Drilling at Dakota Gold Corp.'s (DC:NYSE American) Richmond Hill Project in the historic Homestake District of South Dakota has outlined an extensive gold system more than a mile in length from north to south, with mineralization open in all directions.

Hole RH22C-013 assayed 5.98 grams per tonne gold (g/t Au) over 30 meters at the intersection of a dominant north-south structure, confirming the existence of higher-grade gold mineralization.

"DC continues to drill aggressively across its Homestake District land package, with two drills turning at the Maitland Project and two at Richmond Hill," Canaccord Genuity analyst Michael Fairbairn wrote in an April 13 research note. "At Richmond Hill, DC is working on upgrading the historic oxide resource . . . and conduct additional exploration/step-out drilling. Results to date bode well for the next resource update, with indications that Richmond Hill hosts a substantial high-grade gold orebody."

Canaccord Genuity analyst Michael Fairbairn doubled down on his Speculative Buy rating for the stock with a US$5 per share target price.

Fairbairn doubled down on his Speculative Buy rating for the stock with a US$5 per share target price.

The project "continues to provide positive drill results," Vice President of Exploration James M. Berry said.

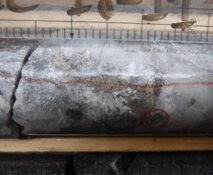

"We are seeing large intervals of visible alteration in the drilling and are using historical drilling, geophysics, and surface mapping to test the known breccia pipes for better-grade mineralization," Berry said. "Four previously known breccia pipes remain untested."

Robert Quartermain and Jonathan Awde head the company, which is exploring 46,000 acres surrounding the Homestake Mine, which it acquired and consolidated over the past decade. The historic Homestake Mine produced more than 40 million ounces (Moz) Au over its lifetime.

"The best place to find a new gold mine is in the shadow of the head frame of an existing gold mine," geologist and investment analyst Matt Badiali has told Streetwise Reports.

Industry giant Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) also backs the company.

Fairbairn wrote in January that "upside potential could be significant" for the company.

"Dakota Gold is now seeking to revitalize this legendary district in hopes of making a material discovery on its land package proximal to the mine," Fairbairn wrote.

The Catalyst: 'Significant Mineralization'

Richmond Hill is 2.3 miles west of another of the company's Homestake projects, Maitland.

It's also 1.5 miles north of Coeur Mining Inc.'s Wharf Mine, which produced more than 79,000 ounces Au in 2022 and is the only current operating gold mine in South Dakota.

Dakota Gold released results from five holes that were drilled into the Twin Tunnels Breccia Pipe and "intersected significant mineralization," Fairbairn wrote.

Hole RH23C-014 intersected 1.35 g/t Au over 42 meters, RH22C-009 intersected 1.21 g/t Au over 5.1 meters, RH22C-010 intersected 1.24 g/t over 1.54 meters, and RH22C-011 intersected 1.24 g/t over 15.4 meters, the company said.

"Tertiary breccia pipes are favorable conduits for gold-bearing fluids in the Homestake District and continue to be a priority drill target," the company released.

'On the Cusp'

Dakota Gold continues to have four drills operating on its Homestake properties, two at Richmond Hill and two at Maitland.

Results from Maitland released earlier this month expanded the gold mineralization of its Unionville Zone.

Drill hole MA22C-007 intersected 7.19 g/t Au over 7 meters and was designed to test the formation south of previous drilling. It likely extended the Unionville Zone farther to the south. Mineralization is open in both directions, the company said.

"The best place to find a new gold mine is in the shadow of the head frame of an existing gold mine," geologist and investment analyst Matt Badiali has told Streetwise Reports.

The drill hole also intersected 5.37 g/t Au over 1.4 meters of Homestake-style gold mineralization. The results from another drill hole at Maitland, MA22C-009, showed gold mineralization similar to the Homestake Mine in the lower portion, the company said. The drill hole returned 5.78 g/t Aug over 4.4 meters.

President and Chief Executive Officer Jonathan Awde has said he was "extremely encouraged" by Maitland.

"We believe we are on the cusp of vectoring toward higher grades and on making a discovery with Maitland," he said.

Much of the land owned by Dakota Gold has not been explored in nearly 30 years, leading experts toward the hope of a large discovery.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dakota Gold Corp. (DC:NYSE American)

Ownership and Share Structure

According to the company, approximately 30% of the company's shares are with management and insiders. Out of management, Co-Chairman Robert Quartermain holds the most shares at 10% or 7.34 million shares. President and CEO Jonathan Awde is next at 9%, with 6.71 million, while COO Jerry Aberle holds 6%, with 4.21 million. The remainder of the 30% is held by other members of management and the board of directors.

According to Reuters, about 26.6% of the shares are with institutional investors, including Van Eck Associates with 3.8%, BlackRock Fund Advisors with 3.6%, CI Investments with 3.6%, Fidelity Management with 3.5%, The Vanguard Group with 3.2%, Barrick Gold Corporation with 3%, Medalist Capital with 2.4%, Delbrook Capital with 2%, and Sprott Asset Management with 2%.

About 27.4% is with strategic investors, Reuters said. The largest holding is with Marin Katusa + KCR LLC, which owns 4.9%.

Dakota Gold has a market cap of US$248.47 million, with 75.3 million shares outstanding and 56 million free-floating. It trades in a 52-week range of US$4.88 and US$2.61.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Dakota Gold Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dakota Gold Corp. and Barrick Gold Corp., companies mentioned in this article.

Disclosures For Canaccord Genuity Corp., Dakota Gold Corp., April 13, 2023

Analyst Certification Each authoring analyst of Canaccord Genuity whose name appears on the front page of this research hereby certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analyst’s personal, independent and objective views about any and all of the designated investments or relevant issuers discussed herein that are within such authoring analyst’s coverage universe and (ii) no part of the authoring analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the authoring analyst in the research, and (iii) to the best of the authoring analyst’s knowledge, she/he is not in receipt of material non-public information about the issuer. Analysts employed outside the US are not registered as research analysts with FINRA. These analysts may not be associated persons of Canaccord Genuity LLC and therefore may not be subject to the FINRA Rule 2241 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.

Required Company-Specific Disclosures (as of date of this publication) Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive compensation for Investment Banking services from Dakota Gold Corp. in the next three months. An analyst has visited the material operations of Dakota Gold Corp.. Partial payment was received for the related travel costs.

General Disclaimers See “Required Company-Specific Disclosures” above for any of the following disclosures required as to companies referred to in this report: manager or co-manager roles; 1% or other ownership; compensation for certain services; types of client relationships; research analyst conflicts; managed/co-managed public offerings in prior periods; directorships; market making in equity securities and related derivatives. For reports identified above as compendium reports, the foregoing required company-specific disclosures can be found in a hyperlink located in the section labeled, “Compendium Reports.” “Canaccord Genuity” is the business name used by certain wholly owned subsidiaries of Canaccord Genuity Group Inc., including Canaccord Genuity LLC, Canaccord Genuity Limited, Canaccord Genuity Corp., and Canaccord Genuity (Australia) Limited, an affiliated company that is 80%-owned by Canaccord Genuity Group Inc. The authoring analysts who are responsible for the preparation of this research are employed by Canaccord Genuity Corp. a Canadian broker-dealer with principal offices located in Vancouver, Calgary, Toronto, Montreal, or Canaccord Genuity LLC, a US broker-dealer with principal offices located in New York, Boston, San Francisco and Houston, or Canaccord Genuity Limited., a UK broker-dealer with principal offices located in London (UK) and Dublin (Ireland), or Canaccord Genuity (Australia) Limited, an Australian broker-dealer with principal offices located in Sydney and Melbourne. The authoring analysts who are responsible for the preparation of this research have received (or will receive) compensation based upon (among other factors) the Investment Banking revenues and general profits of Canaccord Genuity. However, such authoring analysts have not received, and will not receive, compensation that is directly based upon or linked to one or more specific Investment Banking activities, or to recommendations contained in the research. Some regulators require that a firm must establish, implement and make available a policy for managing conflicts of interest arising as a result of publication or distribution of research. This research has been prepared in accordance with Canaccord Genuity’s policy on managing conflicts of interest, and information barriers or firewalls have been used where appropriate.

Canaccord Genuity’s policy is available upon request. The information contained in this research has been compiled by Canaccord Genuity from sources believed to be reliable, but (with the exception of the information about Canaccord Genuity) no representation or warranty, express or implied, is made by Canaccord Genuity, its affiliated companies or any other person as to its fairness, accuracy, completeness or correctness. Canaccord Genuity has not independently verified the facts, assumptions, and estimates contained herein. All estimates, opinions and other information contained in this research constitute Canaccord Genuity’s judgement as of the date of this research, are subject to change without notice and are provided in good faith but without legal responsibility or liability. From time to time, Canaccord Genuity salespeople, traders, and other professionals provide oral or written market commentary or trading strategies to our clients and our principal trading desk that reflect opinions that are contrary to the opinions expressed in this research. Canaccord Genuity’s affiliates, principal trading desk, and investing businesses also from time to time make investment decisions that are inconsistent with the recommendations or views expressed in this research. This research is provided for information purposes only and does not constitute an offer or solicitation to buy or sell any designated investments discussed herein in any jurisdiction where such offer or solicitation would be prohibited. As a result, the designated investments discussed in this research may not be eligible for sale in some jurisdictions. This research is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. This material is prepared for general circulation to clients and does not have regard to the investment objectives, financial situation or particular needs of any particular person. Investors should obtain advice based on their own individual circumstances before making an investment decision. To the fullest extent permitted by law, none of Canaccord Genuity, its affiliated companies or any other person accepts any liability whatsoever for any direct or consequential loss arising from or relating to any use of the information contained in this research.

For United States Persons: Canaccord Genuity LLC, a US registered broker-dealer, accepts responsibility for this research and its dissemination in the United States. This research is intended for distribution in the United States only to certain US institutional investors. US clients wishing to effect transactions in any designated investment discussed should do so through a qualified salesperson of Canaccord Genuity LLC. Analysts employed outside the US, as specifically indicated elsewhere in this report, are not registered as research analysts with FINRA. These analysts may not be associated persons of Canaccord Genuity LLC and therefore may not be subject to the FINRA Rule 2241 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.