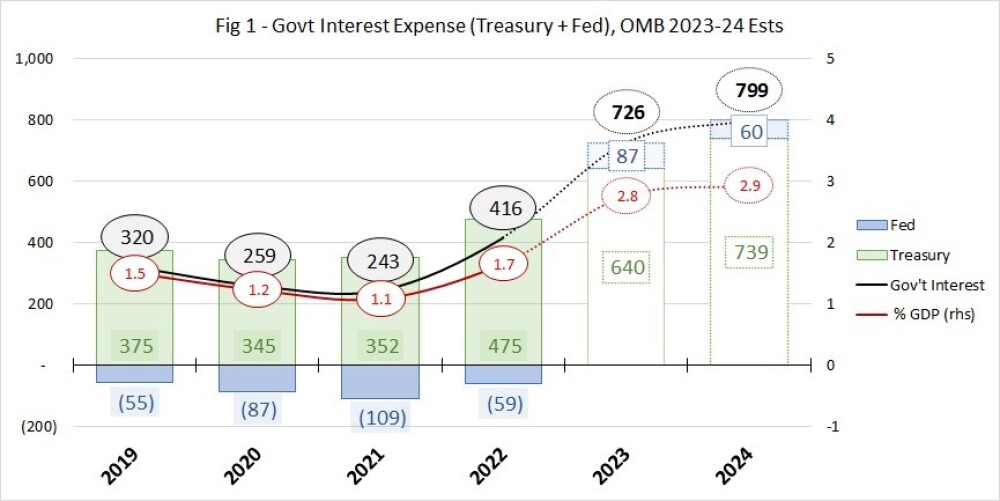

Entitlements, which include Social Security and Medicare, represent about 65% of the Federal government's outlays. Interest on the debt stands at around 12% but is rising rapidly after a decline in the 1990s and the first decade of this century.

Defense is another 12%. No one is willing to tackle entitlements, the elephant in the budget room, while interest has to be paid.

Though not such a large number, interest on the debt has risen dramatically in 2022 and is projected to nearly double again as low-coupon debt is replaced by higher-coupon debt, as can be seen in the graphic.

These numbers show why it is so difficult to bring down government spending and why there is so little wiggle room in debt-ceiling negotiations (though I am sure you and I could find a few specific items to eliminate). It is also why they keep raising the so-called debt ceiling 78 times since 1960. I say "so-called" because it's really not much of a ceiling if it is raised every time the government hits it.

According to Treasury Department propaganda, the US$6.5 trillion the federal government spent in the fiscal year 2023 was "to ensure the well-being of the people of the United States." This presumably would include half a billion to build an art museum in Nassau, Bahamas. Or US$50 million on a "visit Tunisia" tourist campaign. Or US$2.1 million on a campaign encouraging rural Ethiopians to wear shoes. This all "to ensure the well-being of the people of the United States?"

A million here, a million there, and pretty soon, you are talking real money.

It's Even Worse

The deficit-to-GDP ratio is now 7.3%, the kind of figure one sees in the depth of a recession, not on the cusp of one. Imagine how high that ratio rises when the denominator moves lower. When most commentators, including the Treasury itself, talk of the U.S. government debt, they give a number of US$31.5 trillion for this year. It is equivalent to 123% of GDP and equates to over US$94,000 per person in the U.S.

That is bad enough, but it excludes unfunded liabilities (mostly Social Security and Medicare) that come to another US$100 trillion plus. That is true government debt. There is no provision for these liabilities, and they are not on the standard government balance sheet. Stan Druckenmiller puts the total number closer to US$200 trillion.

Yet Treasury Secretary Yellen thinks the administration's offer to cut US$3 trillion from the budget over the next ten years is "reasonable."

The Economy Heading Toward Recession

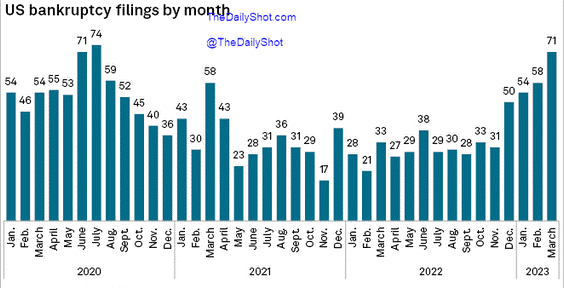

This week, the Leading Economic Index has now declined 13 months in a row, the longest stretch since the one that began in April 2007. It is now down 8% from a year ago; it has never dropped this much without a recession.

Two items illustrate this: the increase in business bankruptcy filings and consumer credit card debt.

Credit card balances, credit card defaults, and bank provisions for credit losses are all rising significantly. Capital One, which generally serves the lower middle class, has boosted provisions for credit card losses dramatically. A year ago, they were US$677 million; by the end of the year, they were US$2.4 billion, and as of quarter end, they are at US$2.8 billion. Not to worry, however: consumer spending continues unabated showing the "health of the consumer."

Inflation: No Surprise!

During covid, the federal government spent over US$5 trillion in two years, that's equivalent to 25% of GDP, according to the Encyclopedia of Economic Information Peter Boockvar.

No wonder inflation followed.

Hedonic Adjustments Don't Always Make Sense

Dave Collum, a professor of Chemistry at Cornell who writes an annual review of the year, provided a wonderful example of the perversity of the so-called hedonic adjustments that the government makes to the inflation numbers (which has the effect of lowering the reported cost of living increases).

In his typically colorful language, he wrote: "The blender your grandmother bought in 1945 died after 70 years because you dropped that pig on the floor. It was replaced by the plastic piece of crap with a life expectancy of the fruit in your smoothy (sic) and can't even be repaired. The cost per use has soared just like the other rapidly depreciating crap in your house, but economists have not yet included accelerated depreciation in the CPI. Thus, the price of the new blender is not hedonically adjusted higher because it is chintzy; it is hedonically adjusted lower because it has more buttons."

I would venture that most of us don't use all these extra buttons anyway.

Do Banks Need More Bureaucratic Regulation?

Truth from a central banker: former president of the Federal Reserve Bank of Atlanta Dennis Lockhart, in a recent interview on Real Vision, noted that banks in the U.S. (and elsewhere) are "inherently fragile," both because of leverage and because of the mismatch between lending and borrowing.

"They depend on trust."

Of course, there was a time when banks did not act like hedge funds but backed their liabilities with assets. And there was a time when directors of a bank were personally liable, without limit, for any depositor losses. This was true in 19th century Britain and until recently for the private Swiss banks. One can guarantee that, as Samuel Johnson said of the man to be hanged within a fortnight, that "concentrates the mind wonderfully."

More Regulation or Better Supervision?

Worthies from Janet Yellen to members of the Fed, from Biden to Elizabeth Warren, know how to solve the banking crisis: add more regulation. The lack of regulation, of which there is none, did not cause the recent crises. More regulation won't prevent another one. Recall that after 2008, the burdensome Dodd-Frank rules intended to prevent another banking crisis were imposed on banks and the rest of the financial sector.

Rather than more regulation, what would help would be the elimination of moral hazard (the implicit guarantee of bailing out banks and depositors) and bank officers and directors being liable for losses. If Yellen, Warren, et al. want the government involved, perhaps better oversight of existing regulations would be more fruitful than more forms to complete.

The Stock Market Is Not That Strong

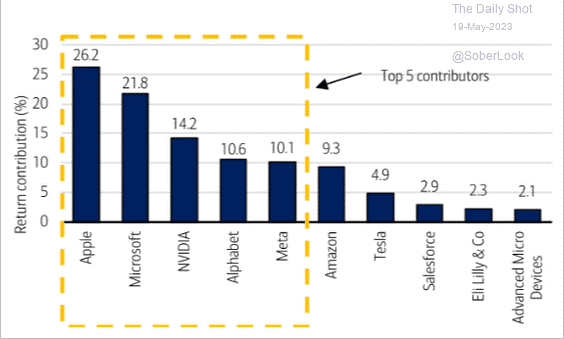

Even though the S&P index is up over 10% so far this year, throw a dart at the list of stocks in the index, and the odds are that it will be down for the year. Over half the stocks in the index are down this year, up to 52.6% for Dish Network.

Note: the table below, from last week, shows the contribution of different stocks to the S&P's return, not their actual performance.

Five stocks are responsible for over 80% of the S&P gains this year.

Nvidia is up 166%, for example, and Meta is up 117%. Apple, which accounts for the highest contribution, was up 35%, well below the return of the smaller leaders. James Stack is to stock markets what Peter Boockvar is to the economy, an encyclopedia of knowledge.

According to Stack, five of the last 15 bear markets, back to 1933, wiped out all of the prior gains, and another one almost did. Only in four did the bear market eliminate less than half of the prior gains, and three of those eliminated virtually half. Bear markets can be vicious.

Financial Privacy: What's That?

With remarkably little publicity, the government has started requiring every brokerage to report directly to a government database all of your trades, including your personal information (names, addresses, and birth years). Of course, brokers were already required to keep this information, but now it must be sent to the government.

Of course, this involves no new cost burden on custodians (and ultimately clients). Nor needless to say, there is the slightest risk of a breach in the database putting individual financial information at risk.

The Consolidated Audit Trail will include all trade cancellations and changes in all securities on U.S. markets. With 10s of billions of trades daily, this will likely become the largest database in the world. That seems like an invitation to hackers worldwide. The SEC, whose brainchild this is, has been hacked before.

Thousands of individuals at the SEC and other agencies will have access to the database. No possible cause for concern there.

UPCOMING APPEARANCES I'll be taking part in a MoneyShow Virtual Expo from June 27-29. Then in July are two live events. First up is FreedomFest, July 12-15, this year in Memphis, Tenn. And next is the ever-popular Rule Symposium, a top conference for resource investors with William Bonner, Robert Friedland, and many more. July 23-27 in Boca Raton, Fla. ERRATUM Saturday's Bulletin was dated 27th June. Must be getting ahead of myself!

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively