Key Points

- Gold

- Breaks up through wedge

- And does that backtest

- New US$ highs coming soon

- Breaks up through wedge

- US$ — heading higher

- Rally to 105

- Euro, Yen, Sterling and Swiss Franc, etc., still look awful

- Nth Am Gold stocks starting a Wave 3

- Have completed C Wave for 2

- Held the strong breakout

- XAU still heading for 165

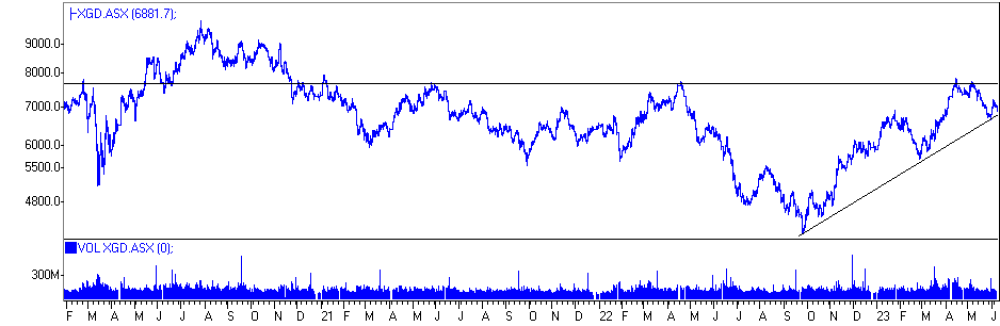

- ASX Gold Stocks starting a Wave 3

- Have completed Wave 2 pullback

- Tax loss selling for 30 June likely to provide bargains over the next two weeks

- Bounced off major technical support here

- August 2020 downtrend support

- Oct 2022 uptrend test

- Horizontal support around 6700

- US equities

- S&P 500 exceeded 4200

- 4300 coming and much more

- DOW 30 about to surge

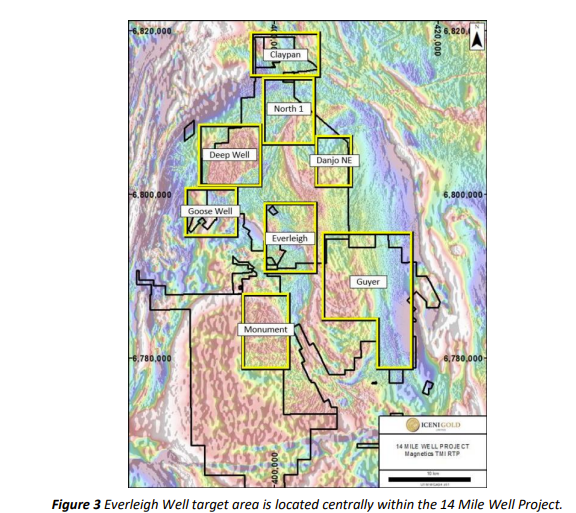

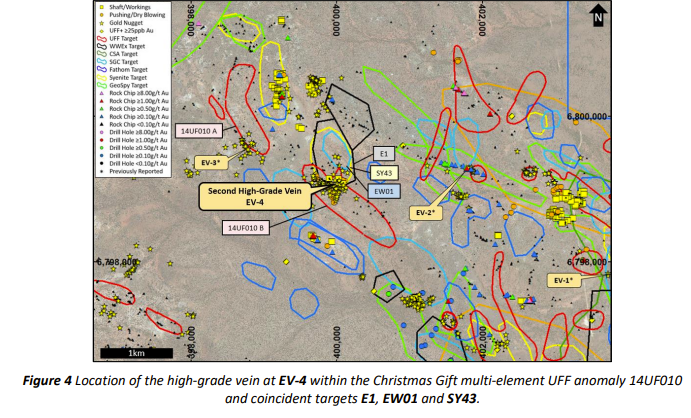

- Iceni Gold — 14 Mile Well Project

- Castlemaine Fault confirming significant gold mineralization potential

- Everleigh Well delivers some further excellent outcrop results

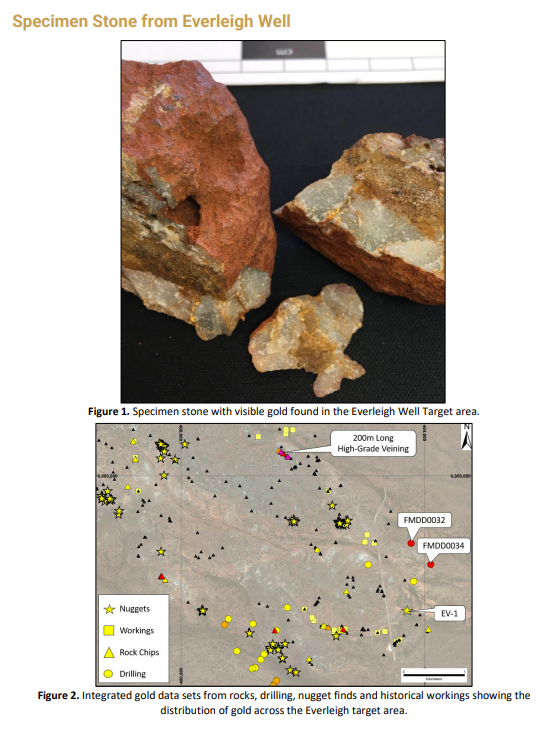

- +14 -18,000g/t grades from a quartz reef specimen stone

- Follows up earlier nuggets and rock chips samples from Everleigh Well target

- More than one mine will be found by ICL in this project

- Thorough professional approach is delivering

- Major earlier MPS research report is attached

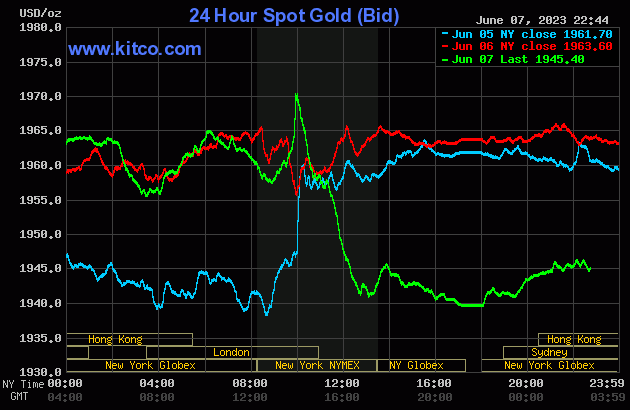

Gold

Here is that backtest action again in yet another US$30 intraday move. Another attempt at slapping down gold by the banksters to try to break the market. It will, of course, fail because far too many participants are buying physical gold now.

And gold is still in technical uptrends near all-time highs in other currencies. The possible pullback to the breakout at about US$1940 basis the futures could occur as the USDXY heads to 105.

Gold is now in a seasonally slow period and has a good record of rallying in the December Half from May - June lows. Gold is still holding above major support, not far from US$2000.

But as has been pointed out, gold is technically ready for another sharp move higher.

Dimitri Speck has provided this graphic for many years, but more recent versions are not freely available.

The expected backtest to around US$1940-50 on this graphic might now happen.

The above seasonal pattern suggests a couple of weeks to chop and confirm a low in May/June before moving seasonally higher in the Dec Half of the year.

Testing uptrends are always testing times.

Gold is still holding above this long-term support level.

The US$ is remaining firm with a rally likely to 105 that might pressure gold lower. A subsequent pullback in the US$ should boost gold higher.

Always keep in mind though, that the Euro, Yen, Sterling, and Swiss Franc have broken major 50-year uptrends.

Gold stocks

- Gold stocks are still holding on

- Wave 2 completed

- Now starting Wave 3

- Strong support around these levels

- Next stop 165 on the XAU

Strong breakout and pullback here. Not sure how much backing and filling is required here, but it should not be too long.

- Supporting on May 2022 downtrend

- Picking up Oct 2022 uptrend

ASX Gold Index

Consolidating on good technical support.

- Sept 2022 uptrend

- July 2020 downtrend

- Horizontal support at around 6700

- Tax loss selling should provide opportunities

US Equities

- Breakthrough 4200 achieved

- 4300 will be next

- DOW 30 about to surge higher

- Short covering driving

- DOW 30 to move sharply higher

Iceni Gold — 14 Mile Well Project delivering

Iceni Gold Ltd. (ICL:ASX)

- Recent work is confirming true under-explored status of these tenements in big mine country

- Expect at least two major gold deposit discoveries in this 14 Mile Well Project

- Complete geo chem assessment over 600km2 tenements

- Important structural feature Castlemaine Fault confirming mineralizing potential

- Market cap A$21m at A$0.10 on 208m shares.

- Numerous high-quality targets zones already identified

- Exploration results confirming potential

- Major earlier report on ICL is attached.

- ICL's greenfields exploration is helping to change market and industry perceptions of gold deposits in the Yilgarn in WA

Iceni Gold has 600km2 of exploration tenements in the area between Laverton and Leonora to the west of Lake Carey. The tenements cover a large area in the midst of numerous important gold mines and deposits, and its difficult terrain with quite deep transported cover has left the area significantly underexplored.

ICL has already identified two key structural features, the N-S Castlemaine Fault in the center of the tenements and the equally important Guyer Shear in the SE portion of the tenements. Each is likely to result in the greenfield discovery of a major deposit of gold mineralization.

And there is much other potential in the remaining target zones.

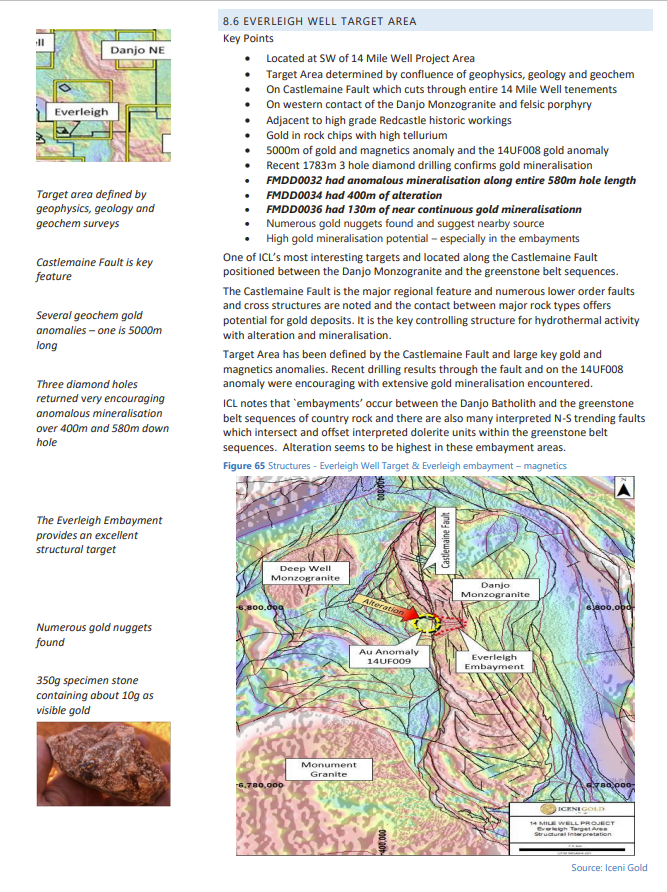

Everleigh Well Project

The Everleigh Well project is continuing to deliver very encouraging results that confirm the regional mineralizing potential of the North-South Castlemaine fault identified by Iceni's exploration efforts.

Strong geo-chem results followed up by stratigraphic drilling confirmed the potential for the discovery of economic gold mineralization there at Everleigh Well.

ICL had previously reported in March 2023 the discovery of visible gold in exposed in situ quartz reef veining that extended for more than 200m.

Iceni noted that the gold in these earlier samples had characteristics of epizonal gold mineralization similar to that in the Golden Mile.

These results, combined with the drilling and numerous gold nuggets found here, provided strong evidence of potential quartz reef gold mineralization.

These now announced very high-grade gold grades from a single specimen stone provide compelling evidence of a gold deposit, possibly major, is there to be found nearby.

Several samples were taken from this specimen stone from the quartz vein outcrop.

High-grade rock chips from outcropping reef:

- 18,207g/t

- 18,179 g/t

- 16,776g/t

- 16,659g/t

- 14,708g/t

This specimen adds to the unfolding picture of a very high-quality drilling target is confirmed.

Follow-up drilling will be underway soon.

ICL — Rally extended up to the downtrend line, but fundamentals should soon change the direction of this stock.

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.