Earlier this month, Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC) released news regarding the drilling of the Perry Zone and the Rising Fawn Zone on its Philadelphia project. While the company is still waiting on assay results, drilling has revealed visible gold on some drill holes.

Arizona Silver stated regarding the news, "We are in the process of drilling out one of the most exciting new gold discoveries in Arizona and anticipate having a large gold-silver resource defined in 2023-2024."

The company is a junior mining exploration company. Arizona Silver has four properties: Silverton, Ramsey, Sycamore Canyon, and Philadelphia, its flagship property. Mike Stark is the President, CEO, and Director, while Greg Hahn is the Vice President of Exploration and Director, as well as a certified professional geologist and geological engineer.

Visible Gold Found During Drilling

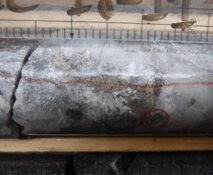

Arizona Silver released the geological sections from the drilling program at the Philadelphia gold-silver project in March 2023. The company is still awaiting assay results, but the program covered 1256m and included 12 drill holes in six sections. Half of these sections are located in the Perry Zone and the other half in the Rising Fawn Zone.

On March 23, 2023, technical analyst Clive Maund said regarding Arizona Silver, "We are still at a very good entry point for the stock, which has big upside from here."

The company defined visibly mineralized intervals by the presence of stockwork quartz or without a hanging wall vein. Some of these visible mineralized intervals may contain visible gold, or gold may be adjacent to visibly mineralized intervals.

According to Greg Hahn, the Vice President of Exploration, "These geologic sections demonstrate excellent continuity of the host geology and stockwork mineralization from two areas separated by +300m of strike. They form part of a continuously mineralized system with a total strike length drilled over at least 1.7 kilometers. The continuity of mineralization down dip is impressive to date, with a dip length of at least 200m demonstrated. Mineralization continues to remain open down-dip and along strike."

Gold Reaching New Heights

After much anticipation, gold finally broke the US$2,000/oz. According to Stockhead, gold has only ever traded at this price for two days in history.

OANDA analyst Edward Moya said, "a weakening economy continues to drive safe-haven flows towards gold. Gold investors now need to see further evidence that the service sector part of the economy is slowing, and that could help the big rally continue." Moya predicts that if current economic instability continues, gold could reach US$2,100.

While values in the tech industry have plummeted, gold seems to be on the rise, reports Nadine McGrath. Gold stocks have been driven up by preparations for drilling and sampling as well as the uncertain market.

According to Anna Golubova of Kitco News, some of the increase in gold value was driven by central banks' buying habits. At the beginning of the year, these institutions purchased 74 tons, and to date have purchased 125 tons of gold. The leading buyers seem to be China, Russia, and Turkey.

Catalysts

Arizona Silver reports that it has a tight share structure, with large stakes owned by management. It has a low burn rate and spends the majority of its money on developing drill sites, particularly in Philadelphia.

Chris Temple of The National Investor said, "Ahead of this news, AZS shares had already been better-than-average performers among the universe of exploration juniors."

According to Greg Hahn, VP of Exploration, "The Philadelphia property is one of the few gold systems remaining in the Western U.S.A. that has never been evaluated using modern exploration concepts . . . All this project needs is drilling to demonstrate its real potential."

The company is expecting to release drill results any day now. It reports that it has had 100% drill hole hits on all patented ground drilling since 2021.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC)

On March 23, 2023, technical analyst Clive Maund said regarding Arizona Silver, "We are still at a very good entry point for the stock, which has big upside from here."

In the same month, Chris Temple of The National Investor shared his excitement with Arizona Silver's march drill results, saying, "Ahead of this news, AZS shares had already been better-than-average performers among the universe of exploration juniors . . . I think, in this case, it owes to AZS shares being in some stronger-than-average hands: people who see progress being made toward a possibly BIG breakout story and don't want to leave."

Ownership and Share Structure

Management and advisors hold more than 28% of the company, while institutions hold 9.9%. Arizona Silver reports having a large following of family and friends who own 42% of the company.

Arizona Silver reports a monthly drilling cost of US$125 per foot in core, or US$50 per foot in RC all-in costs

Market Watch reports that Arizona Silver has a market cap of CA$35.33 million and 69.28 million shares outstanding. It trades in the 52-week range between CA$0.17 and CA$0.55

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: none. She or members of her household are paid by the following companies mentioned in this article: none. Her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Arizona Silver Exploration Inc. Please click here for more information. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of none. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arizona Silver Exploration Inc., a company mentioned in this article.