The first quarter of commercial production bodes well for Silver X Mining Corp. (AGX:TSX.V). The company reported steady performance in production results at its 100%-owned Nueva Recuperada project for the three months ending on March 31.

Silver X Mining is a mining company that specializes in the exploration and extraction of silver resources. With a focus on silver, the company aims to capitalize on the growing demand for precious metals in various industries, including electronics, solar energy, and jewelry. The company employs advanced exploration techniques and technologies to identify and develop high-potential silver deposits.

By leveraging its expertise and strategic partnerships, it aims to become a leading player in the silver mining industry. The company is committed to responsible mining practices, ensuring environmental sustainability and community engagement in its operations.

On May 4, technical analyst Clive Maund said, “Silver X Mining is an immediate strong buy as it is in the process of reversing to the upside after a heavy correction. At the time of writing, it is putting in a bullish “inverted hammer” candle.”

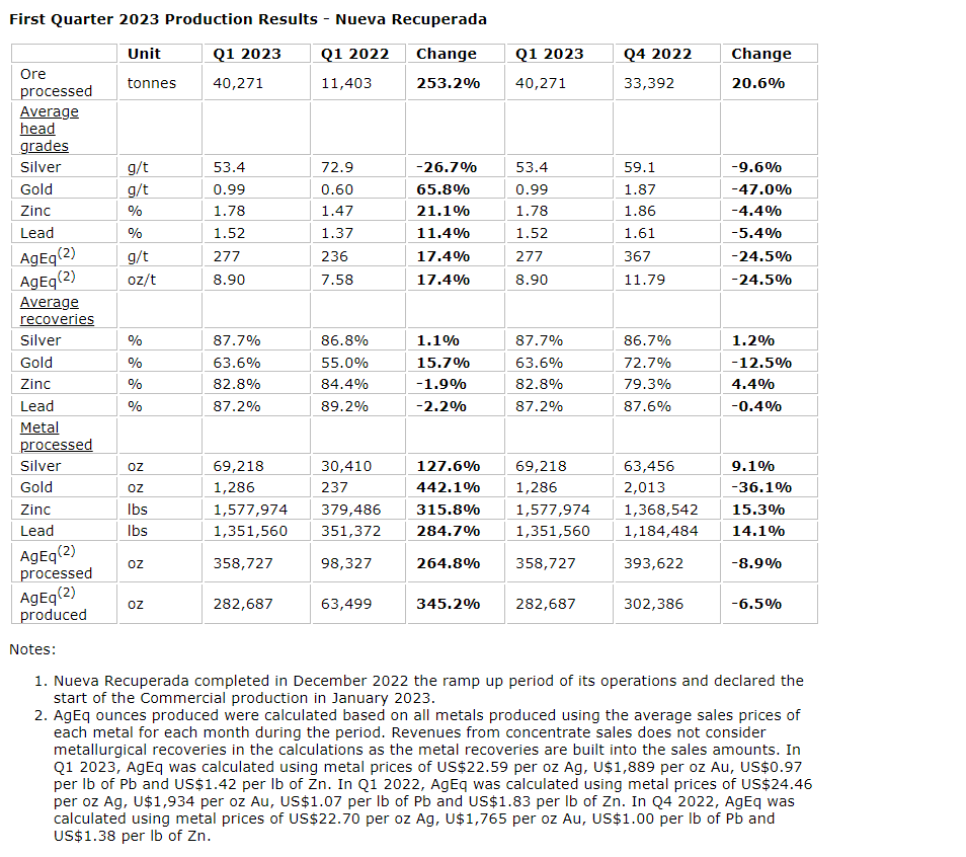

Total Production of 282,687 AgEq

The results from this first quarter noted that production was maintained at the previous quarter's level. However, head grades were lower in light of the stope selection of lower grading blocks, which was done to avoid poor gold recoveries for higher-quality ores while the plant's gold circuit was in repair.

First quarter production results are as follows:

- Declared commercial production in January 2023 and returned to targeted throughput in January after a period of social disruption in Peru.

- Total production of 282,687 silver equivalent (AgEq) ounces with an average head grade of 277 grams per tonne AgEq.

- Ramp up continues with a record throughput of 17,239 tonnes at 575 tonnes per day in March 2023.

- Processed 265 % more AgEq ounces in the first quarter of 2023 than in the first quarter of 2022, with 358,727 AgEq ounces compared to the 98,327 AgEq ounces in 2022.

President and CEO Jose M. Garcia commented on these results, saying, "I am pleased to report positive momentum and strong operating performance in our first quarter of commercial production at Nueva Recuperada . . . Despite supply shortages in the fourth quarter of 2022 due to road blockages in Peru, we achieved [a] record performance in March of 17,500 tonnes processed at a rate of 575 tonnes per day. Throughput continues to increase along with improved ore selectivity and stronger mine development translating into better head grades. These outcomes reflect Silver X's dedication to efficiency and signal the potential for positive results in future quarters."

In a May 12 research report from Red Cloud, analyst Timothy Lee noted the production results, saying, "Overall, the results are about in-line with our expectations. The throughput was slightly above our estimate, but given the lower grades, the oz AgEq was slightly below our estimate for the quarter. Silver X stated that ore selection should lead to higher average grades going forward, and we anticipate that this, combined with further ramp-up, will lead to increased production in future quarters."

With this, Lee reiterated his Buy rating on the company, with a CA$1.05 target price.

Why Silver?

In the world of investments, silver has long held a position of allure and value. Known for its versatility, industrial applications, and historical significance, silver continues to attract the attention of investors seeking diversification and potential profit. With this and the rising uncertainty in the U.S. dollar, investors are leaning into the metal.

Silver has also garnered the attention of a number of analysts and newsletter writers. On May 10, Rick Mills of Ahead of the Herd noted that conditions in 2023 have set up gold and silver.

He wrote, "As concerns of undersupply linger on, the precious metals market will be well-positioned to maintain its bullish trend from the start of 2023."

Michael Ballanger of GGM Advisory Inc. also commented on the sector in an April post. He said, "Gold and silver remain very much in uptrends, with no better confirmation than the GSR trading under 80 and threatening to break down through 78.00, the uptrend line drawn off the 73.85 low back in December."