For investors looking for a larger mid-cap gold stock as an addition to a Precious Metals portfolio, which is not a bad idea with the world falling apart all around us, Victoria Gold Corp. (VGCX:TSX; VITFF:OTCMKTS) is considered to be a worthy addition, and the good thing is that with it well within a large completing base pattern, there is still everything to go for.

On the 5-year chart, we can see how it is basing above a zone of strong support following a severe decline last year from a large top area.

Before leaving this chart, we can observe how an advance from here will not encounter serious resistance until it gets to the CA$13 area.

Now we will proceed to look at the base pattern in much more detail on the 1-year chart.

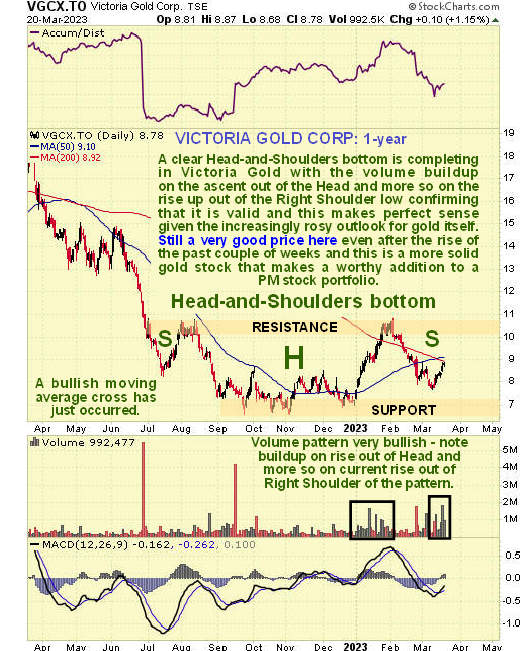

The 1-year chart enables us to see the base pattern in its entirety. It is a rather fine example of a Head-and-Shoulders bottom whose validity is confirmed by the strong volume on the rise out of the Head of the pattern and again on the current rise out of the Right Shoulder low. This large base pattern has allowed time for the falling 200-day moving average to drop down close to the price, which symbolizes the time required for enough stock to rotate from weaker to stronger hands and, in so doing, set it up for a new bull market.

From a timing standpoint, we have a very favorable setup for buyers here. Investors could have bought Victoria Gold back last July in the vicinity of the Left Shoulder low, having correctly calculated that it was undervalued, but then they would have had to sit out nine months of "dead time" waiting for the base pattern to complete, whereas if you show up and buy it now as it hauls itself up out of the Right Shoulder low, the timing is much better as it should soon "get on with it" and break out of the entire base pattern to commence a major bull market.

Although it would have been even better to buy it very close to the Right Shoulder low about two weeks ago, in the larger scheme of things, this is "splitting hairs" when you think about where this stock could end up if we see the hyperinflation-driven bull market in gold that is now inevitable.

In conclusion, Victoria Gold is regarded as an excellent core holding in a precious metals stock portfolio and is rated a strong buy here and especially on any minor short-term dips such as may occur today due to gold being down this morning.

Gold is reacting back now because it got short-term overbought, and market players are relaxing, thinking that the Fed has "got the banks' backs" or at least the big banks backs, seemingly overlooking the trillions of dollars that are going to be created out of thin air to accomplish this that will lead to hyperinflation.

Victoria Gold trades in healthy volumes on the US OTC market.

Victoria Gold Corp.'s website.

Victoria Gold Corp. closed at CA$8.78, $6.42 on March 20, 2023.

Originally published on clivemaund.com on March 21, 2023, at 9:20 am EDT.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures:

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.