Alpha Copper Corp. (ALCU:CSE;ALCUF:OTC) has signed a communications and engagement agreement with the Tahltan Central Government for its new Star project in British Columbia's Golden Triangle.

Star is situated in the traditional territory of the Tahltan Nation. The company said the agreement gives direction to ongoing discussions with the Tahltan and provides a framework for sharing information about Alpha's activities.

"This is the first step to a respectful and constructive collaboration as we explore for copper and gold in Tahltan traditional territory,” Alpha Chief Executive Officer Darryl Jones said. “The project contains a prospective porphyry system that has been tested to 664 meters below surface and remains open at depth. The project is in the Golden Triangle of B.C., a region that is world-renowned for its endowment of copper and precious metals."

The Tahltan Central Government represents about 5,000 members of the Tahltan Nation living on- and off-reserve.

Alpha obtained Star and its Hopper project in the Yukon Territory with its purchase of CAVU Energy Metals Corp., which closed in December 2022.

Red Cloud Securities analyst Taylor Combaluzier said CAVU was "well-positioned" to make a significant copper discovery before its purchase by Alpha.

Star is a multi-target copper-gold porphyry project in the Golden Triangle with 106.98 meters graded at 0.77% copper (Cu) in one hole. Over 13,000 meters of modern drilling have been completed there, and it is fully permitted for 200 drill sites until 2026.

"These could be multibillion-pound copper deposits," Jones has said of Star and Hopper.

Red Cloud Securities analyst Taylor Combaluzier said CAVU was "well-positioned" to make a significant copper discovery before its purchase by Alpha.

"We believe the company stands to benefit from the global trend toward electrification, which will require increased copper production to meet the demands of the worldwide green economy," Combaluzier wrote about CAVU before the sale.

The Catalyst: Drill-Ready Targets

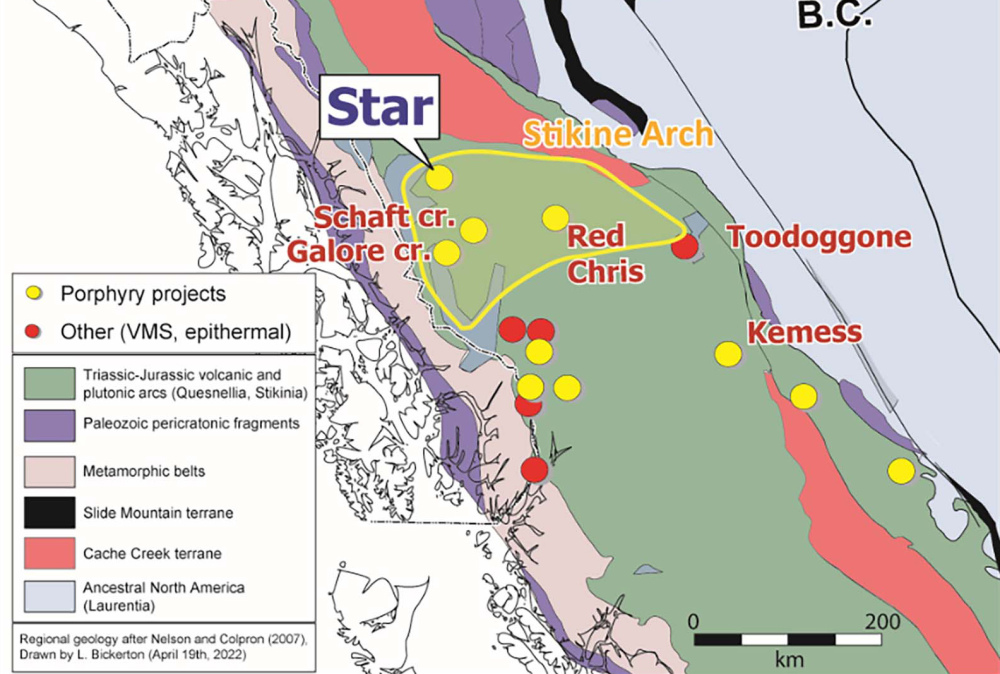

The Star Project is 6,829 hectares and about 50 kilometers from Telegraph Creek. Alpha said the site sits within the Stikine Arch formation, which hosts other large porphyry copper-gold projects like the Red Chris mine and Galore Creek project.

Nearly 19,000 meters total of drilling has been done at Star since 1955. Access to the project is through an airstrip on-site and a network of trails and drill roads. There are camp facilities available.

Other historical drill results include 242.3 meters at 0.44% Cu and 0.32 grams per tonne gold (g/t Au) from surface; 76.94 meters at 0.78% Cu, 0.55 g/t Au, and 1.28 g/t silver (Ag) from 12.02 meters; and 324 meters at 0.44% Cu, 0.219 g/t Au, and 0.74 g/t Ag from 4 meters.

The project includes five permitted drill-ready porphyry targets: Star, Star North, Star East, Pyrrhotite Creek, and Copper Creek, the company said.

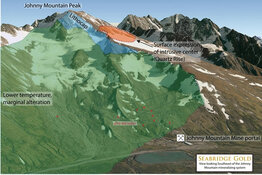

Star has been drilled to 664 meters below the surface. Most of the others host promising soil anomalies confirmed by surface trenching or drilling. A single historical diamond drill hole from Pyrrhotite Creek reported 146.3 meters at 0.32% Cu.

Company Narrows Its Focus

Alpha recently announced it had canceled an option agreement for the Okeover project in British Columbia to focus on Star, Hopper, and its Indata project, which is also in British Columbia.

"Trillions worth of new projects are thus in danger of falling by the wayside unless much more copper is discovered — more than is currently possible, in my opinion," analyst Rick Mills wrote.

"We have chosen to focus on the assets in our portfolio that we believe have more immediate exploration upside," Jones said.

Indata is close to Northwest Copper's Kwanika and Stardust discoveries. Results from 2022 drilling released in January show the existence of porphyry mineralization from surface to 173 meters, with 173.6 meters grading 0.23% Cu starting at 2.9 meters.

Alpha recently announced Hopper had been issued a 10-year permit for drilling and road and trail building.

A 74-kilometer multi-target porphyry copper-molybdenum project, Hopper has "significant copper-gold-silver peripheral skarn mineralization," Alpha has said. The best intercept there was 22.28 meters at 1.405% Cu.

Prices Could Go 'Higher Than Anyone Expects'

What's at stake is the future of green technologies like electric vehicles (EVs), which use more than three times the amount of copper as gas-burning cars. Charging infrastructure, solar panels, wind, and batteries all require more of the red metal, as well.

The need for copper is expected to double from about 25 million metric tons (Mmt) in 2021 to about 50 Mmt by 2035, according to a report by S&P Global.

"Trillions worth of new projects are thus in danger of falling by the wayside unless much more copper is discovered — more than is currently possible, in my opinion," analyst Rick Mills wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Alpha Copper Corp. (ALCU:CSE;ALCUF:OTC)

Wall Street analysts Goehring & Rozencwajg wrote in a report that copper mine supply growth will "grind to a halt this decade" and copper prices will rise "far higher than anyone expects."

"The number of new world-class discoveries coming online will decline substantially and depletion problems at existing mines will accelerate," the report said. "Also, geological constraints surrounding copper porphyry deposits, a subject few analysts and investors understand, will contribute to the problems."

As Mills wrote: "Bottom line? We gotta find more copper."

Ownership and Share Structure

About 15% of the company is held by insiders, including the CEO Jones, who holds 1.54% or 800,000 shares; and Director Daniel Matthews, who owns 1.11% or 580,000 shares, according to Reuters.

The rest is retail, Alpha said.

The company has about 52 million shares outstanding, 48.9 million of them free-floating, with a market cap of CA$14 million. It trades in a 52-week range of CA$1.02 and CA$0.135.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Alpha Copper Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Taylor Combaluzier, Red Cloud Securities:

Disclosure Requirement: Red Cloud Securities Inc. is registered as an Investment Dealer in all Canadian provinces and territories, and is a member of the Investment Industry Organization of Canada (IIROC). Part of Red Cloud Securities Inc.'s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Red Cloud Securities Inc. has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before investment. Red Cloud Securities Inc. will not treat recipients of this document as clients by virtue of having viewed this document.

Red Cloud Securities Inc. takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report.

Company Specific Disclosure Details:

The analyst has visited the head office of the issuer or has viewed its material operations.

The issuer paid for or reimbursed the analyst for a portion or all of the travel expense associated with a visit.

In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services or has been retained under a service or advisory agreement by the issuer.

In the last 12 months, a partner, director or officer of Red Cloud Securities Inc., or the analyst involved in the preparation of the research report has received compensation for investment banking services from the issuer.

Dissemination: Red Cloud Securities Inc. distributes its research products simultaneously, via email, to its authorized client base. All research is then available on www.redcloudsecurities.com via login and password.

Analyst Certification: Any Red Cloud Securities Inc. research analyst named on this report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst's personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst's compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.