Nova Royalty Corp. (NOVR:TSX.V) is a potential heirloom stock currently flying under the radar. It has strong management, access to capital, and key assets for the transition to green energy.

Selling for less than half of its net asset value, Nova Royalty is a rare opportunity. Nova Royalty holds and seeks to acquire royalties in nickel and copper, essential metals for the global energy transition, with a heavy emphasis on the latter. It has one producing royalty now that covers more than half its overhead.

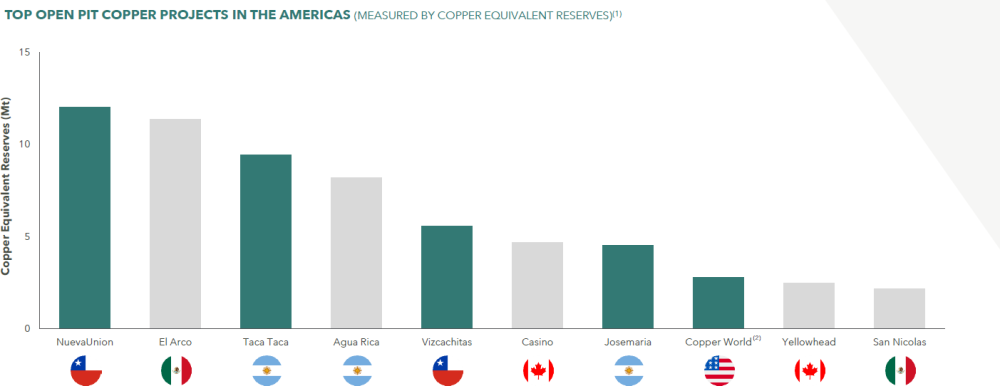

More importantly, it holds royalties on five of the largest eight undeveloped open-pit copper projects in the Americas (including number one and number three). In all, it has royalties on seven projects in development plus another 14 on earlier-stage projects, all in the Americas.

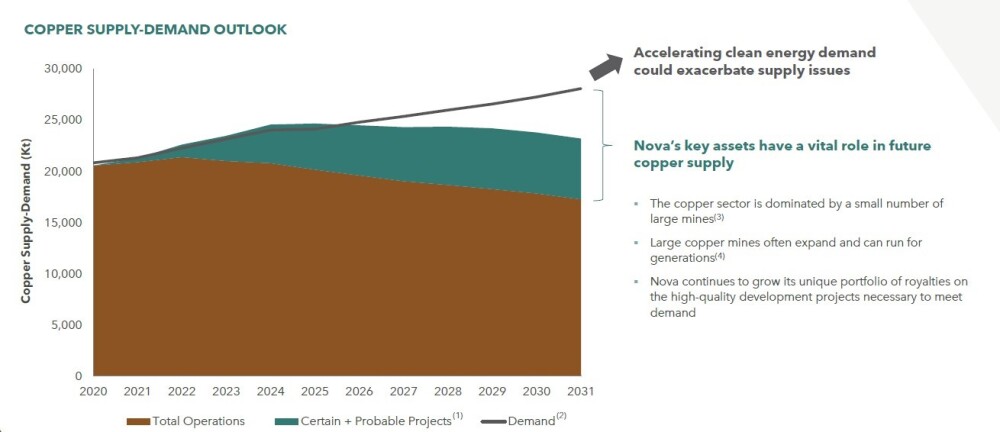

Copper, a Critical Mineral Ahead, Is in Short Supply

We cannot overemphasize the importance of new copper resources. Copper is a key metal used in the green revolution; copper usage in solar and wind is four to six times greater than in electrical generation by fossil fuels and four times greater use in electric vehicles than in those with internal combustion engines.

At the same time, there is a shortage of pending supply.

Freeport Resources Inc.'s (FRI:TSX.V) CEO recently said, “I don't know where all the copper required is coming from." Major gold miners are now seeking copper reserves, including Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), which now refers to itself as a "gold and copper company," while the large diversified miners, such as BHP and Rio, are spending more money looking for new copper deposits.

Large deposits, such as those on which Nova holds royalties, are being fast-tracked into production. Copper mines tend to be long-lived assets, and as the royalty owner, Nova will receive ongoing revenue without additional investments.

Taca Taca, for example, at the current US$4/lb copper price, would be expected to generate over US$7.5 million a year for the mine's projected 32-year mine life.

To put it in perspective, Nova has a current market cap of less than US$100 million.

Revenue Covers Most of Overhead

Nova's only currently producing royalty is a 1% NSR on the Aranzazu mine in Mexico, which generated CA$2 million for Nova last year as the mine achieved record production. This year is expected to be similar to last, while several brownfields targets are being drilled with the potential to extend the mine life.

This is the kind of mine whose life is continually extended; in 2020, it had a stated mine life of seven years but is still going strong. The mine could go on for decades. Revenue from this mine covers more than half of the company's ongoing G&A.

The rest is made up of equity issues under its ATM program as well as the occasional drawdown on its line of credit (more on this later).

Future Revenue Makes Nova Very Undervalued

But current cash flow is not the reason to buy Nova. It is the royalties that Nova holds on future mines that make it a compelling investment. Aranzazu represents only about 3% of the company's NAV.

Most of its value is on royalties on major copper mines expected to come on stream at the end of the decade.

Using a 5% discount rate, Nova is currently selling for less than half its Net Asset Value. Though a 5% discount rate is arguably low, crucially, the royalties that Nova has acquired on the next generation of major mines could not be replicated today.

If major copper mines are relatively rare, royalties on those mines are even rarer. Most of the NAV is based on the development assets, with only 2% attributed to exploration properties. Over time, some of these will move toward development, and their value will increase.

During 2022, there was significant progress at several of the development projects on which it holds royalties, moving closer to feasibility studies and production decisions. In aggregate, some 40% of Nova's NAV is up for a production decision within the next 12 months.

Given the long lead times on large copper mines, we do not expect revenue from these assets until the end of the decade.

Progress at Several Major Projects

- First Quantum Minerals Ltd.'s (FM:TSX; FQM:LSE) Taca Taca expects the Environment and Social Impact Assessment study approval by the end of the year, with a construction decision now in 2025.

- HudBay Minerals Inc.'s (HBM:TSX; HBM:NYSE) Copper World expects a Pre-Feasibility study (“PFS") during the second quarter of this year. Nova retains a right of first refusal on an additional 0.51% royalty.

- Lundin Mining Corp.'s (LUN:TSX) Josemaría expects an updated resource estimate after spending US$400 million this year.

- Vizcachitas, owned by Los Andes Copper Ltd. (LSANF:OTCMKTS), released a PFS last month.

We should note that there is a buy-back clause on the Taca Taca royalty. However, given that, under the terms of the royalty, First Quantum would have to buy not only Nova's royalty but another held by Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) at the same time, the cost would be around US$360 million at this time.

The miner would be unlikely to spend that much money while in the process of developing and then building a mine. Nova is actively looking now for near-term cash-flowing assets to fill the gap before these large mines come onstream and has some that it is actively looking at now.

To date, most of Nova's transactions have involved equity to legacy royalty holders who want continued exposure. As the company moves towards generating more royalties or streams from mining companies, this will likely involve more cash.

Nova Has Access to Capital From Friendly Lender

Currently, the company has CA$3.3 million in cash but also has access to a convertible loan facility from Beedie Capital. It has already drawn down CA$9.2 million, leaving CA$15.8 available. Earlier this year, it drew down CA$1.5 million to fund the purchase of an additional 0.03% royalty on the Copper World project. (There are also various deferred payments due for this acquisition.)

For a major acquisition, Nova would likely go to the market to raise equity financing, along with the convertible loan. It pays 8% per year on the drawn amounts plus 1.5% on undrawn amounts. The debt is convertible to shares at 20% above the stock price when drawn back; the range is CA$1.78 to CA$5.67.

In addition to the loan facility, Beedie also owns over 10% of the shares in Nova. The company has been an aggressive user of its At-the-Market facility (“ATM"), issuing one million shares in each of the last two quarters. Given that the average daily volume of the stock in both Toronto and in the U.S. (ex., the ATM issuances) is little more than 100,000, the ATM is obviously very significant.

A U.S. listing, on which the company is working, would boost volume, but this probably would occur until next year. Nova is lean yet has some strong people. The CEO is Alex Tsukernik, who has over 15 years of corporate finance experience and has demonstrated an ability to negotiate deals with existing royalty owners. Chairman of the Board is Brett Heath, who is also CEO of Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American) and was a founding shareholder of Nova.

An important advisor and director is Douglas Silver, co-founder of International Royalty Corp., a base metals royalty company sold to Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX), and a man with unrivaled knowledge and experience in the base metals royalty space. In addition to Beedie's 10% share ownership, insiders, mostly management and directors, hold another 20%, and the royalty holders from whom Nova acquired royalties another 10%.

In sum, Nova has the people, the balance sheet, the vision, and perhaps most of all the assets to become a core holding. If it did nothing else now, it would be a profitable investment. But we expect Nova to continue to build with strong transactions and accretive deals.

Buy Nova Royalty with a limit of CA$1.45. (It also trades on the OTC market in the U.S., NOVRF, with strong volume and narrow spreads; use limit of 1.06.)

Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Graphics from Nova Royalty.

Adrian Day Disclosures:

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2022. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

Disclosures:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Nova Royalty Corp., Barrick Gold Corp., Franco-Nevada Corp, and Royal Gold Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: Barrick Gold Corp., Franco Nevada Corp., Metalla Royalty & Streaming Ltd., and Royal Gold Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company release. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Nova Royalty Corp., Barrick Gold Corp., Franco-Nevada Corp., Metalla Royalty & Streaming, companies mentioned in this article.