Canadian mineral explorers are taking another look at their projects in the rush for the new "white gold," lithium, which is in big demand as part of the green energy transition.

Quebec Precious Metals Corp. (QPM:TSX.V; CJCFF:OTCQB;YXEP:FSE) is no different. It has started a study to look at whether its James Bay projects in Quebec host viable deposits of the metal.

While recent volatility in the sector may have scared some investors, analysts at Canaccord Genuity in a May research note said they believed the market could be bottoming out.

Chinese spot prices fell more than 65% from highs in late 2022, analysts wrote in the May 5 note.

"While this has driven negative investor sentiment YTD, we don't think this represents a true picture of the lithium market," the analysts wrote. "We see reasons to be more optimistic toward equities in the short-term as pricing bottoms."

But the analysts said their medium-to-longer term expectations continued to call for market deficits and elevated pricing.

"As such, we remain long-term bulls on the sector," they wrote.

"We believe the Corvette property is evolving into a world-class spodumene resource," analysts Anoop Prihar and Alex Riazanov of Eight Capital wrote.

According to Morningstar, the dip in lithium prices was the result of the expiration of China's electric vehicle (EV) subsidies.

"As demand growth accelerates, we expect the supply deficit will remain in place," Seth Goldstein wrote. "Most of the new supply required to meet demand will come from new, greenfield resources. Across all resources, many of these projects generally face delays, and we forecast enough supply will be delayed from management's initial timelines to keep the lithium market undersupplied."

A soft, silvery metal with highly reactive and flammable properties, lithium is a major component of EV batteries. It's also used to strengthen alloys, as a high-temperature lubricant, and as a drug to treat bipolar disorder.

The Catalyst: A Hedge Against China, South America

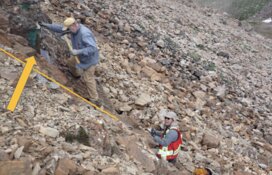

QPM has contracted ALS GoldSpot Discoveries Ltd. to do a detailed lithium-targeting study on its 1,338 claims covering 697 square kilometers, all 100%-owned. Many lithium deposits in the region are hosted in pegmatite rocks.

"We know we have pegmatite on our gold projects, but we didn't focus on lithium," QPM Chief Executive Officer Normand Champigny said. "That was not the purpose of the creation of the company. But we almost have a moral obligation to find out. And so that's what we're doing now."

Initial results of the study are expected as early as July.

The U.S. has also allocated US$5 billion to build out its national EV charging network, the Eight Capital analysts noted.

Also in James Bay, Patriot Battery Metals Inc. (PMET:CA) discovered a 4.3-kilometer trend of spodumene pegmatite at its Corvette project in 2017. Its market cap was nearly CA$500 million last fall. Now, it's CA$1.47 billion.

"We believe the Corvette property is evolving into a world-class spodumene resource," analysts Anoop Prihar and Alex Riazanov of Eight Capital wrote in a research note on May 29. "Based on the drill results released to date, we estimate the CV5 zone contains approximately 130mm tonnes of 1.16% Li2O mineralization. This, in turn, is likely sufficient to allow for 800,000 tonnes of spodumene production for 20 years. On this basis, PMET compares favorably to the highest-quality spodumene resources globally."

Canadian Prime Minister Justin Trudeau and provincial leaders are selling the country as an important backstop to shift supply chains away from South America and China.

QPM noted that its Elmer East project is located north to northwest of three significant lithium deposits being developed by Allkem Ltd. (OROCF;OTCMKTS), Critical Elements Corp. (CRE:TSX.V), and Investissement Québec and Livent Corp. (LTHM:NYSE).

QPM also has another play when it comes to lithium. It entered a binding memorandum of understanding with Idaho Champion Gold Mines Canada Inc. (ITKO:CNX) last fall for Idaho Champion to acquire a 100% interest in two other James Bay lithium pegmatite projects. QPM still has 6% of its shares.

Why Lithium?

Analysts from both Canaccord and Eight Capital predicted that lithium market deficits would widen into the late 2020s, and those shortfalls will be driven by demand in North America.

The United States' electric vehicle (EV) penetration of 6% lags behind China's 26% and Europe's 20%, the Eight Capital analysts noted. But President Joe Biden's administration has committed to a target of 50% of new vehicle sales being EVs by 2030.

"We estimate North American lithium nameplate production capacity will be 262,900 LCE (million tonnes lithium carbonate) 2026 based on projects that currently have completed a Definitive Feasibility Study (DFS)," Prihar and Riazanov wrote. "Although this is a significant increase from the current North American production capacity of 6,000 tonnes LCE, it's still more than 128,000 tonnes short of what we anticipate will be required by the battery plants. As such, we anticipate the fundamentals underlying lithium demand to remain robust."

US 'Most Attractive' EV Market

China only has less than a quarter of the world's lithium resources but controlled about two-thirds of the world's lithium processing and refining capacity in 2021, Rystad Energy said.

Biden has allocated US$3.16 billion in grants to support domestic EV battery manufacturing. The Inflation Reduction Act (IRA) also provides up to a US$7,500 tax credit for EVs that source 40% of their materials from North America or countries that have free-trade agreements with the U.S. That requirement increases to 80% by 2027.

The U.S. has also allocated US$5 billion to build out its national EV charging network, the Eight Capital analysts noted.

"We continue to believe that the United States is the most attractive EV market globally," the analysts wrote.

The Canaccord analysts noted that the drop in lithium equities since 2022 highs reflects weaker pricing.

"While we continue to see long-term valuation upside across the sector, we think recent sector M&A activity (so far Australian centric) marks a line in the sand with respect to implied asset/strategic values," they wrote. "This has driven a possible shift in investor sentiment, with lithium equities appearing to have somewhat stabilized. The potential for price rises into 2H'23 represents a more powerful potential catalyst for shares, in our view."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Quebec Precious Metals Corp. (QPM:TSX.V; CJCFF:OTCQB;YXEP:FSE)

Ownership and Share Structure

Major mining company Newmont Corp. (NEM:NYSE) owns about 13% of QPM. Government-backed Caisse de Dépôt et Placement du Québec and other Québec institutions own about 12%.

QPM management and insiders own about 15%, including non-executive Chairman James Shannon with 905,000 shares and Champigny with 277,000 shares, the company said.

The rest, 60%, is retail.

The company is covered by newsletter writer Chris Temple of The National Investor.

Quebec Precious Metals has a market cap of CA$7.03 million and 83.2 million shares outstanding, of which about 71 million are free-floating. It trades in a 52-week range of CA$0.14 to CA$0.06.

Sign up for our FREE newsletter

Important Disclosures:

- Quebec Precious Metals Corp. is a billboard sponsor of Streetwise Reports and has paid SWR a sponsorship fee between US$3,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Quebec Precious Metals Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.