Canadian mining firm Usha Resources Ltd. (USHA:TSX.V; USHAF:OTCQB) has executed option agreements for the rights to purchase two lithium-rich properties both within the Thunder Bay Mining Division of Ontario, which is aligned with its planned expansion into hard-rock pegmatite space.

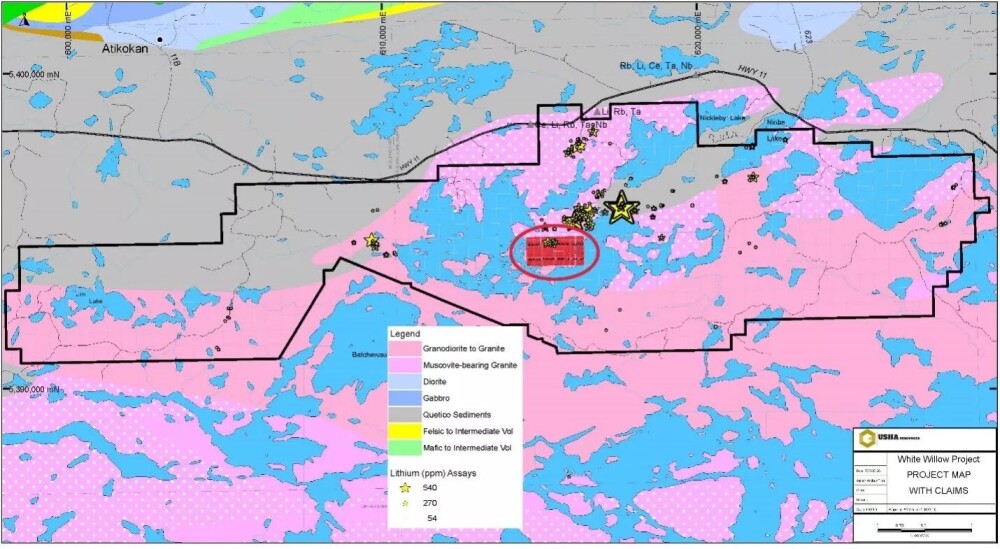

The company has entered into two option agreements. The first is for the right to purchase 100% interest in 712 unpatented mining claims in the White Willow Lithium-Tantalum Property from 2758145 Ontario Ltd., which hosts fertile lithium-cesium-tantalum (LCT) bearing pegmatites.

The second is for the right to purchase 100% interest in eight unpatented mining claims in the Nym Property from vendors 2758145 Ontario Ltd., Peter Gehrels, and Allan George Onchulenko of Atikokan, Ontario.

The White Willow and Nym properties amount to 720 mining claims totaling 16,230 hectares.

These acquisitions are a part of the company's strategy to build an accretive portfolio of highly complementary hard-rock pegmatite assets to its fully owned flagship Jackpot Lake Lithium Brine project.

The acquisitions are still subject to the approval of the TSX Venture of the Toronto Stock Exchange.

Usha is a junior exploration company that focuses on high-grade precious and base metal projects across North America. The company has several ongoing projects, including the Jackpot Lake Project in Nevada, Lost Basin Project in Arizona, and the Nicobat Project in Ontario, Canada.

The Catalyst: Rich Lithium Production Potential in Newly Acquired Properties, Developments in Other Projects

The 15,510-hectare White Willow property, located 170 kilometers west of Thunder Bay, is a prime showcase of the region's rich lithium potential alongside other projects of other companies in the area.

Usha CEO Deepak Varshney said the properties have a significant number of mapped pegmatites, and the White Willow has a confirmed highly evolved LCT mineral system with high-grade tantalum.

"By making these strategic acquisitions, we are positioning Usha at the forefront of the evolving lithium market, thereby securing a foothold in the rapidly expanding green energy sector . . . We are very pleased to have been able to assemble this highly prospective land package at a low cost," he said about the White Willow acquisition.

"(The Nym Property), collectively with White Willow, presents a unique and timely opportunity to capitalize on the rapidly growing lithium market in Canada. We believe this project has the potential to join an emerging group of Tier-1 projects in Ontario . . . and we look forward to beginning exploration work shortly with the goal of drilling White Willow and Nym in 2023," he added.

Technical analyst Clive Maund sees Usha as an "immediate speculative Buy" given that the stock is treading on its support levels after experiencing a strong pick-up last February.

The company also recently announced the phases of development of its other projects. Jackpot Lake lithium project is being drilled with a goal to complete a maiden 43-101 resource estimate this year, with additional drilling activities to be done throughout 2023. By 2024 and beyond, Usha plans to complete permitting for production, expand and grow resource, conduct advanced studies, as well as develop and optimize the mine site and the production.

The Nicobat nickel project is set to be spun out into its own (to-be listed) public company, Formations Metals Inc. on April 12, 2023, whereby shareholders will receive a 20% "share dividend." Future work throughout 2023 will focus on making the historic resource compliant and expanding on the work completed to assess for other high-grade "ribs" and the potential high-grade feeder zone.

Green Tech Market's Strong Global Demand for Lithium

Fortune Business Insights noted that the global market for lithium, an integral component in green and sustainable technology, is forecasted to reach a value of US$22.6 billion by 2030.

It is forecasted to grow at a compounded annual growth rate of 15.7% over the period 2022-2030 from the latest estimates of US$7 billion last year.

The demand for lithium is continuously growing because of its use in rechargeable batteries, especially as the world pivots towards a greener and more sustainable future.

Chris Temple of The National Investor tagged Usha as a speculative-rated stock, pointing out Usha's bright prospects mainly on the Jackpot Lake project, as well as its unique Nevada-centric lithium exploration story.

Deemed the "lightest metal in the world," lithium is a great option for use in electric vehicles. Demand is seen to continue to rise as more people shift to buying electric or hybrid vehicles.

While lithium prices have seen a downtrend, Bevis Yeo of the Stockhead said analysts are forecasting a rebound in the second half of the year.

There have been steps taken by companies to increase output, unlike previous moves to slash production when lithium prices dropped.

Fastmarkets forecasts that lithium demand from electric vehicles will increase at a compound annual growth rate of 20% to 2.28Mt of lithium carbonate equivalent in 2033, from 321,000t in 2022.

There is still an emerging significant supply gap for lithium, as forecasted deficits could reach 3.3 million tons by 2030 and continue to grow, estimates from Usha said.

Why Usha?

Usha CEO Varshney said the acquisition of the White Willow and Nym properties present an exceptional opportunity for exploration and potential development.

"The rising global demand for lithium, driven by the green energy revolution and the exponential growth of electric vehicles, makes the acquisition of the White Willow Lithium-Tantalum Property an attractive investment. This acquisition promises to position the company at the forefront of the burgeoning lithium market, offering significant growth opportunities," Varshney added.

The properties are also highly complementary to Usha's 100% owned flagship Jackpot Lake Lithium Brine Project in which the company tripled its land position and is now progressing with its maiden drill program, with a goal of defining a 43-101 resource estimate. The company is also looking to invest CA$250,000 into future drilling programs at the White Willow site, with two main exploration targets including the Nym Property.

Technical analyst Clive Maund sees Usha as an "immediate speculative Buy" given that the stock is treading on its support levels after experiencing a strong pick-up last February.

"The reason that classic buy spots continue to work is that the majority of investors will maintain their time-honored tradition of buying high and selling low, so we try to do the opposite. Usha surged on big volume early in February and then reacted back on dwindling volume to the classic "Buy spot" that it is now at," Maund said.

He also noted that Usha has strategic properties of rich mine sites, and is focused "on the development of quality battery and precious metal properties that are drill-ready with high-upside and expansion potential" which makes it a good and safe bet for investors.

Chris Temple of The National Investor tagged Usha as a Buy at the start, then changed to a speculative-rated stock, pointing out Usha's bright prospects mainly on the Jackpot Lake project, as well as its unique Nevada-centric lithium exploration story.

Streetwise Ownership Overview*

Usha Resources Ltd. (USHA:TSX.V; USHAF:OTCQB)

"By and large, (Usha's) early work has suggested a shallower and richer potential lithium resource here. This is one distinction. Another, reportedly, is the fact that the water source underground Jackpot Lake is independent of any other major aquifer," Temple said.

"Besides many of Usha's unique attributes at Jackpot Lake (it has a few other exploration assets of various kinds as well) consider its share count: only 35 million shares or so outstanding, of which but a quarter or so is in the market," he added.

Ownership and Share Structure

13.3% of Usha Resources shares are owned by management and insiders. CEO Deepak Varshney owns 5.04% of shares, with 1.8 million shares, while Director Navin Varshney owns 7.1%, or 22.53 million, valued at CA$1 million.

According to Reuters, 15.03% is with institutions and strategic investors. Out of this category, Palos Management Inc. has the most at 1.77%, with 0.63 million shares.

The balance of 71.7% is held by retail investors.

Usha said in its latest corporate presentation that its market capitalization is at CA$12.7 million, with 46.037 million common shares. According to Market Watch, the company currently has 47,087,394 shares outstanding and trades in the 52-week range of CA$0.21 to CA$0.42.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Nika Catalado wrote this article for Streetwise Reports LLC as an independent contractor. They or members of their household own securities of the following companies mentioned in the article: None. They and members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Usha Resources. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Usha Resources., a company mentioned in this article.