First Tellurium Corp. (FTEL:CSE) has established a research, development, and commercialization company to explore new uses for the rare element as it explores its Deer Horn project in British Columbia.

The new company, 1406975 B.C. Ltd., will look to develop improved thermoelectric generators that can be used in the renewable energy and automotive industries.

"Thermoelectric applications, whereby heat is converted to electricity, represent the No. 2 use of tellurium worldwide," First Tellurium President and Chief Executive Officer Tyrone Docherty said. "Tellurium's unique properties make it an ideal material for this process. Our new venture allows us to take these properties further and pursue potential solutions for some of the world's most pressing problems related to greenhouse gases and fossil fuel dependence."

Tellurium's (Te) role as a semiconductor has increased its use in solar photovoltaic (solar PV) panels.

Recent International Energy Agency (IEA) forecasts show that solar PV technology will generate more power by 2027 than any other source. Te and silver (Ag), also in demand for solar PV, are abundant at Deer Horn.

The market for Te is expected to grow by about 60 metric tons from 2020 to 2024, according to research by Technavio.

"Factors such as increasing urban population, rise in disposable income, strong supply chain, and high internet penetration are driving the growth of the global consumer electronics market," the research firm said in a release. "The increase in demand for consumer electronics will, in turn, drive the demand for tellurium over the forecast period."

The Catalyst: A Positive PEA

Deer Horn is known to have the only positive preliminary economic assessment (PEA) for a Te project in North America. It's named by First Solar Inc. (FSLR:NYSE) as one of only four world-class Te projects.

"There's a very decent chance tellurium will breakout this year because First Solar is using 60 to 70% of worldwide production to make a solar panel," said asset manager Chen Lin, author of the What's Chen Buying? What's Chen Selling? newsletter. "Their production has grown rapidly."

First Solar plans to double its solar panel manufacturing capacity and spend US$1.36 billion to lessen China's dominance of the market, according to S&P Global.

But thermoelectric applications, where heat is converted into electricity, can provide alternatives for power generation and refrigeration, and could help solve the global energy crisis and lessen environmental pollution.

"We see unlimited opportunities for the growth and uses of tellurium," Docherty said. "One of our key goals is to position First Tellurium at the forefront of the sector's innovation, particularly around renewable energy and energy efficiency, and therefore drive value in the company."

"There's a very decent chance tellurium will breakout this year because First Solar is using 60 to 70% of worldwide production to make a solar panel," said asset manager Chen Lin.

Te is one of the least common elements on the planet, according to the U.S. Geological Survey. Most rocks contain an average of about 3 parts per billion Te, making it eight times less abundant than gold. In addition to solar panels and thermoelectric applications, it's also used in lithium batteries and is to vulcanize rubber, tint glass, and manufacture rewritable CDs and DVDs.

The market has seen an increased push from both American and Canadian governments to apply more funding to Te mining. Docherty noted that U.S. President Joe Biden has banned solar panels coming from a Chinese company that uses forced labor.

"There's a lot of pressure now to source solar panel production from domestic suppliers," said Docherty. “Our goal is to help meet that demand, both from our Deer Horn project in BC and our Klondike project in Colorado."

The global market for Te is predicted to grow at a compound annual growth (CAGR) of 4.6% between 2022 and 2030.

Co. Looking Years Ahead

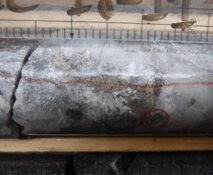

The company plans to continue exploration at Deer Horn this year. The project's PEA was calculated on 450 meters of a 2.4-kilometer gold-silver-tellurium vein system. Sampling in 2022 identified a possible 1.1-kilometer extension of the system, the company has said.

"Drilling planned for 2023 will focus on confirming and enlarging the zone extension," said Docherty. "We also plan to conduct infill drilling to expand the current indicated and inferred resources."

The company will also test new targets and do mapping and aerial surveys of the 5,133-hectare property. First Tellurium is also looking to get a permit for a 10,000-tonne bulk sample at Deer Horn, which is targeted for 2025.

"We are looking two or three years ahead with Deer Horn," Docherty said. "We believe the project will be ready for the sort of 'ground-truthing' a bulk sample can provide towards a production decision."

In addition, the company's Klondike Tellurium Project in Colorado is considered one of America's top Te exploration projects and was previously owned by First Solar as a potential source of raw Te for its solar panels.

Ownership and Share Structure

According to the company, 11% of First Tellurium is owned by management and insiders.

Docherty owns 10.50% or 7.63 million shares, Director Josef Anthony Steve Fogarassy has 1.38% or 1 million shares, and Director Lyle Allen Schwabe has 0.77% or 0.56 million shares. There are no institutional investors, and the rest is retail.

The company has a market cap of CA$14.65 million, with about 95 million shares outstanding, and 63.46 million free-floating. It trades in a 52-week range of CA$0.27 and CA$0.08.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: First Tellurium Corp. Please click here for more information.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of First Tellurium Corp., a company mentioned in this article.