Lion One Metals Ltd.'s (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX) share price pulled back recently, thereby presenting "a buying opportunity for investors to get exposure to one of our Top Picks among the precious metals explorers/developers," reported Eight Capital analyst Felix Shafigullin in a May 23 research note.

"We view Lion One as undervalued relative to other gold developers under our coverage," Shafigullin added.

277% possible gain

The drop in Lion One's share price, by about 34% since the beginning of May, is due to the decline in the gold spot price from its 2023 peak, Shafigullin noted. Now, the Canadian explorer is trading at about CA$0.69 per share, and Eight Capital's target price on it is CA$2.60 per share.

The difference between the current and target prices implies a significant potential return for investors, of 277%. Lion One remains a Buy.

Reasons for Top Pick status

Shafigullin cited four key reasons why Lion One is one Eight Capital's Top Picks.

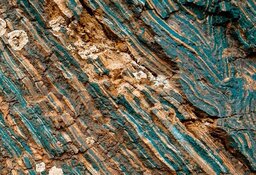

1) Its project Tuvatu is high grade, fully permitted for an underground operation and supported by the government of the mining friendly jurisdiction, Fiji. Tuvatu's total current resource stands at 2,300,000 tons of 8.8 grams per ton gold (660,000 ounces of gold) plus it has "substantial upside potential in both size and grade," the analyst described.

2) The start of production at Tuvatu is less than a year away. The company has started mining at the URA1 and URW1 lodes and stockpiling the extracted ore. This will be fed into the pilot processing plant when it is finished being built, which is expected by year-end. Now, construction is about 60–70% done.

"The pilot plant would allow Lion One to generate cash inflows while developing a better understanding of the Tuvatu ore body, including the multiple high-grade feeder structures located below the resource boundary that extend to a depth of 300–400 meters," wrote Shafigullin.

3) The feeder structures, outside the Tuvatu resource boundary and open at depth, could substantially increase the existing resource, as drilling has shown the presence of "exceptional high-grade intercepts," Shafigullin wrote. Indeed, the next mineral resource estimate update, expected by the end of Q2/23, should encompass these deep feeder zones.

4) Significant potential exists for regional exploration on Lion One's Fiji property, which includes the Navilawa caldera. The bulk, or 95%, of the land package remains open for discovery as Tuvatu only accounts for 5% of it. Further, some testing the company did in the caldera returned positive results, suggesting it may contain multiple zones of gold mineralization, similar to Tuvatu.

"We model the regional upside [at] 500,000 ounces of gold, which is a conservative figure, in our view, given the abundance of underexplored regional targets in the caldera," Shafugullin wrote.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |