Beeline has one major feature that puts it ahead of Robinhood. Click here to see how this mortgage company has incorporated AI into its customer portal.

Over the past couple of decades, tech-based mortgage services have slowly been breaking into the market. Many of them promise speed and convenience, but Beeline Mortgages offers the largest array of features and incorporates artificial intelligence (AI) into its lending process.

The Robinhood of Mortgages

Robinhood has democratized the investment industry by allowing ordinary people to break into the market and purchase stocks, exchange-traded funds (ETFs), options, and cryptocurrencies. Robinhood allows consumers to purchase a fraction of a stock, which makes the market more accessible to ordinary people who want to invest. Robinhood Stocks, also known as Robinhood Financial LLC, is the brokerage division of Robinhood that handles the buying and selling of stocks and other securities on behalf of its customers. Compared to an organization like Fidelity, while Robinhood does not offer the more specialized tools preferred by traditional brokers, it does offer a simplified process that works well for those new to trading.

Through Robinhood Stocks, users can access a range of publicly traded stocks listed on major U.S. exchanges such as the NYSE and NASDAQ. Users can search for stocks by name, ticker symbol, or sector and can view real-time stock prices, charts, and other financial data.

In 2021, Beeline Mortgage was listed as one of the top 100 mortgage companies in America by Mortgage Executive Magazine.

Beeline has a number of features that make it attractive to consumers. Many of these features are available through its customer portal. It generates its own leads directly instead of buying from aggregators.

It has a fully immersive, mobile-friendly, and highly converting proprietary POS experience, pull asset, income, bank statements, and payroll that is fed directly into the POS. Beeline also has a POS process for Debt Service Coverage Ratio Loans (DSCR) and display pricing options for conventional and non-QM available through the POS.

Beeline stands out from the crowd because it has incorporated artificial intelligence into its services. It uses AI to interpret bank statements during the POS process and trigger conditions in the user portal. This technology allows Beeline to make automated, real-time approvals, 95% of which reach closing. The in-house platform takes customers instantly from Clear to Close on titles at the moment, without having to go to land records for 60% of all re-financings. By June 1, the company hopes to improve the AI system so that it is able to answer complex queries and give detailed quotes at all hours.

Why a Mortgage App?

According to a survey by Fannie Mae, a government-sponsored mortgage company, younger homebuyers, including Gen Z, are more likely to use online and digital tools throughout the mortgage process, including mortgage apps.

The survey found that 58% of younger homebuyers, defined as those under age 35, used online mortgage calculators or apps during the home-buying process, compared to just 39% of buyers aged 35 and older. Additionally, 37% of younger buyers applied for a mortgage online, compared to 21% of older buyers.

Smart Asset also did a general overview of Beeline in April, saying, "Beeline Loans stacks up fairly well to Rocket."

While the survey did not specifically break down usage by generation, it's worth noting that Gen Z is the youngest generation of homebuyers and is likely to be included in the younger buyer group. The survey also found that younger buyers were more likely to prefer digital communication and technology-enabled solutions throughout the mortgage process, including e-signatures and mobile apps for tracking the status of their mortgage application.

The features that Beeline offers are similar to Robinhood because it is an online, automated process that eliminates barriers between users and their finances. However, if Beeline can polish its AI system, that may represent a feature beyond Robinhood's capabilities, as Robinhood does not currently have an AI system or assistant for users to lean on.

Why Mortgages?

Mortgage rates have risen by an eighth of a percent at the beginning of the week, marking a small change in what has largely been a plateau for the industry.

According to Mortgage News Daily, "The market is locked smack dab in the middle of a very broad debate about inflation and economic growth. The questions at hand will require weeks and months of answers- not days."

Still, this rising interest won't stop home buyers, as The Morgage Report noted, "But while affordability could take a hit, buying a home may be an even smarter move given how inflation will push rent prices higher."

Ward Morrison, CEO and President of Motto Franchising LLC noted, "Affordability is continually a comparison of renting v.s. buying. As rent continues to increase due to inflation, homeownership may still be the cheaper alternative."

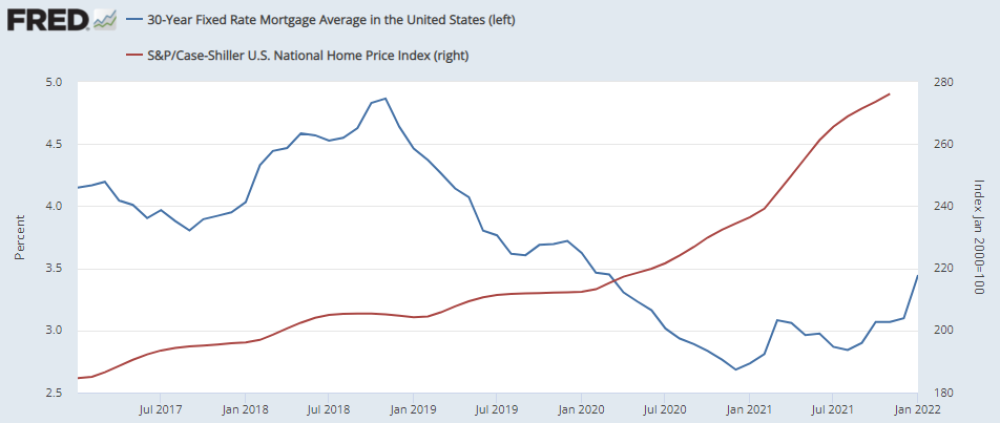

The article by The Mortgage Report shared the below chart saying, "While not completely mirroring each other over the past five years (and mortgage rates, by nature, are more volatile), home values took off when interest rates cratered in 2020 . . . A similar pattern could unfold this year, with mortgage rates expected to rise further and housing prices projected to grow at a lesser pace."

Co-founded and COO of Beeline Jess Kennedy also commented on the market. They said, "I don’t anticipate that housing prices will come down — they just won’t continue to grow exponentially as they have in the past year."

Competition

Among the top mortgage lenders in the industry, according to Forbes, are: JPMorgan Chase & Co (JPM:NYSE), PNC Financial Services Group Inc. (PNC:NYSE), and Bank of America Corp. (BAC:NYSE)

According to Market Watch, Chase has a market cap of US$403.36 billion, with 2.92 billion shares outstanding and 2.89 billion shares in public float. It operates in the 52-week range between US$101.28 and US$144.34.

PNC Bank has a market cap of US$48.06 billion, with 399.11 million outstanding shares. There are 397.47 million shares in float. It operates in the 52-week range between 110.31 and 176.47.

Bank of America has a market cap of US$225.85 billion, with 7.97 billion shares outstanding and 7.95 billion shares in public float. It operates in the 52-week range between US$26.32 and US$38.60.

All three companies represent a traditional model of mortgage lenders.

According to its website, Beeline Mortgage charges lower fees than many other mortgage lenders.

The company claims to have no lender fees and offer competitive interest rates.

Beeling also offers a fully digital mortgage application process, which it claims can save borrowers time and streamline the mortgage process. Borrowers can complete the application online and upload documents electronically.

The company also offers personalized service for its customers.

Beeline Mortgage emphasizes personalized service and working closely with borrowers to find the right mortgage for their needs. It claims to have experienced loan officers who are available to answer questions and guide borrowers through the mortgage process.

In 2021, Beeline Mortgage was listed as one of the top 100 mortgage companies in America by Mortgage Executive Magazine.

Smart Asset also did a general overview of Beeline in April, saying, "Beeline Loans stacks up fairly well to Rocket."

The two lenders share many similar perks, such as simple application processes, faster closing times, lower fees, and more."

Beeline also shared the graphic above, outlining how it compares to other competitors.

Catalysts

Beeline also recently concluded a round of financing. The company has a valuation cap of US$20 million pre-money, which is about US$231.17 per share.

Upon a change of control, these notes may convert at a 20% discount. The company is offering price protection, which allows investment in the Bridge Round to not be diluted after 15% of the options are vested.

Ownership and Share Structure

There are 500,000 shares authorized and 164,404 shares outstanding. Fully diluted shares account for 67.91% of the company's ownership. There are 53,822 series A preferred stocks, with 29,987 of these shares outstanding, accounting for 12.38% of the company's ownership. There are 9,426 common stock warrants, which account for 3.89% of the company's ownership. The company has taken on a number of financing operations and raised US$29,135,130.13.

The most significant shareholders in the company are Peter Gonzalez, with 42,627 shares, Nicholas R. Liuzza Jr., with 36,182 shares, Honey Jar Investments Pty Ltd., with 11,683 shares, and Stephen Katz, with 9,866 shares, Jessica N. Kennedy, with 4,850, and John N. Chandler, with 3,195.

Institutional investors include the Nicholas R. Liuzza Jr. Trust, with 9,727 shares, El Moto Pty Ltd., with 5,635 shares, Zed Seven Pty Ltd ATF: The Stockwell Family with 5,050 shares, and Pacificus Partners, LLC, with 6126 shares.

In 2021, Beeline made a total of 1,202 loans and brought in a total of 6,943 net loan revenues and 961 net title revenues, adding up to a net total of 7904. Its total OPEX was 17,919. The full data from 2022 has yet to be released, but the company made a total of 863 loans and brought in 6,767 total revenues and 13,799 total OPEX.

The company's budget for 2023 is 1,110 loans, 5,994 net loan revenues, and 1,856 net title revenues. The forecast for 2024 is 2,923 loans, 23,969 net loan revenues, and 5,737 net title revenues for a total of 29,705 total net revenues and 20,794 OPEX.

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Beeline Mortgage, a company mentioned in this article.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Beeline Mortgage.Click here for more information.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.