which can continuously finance exploration activities in their projects without taking on big fund-raising initiatives.

Ownership and Share Structure

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

Management and insiders own 5% of the company. CEO and President Jordan P. Trimble owns 1.62%, with 2.48 million shares.

Institutional investors include Alps Advisors, Inc. which owns 5.81% with 8.92 million shares, while Mirae Asset Global Investments owns 4.18% with 6.42 million shares. Exchange Traded Concepts, LLC owns 2.76% with 4.24 million shares. MMCAP Asset Management holds 2.38% with 3.66 million shares, while Incrementum AG also owns 1.51% with 2.32 million shares. Sprott Asset Management LP has 0.86% interest with 1.32 million shares, DWS Investment GmbH owns 0.39% with 0.60 million shares, and Vident Investment Advisory, LLC holds 0.35% with 0.53 million shares.

David Cates, the current president and CEO of Denison Mines and a Director of Skyharbour, owns 0.81% with 1.25 shares. Denison Mines Corp., Rio Tinto, and Paul Matysek, the previous founder and president and CEO of Energy Metals Corp, all represent strategic investors. Denison owns 11.4 million shares, while Rio Tinto holds 3.6 million shares.

The rest of the shares are held by retail investors.

Skyharbour reports that it has approximately CA$7 million in the treasury, with another CA$3 million expected to come from the option partner payments scheduled in the next 12 months. The company has a monthly burn rate of CA$125,000.

According to its latest company report, Skyharbour has a market cap of CA$59.8 million and 161.5 million issues and outstanding shares. The shares trade in the 52-week range between CA$0.22 and CA$0.43 in a 52-week period.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor(s) of Streetwise Reports and has paid SWR a sponsorship fee between US$3,000 and US$5,000.

- Nika Catalado wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.