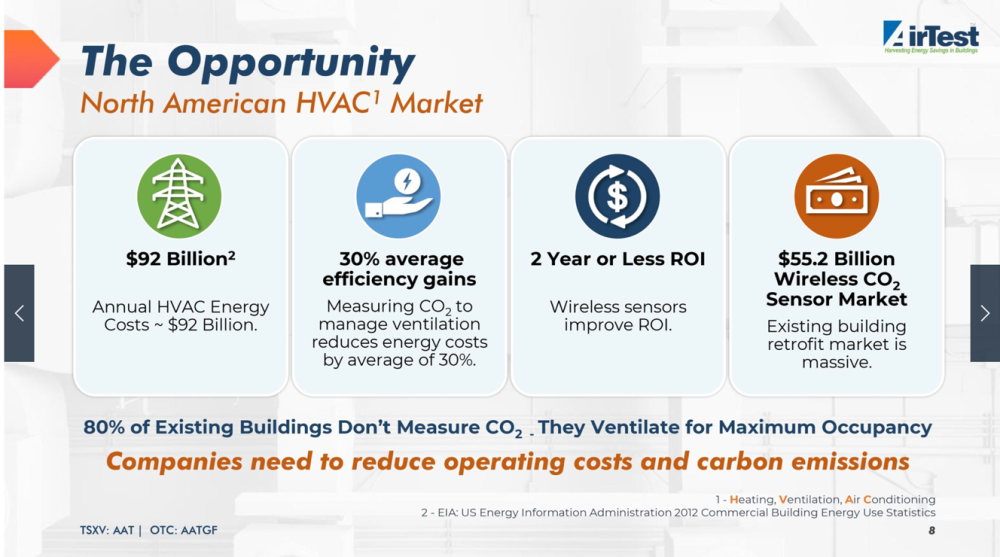

- As fuel prices and global warming rise, companies look to energy-efficient solutions to reduce costs, and solutions to reduce carbon footprint

- Incentives from utilities for energy-saving devices and leading Energy consultants supportive of AirTest products could impact sales substantially

- Large users are discovering that AirTest Technologies’ novel energy-saving products pay for themselves in a short time and reduce carbon footprint and operating expenses by up to 93%

- The industry-wide shift to heat pumps using refrigerant gas for heating and air conditioning requires reliable refrigerant leak detectors for safety. AirTest revealed a compelling, new product at a major trade show at AHR Expo

- The global smart energy market size was valued at US$143.15 billion in 2021 and AirTest's share price and market cap are CA$0.02 and CA$4.5 million respectively

Over the years, ATI AirTest Technologies Inc. (AAT:TSX.V; AATGF:OTC) has supplied over 1,300 customers, with 800+ being in the U.S., over 300 in Canada, and 70 internationally. AirTest energy-saving and carbon reduction products have been installed at Ikea, Lowe's Companies Inc. (LOW:NYSE), Canadian Tire Corp. (CDNAF:OTCMKTS;CTC:TO), Shoppers Drug Mart, US Postal Service, FedEx Corp. (FDX:NYSE), City Seattle Light, Seattle Schools, and many others.

2022 Energy Crisis Ignites Strong Interest in AirTest Products

I have been following AirTest for the past few years when I learned about its carbon-reducing and energy-saving solutions that were already selling well, but they just weren’t yet getting the kind of traction one would expect with such big market needs.

Then the 2022 global energy crisis shocked much of the world and my interest perked up again when I saw AirTest report record sales for December 2022.

The first thing I noticed was that after a prolonged period of relatively few news releases, all of a sudden, the frequency of press releases was increasing and the messages were signaling that AirTest sales could finally achieve the kind of sales growth that I was expecting because their products are game-changers in a very large and fast-growing market.

Their products solve big problems of energy cost reduction, and carbon footprint reduction and they have the most cost-effective and reliable products to safeguard occupants in buildings served by heat pumps.

There is a strong trend now in heating and air conditioning shifting away from natural gas to heat pumps using the refrigerant gas.

AirTest Hires New President to Expand Sales

In November, the company announced the hiring of a new President, Lorne Stewart.

Ted Konyi, the Company's CEO, commented, "With Lorne's first day under his belt, I am already seeing some exciting new initiatives in the sales and marketing of the Company's Energy Efficiency solutions. It is clear that the Company has some tremendous opportunities in this perfect storm of high and ever-increasing energy costs and strengthening ESG mandates. This should be a fantastic time for growing the Company's revenues and profitability and I believe that Lorne has the skill set to lead the Company to a very successful future."

Lorne added, "AirTest has generated business over the last 20 years with over 1,600 customers. This existing base of customers represents a database that can be introduced to the Company's latest offerings with tremendous potential. In addition to this existing database of clients, a large number of prospective customers are also reaching out to the Company driven by our quality, value proposition, and industry expertise. I'm looking forward to leading AirTest to significant sales growth and profitability."

AirTest Products are a Hit at AHR Expo in Atlanta

In February this year, AirTest announced that the Company had a successful exhibit at the annual AHR show in Atlanta. The Company's three latest product introductions were very well received by both existing customers and new prospective accounts.

Ted Konyi commented, "There was definitely a buzz at the AHR show this year. Energy Efficiency was front and center and ESG mandates were widely discussed. The introduction of the IAQEye™, our new BACnet capable Parking Garage sensors, and the RM7000 Refrigerant Leak Detector made great impressions.

While at the show, the Company delivered the first 83 RM7000 refrigerant detectors to a California-based hotel chain. The first hotel in the chain to adopt VRF heat pumps chose the AirTest RM7000 to provide alarmed leak detection. The mechanical contractor installing the RM7000 in each of the hotel rooms noted that this will now be installed in all their commercial heat pump retrofits. Great news for AirTest."

With the advent of more and more legislation banning the use of natural gas in new construction, commercial buildings are turning to Heat Pumps in new and retrofit projects. Heat Pumps have the benefit of providing both Air Conditioning and Heating with one appliance. However, while attaining better efficiency and reduced costs, they do increase the risk of refrigerant leaks in confined spaces. The fact that refrigerant leaks can be dangerous and even lethal is presenting another large opportunity for AirTest.

If sales and news events continue to ramp up as strongly as I suspect they might, I can easily see higher share prices from what appear to be very undervalued share prices. With a good inventory on hand to meet rising incoming orders, AirTest should have little difficulty raising whatever capital is required to meet new orders.

While there are currently no mandatory requirements for refrigerant leak detection in enclosed spaces heated and cooled by heat pumps, it is widely anticipated that this will become a safety requirement because of the high risk that occupants can be exposed to leakages if they occur.

Many mechanical contracting companies, responsible for installing heat pumps, are already deploying refrigerant leak detection. The global market for heat pumps should grow from US$60.4 billion in 2021 to US$96.7 billion by 2026 according to several sources including BCC Research.

AirTest's, simple-to-install, NDIR-based refrigerant leak detector surpasses the metal oxide sensors (MOS) that are currently marketed. Their sensors provide a wider range of sensitivity, no ongoing calibration requirements, and no need to replace the sensor element with an anticipated life exceeding ten years.

MOS detectors require calibration every six months and sensor replacement every two years or less and can generate false positives. These differences equate to a significant lifecycle cost advantage for AirTest NDIR sensors. AirTest sensors have been designed to provide easy application in both retrofit and new construction. AirTest appears to have strong advantages over the competition.

Leading Energy Consultant Allies with AirTest Products

Alternative Energy Systems Consulting, Inc. is a leading consultant to governments, utilities, and large companies seeking energy systems evaluations. In February this year, AirTest announced that they have allied with Alternative Energy Systems Consulting.

Antonio Corradini, CEO said, "AESC is always on the lookout for new innovative technologies to assist in reducing energy consumption and providing a path to Net Zero. We work closely with all of California's Investor Owned Utilities to evaluate and validate emerging technologies, such as those developed by AirTest. Preliminary data from AirTest indicates that with utility incentives, the AirTest DCV offering may provide a payback in under one year. We are excited to be assisting AirTest with this project and look forward to the evaluation results."

If results continue to perform as expected, a nod from AESC to their large customer base of giant users could result in exceptional sales growth for AirTest. And the timeframe is likely to be relatively short. It does not require much time to test AirTest products' performance metrics.

‘Save on Energy’ Approves AirTest Demand Control Ventilation Energy Savers for 50% Subsidy

Save on Energy provides energy-efficiency opportunities and resources to more than 250,000 homes and businesses in all sectors across Ontario to help them better manage their electricity use, saving nearly 16 TWh of electricity. This is equivalent to powering 1.7 million homes for one year.

Save on Energy is Ontario's recognized and trusted source for energy-efficiency opportunities and knowledge in the province. Since 2011, Save on Energy has proudly provided energy-efficiency opportunities that have saved nearly 16 TWh of electricity. This is equivalent to powering 1.7 million homes for one year. Save on Energy programs will continue to help ensure the IESO delivers the best value for program participants, the ratepayers of Ontario, and the provincial electricity system.

AirTest announced that the Company's IAQEye™️ Demand Control Ventilation (DCV) solution has been approved by Save On Energy for a 50% subsidy. The DCV solution is intended to be installed at numerous shopping malls in Ontario.

The global smart energy market size was valued at US$143.15 billion in 2021 and AirTest's share price and market cap are CA$0.02 and CA$4.5 million respectively which in my opinion, makes AirTest an attractive buying opportunity for the short term and for the long term.

The CEO went on to comment, "DCV is a well-known protocol for measuring CO2 in temperature-controlled spaces. The idea is a simple one, to measure CO2 levels to adjust the amount of ventilation required.

This typically results in a reduction of the amount of outside air required based on the population of the space. This protocol can be very effective in reducing energy costs by limiting the heating and cooling of outdoor air for the amount that's required based on the number of people in a space.

DCV is particularly successful in buildings that have a high population, and variabilities, such as retail stores, schools, theaters, conference centers, and airports. Generally, it can yield a 30 to 40% reduction in energy costs. While DCV has been applied in many situations, the wireless solution that AirTest is now providing has reduced the cost of installation . . . running the wires and conduit, and the labor associated with it . . . that made it expensive and in many cases uneconomic.

The AirTest wireless solution cuts the costs in half. The subsidy from Save On Energy further reduces the cost by an additional 50%. This should give the customer a payback period of close to one year. Of course, it will also assist the customer in reducing their carbon footprint, a major new initiative in today's world."

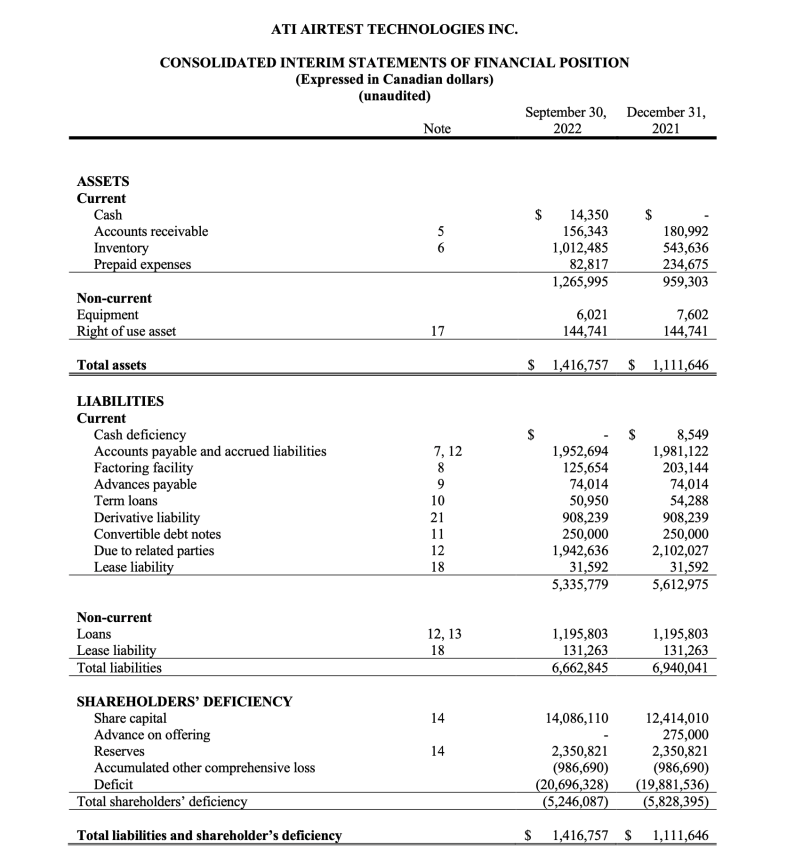

Financials

The most current financial filing I could find on SEDAR is for the quarter ending September 30, 2022, which is just before sales began to take off. Sales and most numbers were mediocre and cash was light. It appears that the company could require a small capital infusion in the next six months to meet its obligations and then a little growth capital to meet expected order increases.

There were no upcoming alarming surprises shown in the September 2022 numbers. My personal experience suggests to me that AirTest will very likely do a small raise in the next 90 days which will probably have very little impact on dilution and share prices.

If shares were to soon rise over CA$0.05, there is a possibility that certain CA$0.05 strike price warrant holders could exercise their warrants resulting in a potentially substantial cash infusion.

If sales and news events continue to ramp up as strongly as I suspect they might, I can easily see higher share prices from what appear to be very undervalued share prices. With a good inventory on hand to meet rising incoming orders, AirTest should have little difficulty raising whatever capital is required to meet new orders. Ted Konyi, the CEO, has a very good track record having raised over US$300 million.

Record Sales Reported for December 2022

Sales in December tallied in at just over CA$340,000 with the previous record dating back to December 2015 at CA$299,000.

Ted Konyi, the Company's CEO, commented, "This was a fantastic way to end the year on a positive note. Most of the additional sales came from long-standing OEM clients who have started to get back to pre-pandemic requirements. Fortunately, we had adequate inventory to cover most of the orders but there remains a healthy order book to be delivered in the first few months of 2023. The timing is also fortuitous as it provides a great platform for our new President to continue to grow sales. We feel confident that this will lead AirTest to new highs in Revenue and Profitability."

Risk Factors

The powerful growth expected for AirTest will require additional capital and the ability to raise that capital appears to be the single biggest risk at this point.

However, with big orders in hand and a CEO who has a proven ability to raise hundreds of millions of dollars, this seems like a risk worth taking.

Conclusion

AirTest seems to have a big leg up in what is rapidly evolving into a large, high-growth market for energy-saving devices that also reduce the carbon footprint. Investment timing is always a significant factor in calculating potential returns, and AirTest appears to offer a short path to growth because sales have just begun to demonstrate the need for its’ products.

The global smart energy market size was valued at US$143.15 billion in 2021 and AirTest's share price and market cap are CA$0.02 and CA$4.5 million respectively which in my opinion, makes AirTest an attractive buying opportunity for the short term and for the long term.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

Charts and images provided by the author.

1) Richard Cavalli: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: ATI AirTest Technologies Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Northern Graphite could become a future advertiser at playstocks.net.

I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: ATI AirTest Technologies Inc. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ATI AirTest Technologies Inc., a company mentioned in this article.