Key Points

- Gold

- Breaks up through wedge

- And does that backtest

- New US$ highs coming soon

- Breaks up through wedge

- Silver still looking solid

- US$ - heading higher

- Rally to 105

- Euro, Yen, Sterling and Swiss Franc, etc., still look awful

- Nth Am Gold stocks starting a Wave 3

- Have completed C wave for 2

- Held the strong breakout

- XAU still heading for 165

- ASX Gold Stocks starting a Wave 3

- Have completed Wave 2 pullback

- Bounced off major technical support here

- August 2020 downtrend support

- Oct 2022 uptrend test

- Horizontal support around 6700

- Bigger picture H&S reversal pattern set up

- Neckline at ~7700

- Much higher target levels generated

- U.S. equities

- S&P 500 exceed 4200

- 4300 coming and much more

- DOW 30 about to surge

- Breaking sharply higher

- Housing sector strong

- Uranium readying to move quite sharply

Gold

Surprised there was no initial backtest on the breakout from the wedge, but I guess it is here now. Maybe a pullback to the breakout while the USDXY heads to 105. Volatility remains high with another US$30 intraday move.

Gold is still holding above major support, not far from US$2000. But as has been pointed out, gold is technically ready for another sharp move higher.

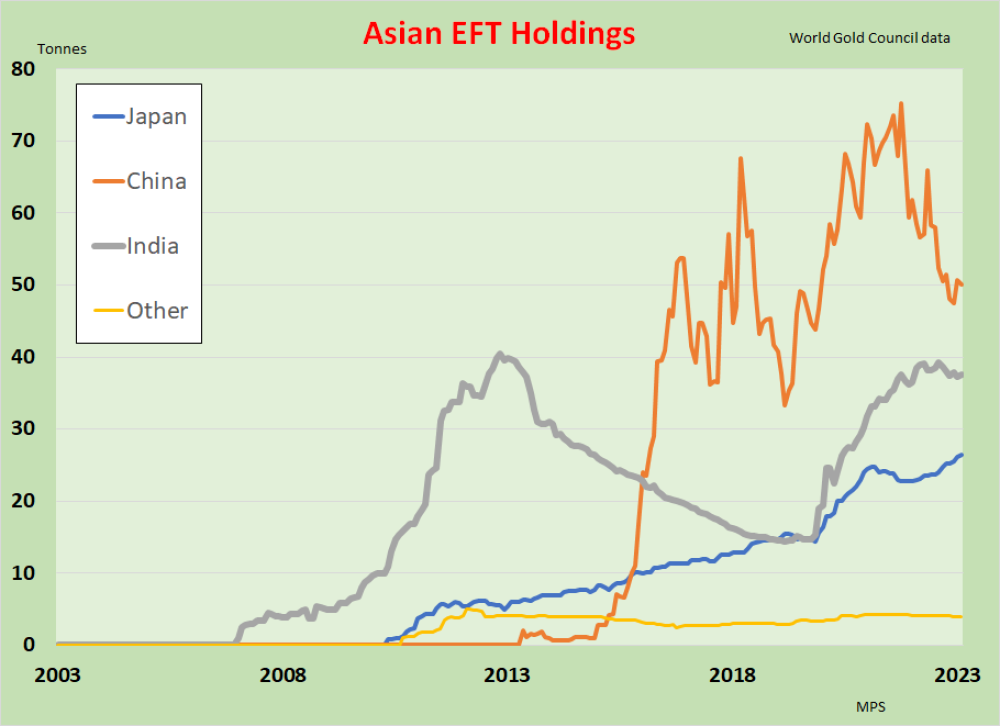

More detail from World Gold Council global data on gold ETFs.

The numbers for Asia are far smaller than for Nth America and Europe and are small against the very large traditional holdings in gold in China and India, but it is the direction that is of interest.

Individual country data for Asia.

Japan rising, with China and India possibly turning.

Also, the expected backtest to around US$1950 on this graphic didn't initially happen, but it might now. Maybe a week or two oscillating before moving higher.

All this might be confirming a low in May/June before moving seasonally higher in the Dec Half of the year.

Uptrend looks good.

Still holding above this long-term support level.

Gold vs. 10-Year T Bonds

- Gold will strongly outperform bonds.

- Initially, gold heading higher

- Then bonds heading lower

Silver

This looks like a very strong setup for a sharp rise soon.

Gold Stocks

- Gold stocks held on to gains

- Five wave C Wave for the low in Wave 2 completed.

- Now starting Wave 3

- Zone of maximum acceleration

- Next stop 165 on the XAU

Five waves down here from the B wave high to complete C and Wave 2. Strong breakout and a small pull back here.

Not sure how much backing and filling is required here, but it should not be too long.

Very nice bounce out of lower technical support and then support on the May 2022 downtrend.

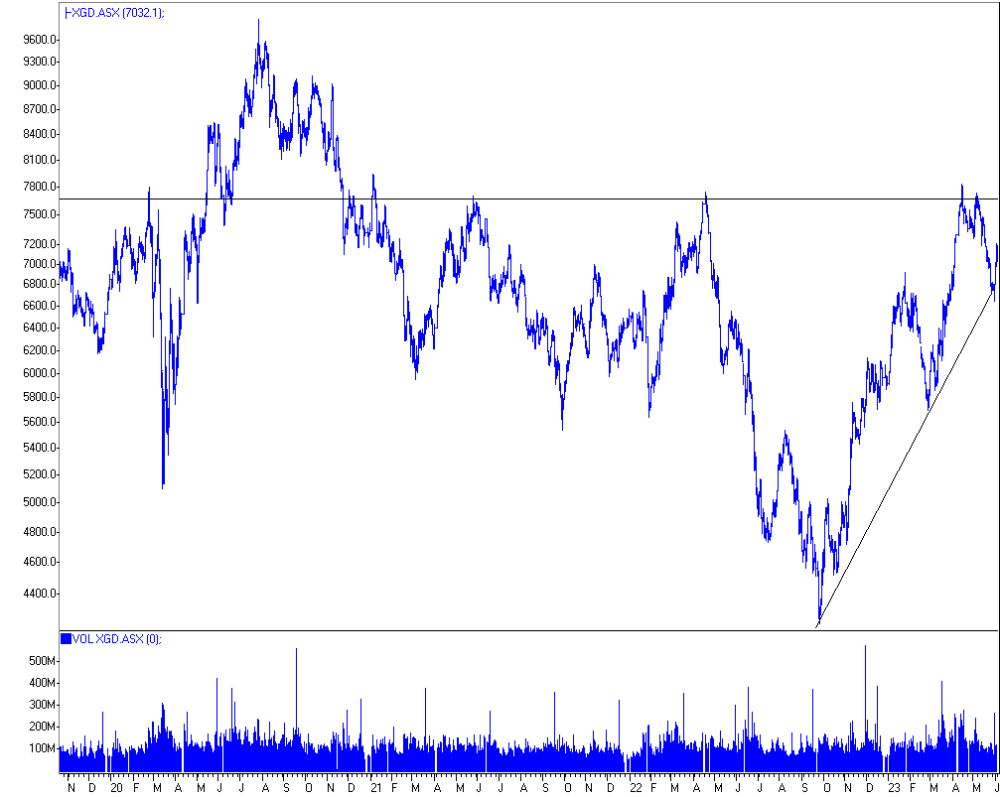

ASX Gold Index

Moving higher from strong technical support

- July 2020 downtrend

- Sept 2022 uptrend

- Horizontal support at around 6700

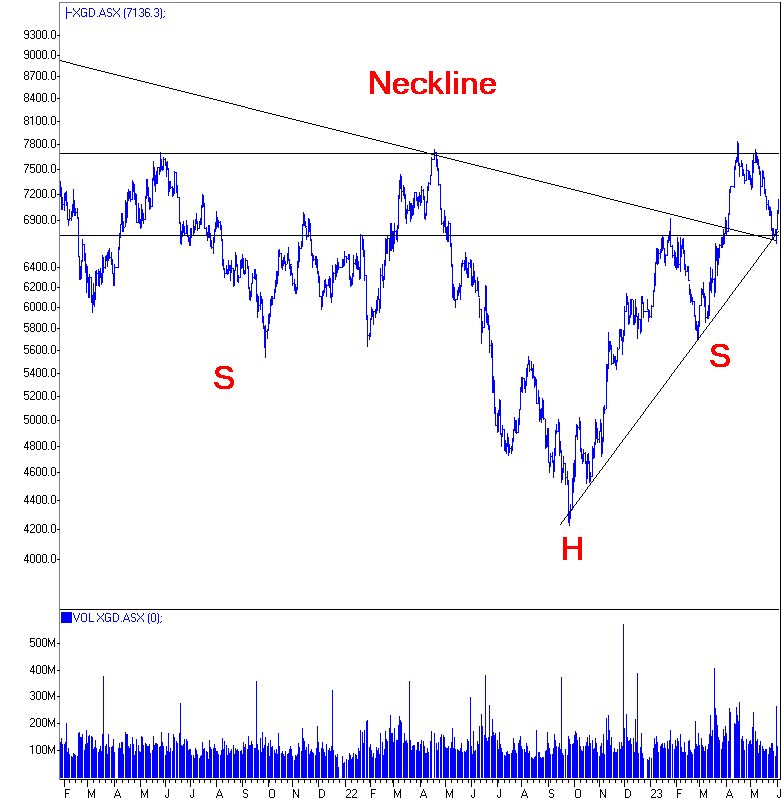

Need to keep repeating the big picture here

- 7700 is important long-term resistance

- Clear 'Neckline' for Head and Shoulders reversal.

- Target is around 12,000 as intermediate after passing 9888 previous all-time high

- Over 20,000 longer term

- XGD has completed 5 Wave C wave to complete Wave 2

The big picture supports a MASSIVE rise in the XGD.

US Equities

- Breakthrough 4200 achieved

- 4300 will be next

- DOW 30 is about to surge higher

- A strong rise coming

- Short covering driving

- DOW 30 to move sharply higher

- Housing still strong

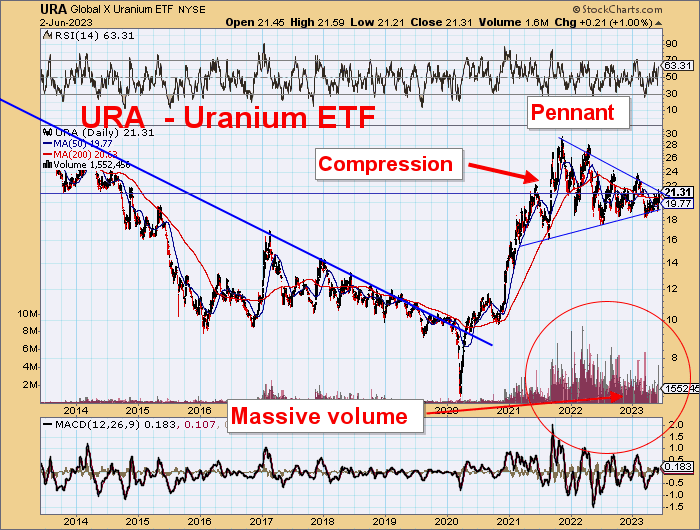

Uranium

Uranium is to break out strongly very soon.

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.