After a sharp reversal in sentiment at the start of the year, the junior explorers and developers (ex-lithium) have faded back into the same frustrating pattern of listlessness where either operational or exploration results deemed “spectacular” in past eras are instead treated as rare and valuable “liquidity events." Just as the canine being fed by Mr. Pavlov learned to salivate upon the ringing of a bell just before dinner time, traders in the junior gold, silver, copper and most other base metal issues have learned that it is the first bid that gets hit after a positive news release that is the best bid to hit.

That is because the junior miners trade on the margin to the extent that is usually the first trade that sets the mood. It has gotten so bad that I actually received a note from a young trader that informed me of the “lousy results” at Marathon Gold’s Valentine Gold Project in Quebec. Quickly calling them up and noticing an intercept of 5 g/t Au over 18 meters, I asked the young man what made him think the results were “lousy.”

His reply was “Well, the stock was $1.21 the day of the release and it’s now $0.91. Results were obviously lousy.”

Notwithstanding that the results reported by MOZ were anything but “lousy”, it simply underscores how tape action controls the narrative on every single stock out there these days.

I was in a conversation with a prominent speaker and newsletter writer this week that told me that unless one is invested in the companies producing, developing, or hunting down metals associated with the electrification movement, the new generation of traders is largely disinterested.

He informed me that his subscriber base is down over 50% despite having some big success recently with Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX) taken out by Kinross Gold Corp. (K:TSX; KGC:NYSE) for around $30 in February 2022.

Rather than complain about it, I am reminded of an anecdote relayed to a group of us by veteran Wall Street Week Elf Julius Westheimer while we were attending the annual Securities Industry Associations (“SIA”) conference in which industry professionals conduct classes in various sectors of the securities industry.

It is very “blueblood” as it is held at the prestigious “Wharton School of Finance” in Philadelphia and they really milk that because when you leave, they present you with a graduation certificate (a “shingle”) that looks like a real Wharton certificate such that when you hang it on your wall, everybody figures you earned a post-graduate degree from Wharton, which you did not. Three weeks over three years at the SIA is nothing like six semesters at the Wharton.

The old Wall Street Week show came on every Friday night around 7:00 p.m. and in the late 70s, it was really the only TV news show that covered stocks and bonds. It aired on public TV in Maryland but was widely syndicated across North America and I believe Europe and was a “must watch” for any young broker trying to learn the trade.

It was on Wall Street Week on October 16, 1987, that the legendary money manager and author Martin Zweig told the host that he actually expected a market crash. The following Monday was the infamous Crash of ’87 where the Dow lost 23.7% in a single trading day.

While most of the Wall Street Week elves were either analysts or fund managers, they used Mr. Westheimer as their “token stock salesman” as his area of specialization was managing retail customers. One of the crowd asked him how he could grow his book (increase the number of clients) and then peppered Julius with a bunch of the books he had read and courses he had taken at which point Julius held up his hand in a gesture of “Enough, already!” and proceeded to tell us all a story which describes not only the retail space in 1979 but also the systemic modus operandi of Wall Street since the first began shuffling paper on a New York curb in the 1800s.

“One day, I was walking to work at Broad and Wall Streets when I noticed a chap trying to sell these yellow umbrellas out of a hand cart but each time a prospective buyer picked one up and examined it, they frowned and put it back. Now, across the street, another chap was selling the same brand of umbrella but they were blue umbrellas and these umbrellas were flying out of his cart so fast that his young son and to keep running back to their apartment for more inventory. The poor guy in the yellow umbrella cart sitting there with no customers flagged me down and ask me what I thought he could do to improve his sales. I said, “Go around the corner to O’Reilly Hardware and pick up a can of blue spray paint.” Because, ya see, down here we only sell what people want to buy.”

Now, the purists that view precious metals with an almost religious affection would never dream of dumping their stacks for something as abhorrent as copper or lithium or uranium because they think that yellow umbrellas are just as useful as blue umbrellas but where they would be in error is that Marketing 101 says you always need to know what one’s customer wants before embarking on a marketing program.

When you go down the “Most Actives” list for the TSX and TSX Venture exchanges these days, you do not find “Gunner Gold," “Streaker Silver,” “Pugnacious Platinum” or “Parlay Palladium."

You find the word “battery” or “lithium” in the names of those corporate issuers dominating the list of “Most Actives,” “Biggest Percentage Gainers” and “Volume Leaders.”

In 2020, my list of juniors was all gold and silver with one token uranium name. By 2023, the list is comprised of eight names with only one pure gold developer (Getchell Gold Corp.) a couple of silver names (that have copper and gold exposure) with the rest exclusively copper and lithium, with Volt Lithium Corp. the most recent addition.

I read the results of a poll of trader/investor types last week that asked participants to list the five most important metals in which they wished to invest. At the top by the widest of margins was lithium while at the nadir was silver. I should add that silver is also the least-trusted of all the metals with gold a close second.

With copper, uranium, nickel, and cobalt all lined up behind lithium as the favorites, it should come as no surprise because the new generation of investors/traders invests in thematic “story” stocks. They also invest as a collective thanks largely to their obsession with social media.

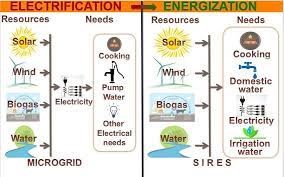

The popularity of these sub-sectors can be broken down into one word: “electrification.” Integral to the replacement of fossil fuels by electricity are three prerequisites:

- New clean and 100% reliable sources of electricity are going to be needed. The only fuel that can deliver is uranium. Nuclear energy will be the source of the trillions of new megawatts required to complete the transition.

- With the new supply of electricity being pumped into an antiquated grid, massive increases in the supply of those metals that transmit electricity are going to be required and the metal that has been the most commonly used is copper.

- Once the new source of electricity provided by nuclear energy has been transmitted by the greatly-fortified copper wiring to households, businesses and vehicles, the need for storage particularly in the EV space is going to require lithium (lithium-ion batteries) along with nickel and cobalt.

Enhanced generation, increased transmission infrastructure, and storage capacity are going to demand huge increases in supply. Over the past five decades, the sector that has discovered the lion’s share of the new mineral deposits around the globe are the juniors which then get absorbed by the multinationals with help from their deep-pocketed investment bank pals.

Therein lies the opportunity for investors as we look out through the rest of the “Boring Twenties.” The younger generation of stock buyers could care less about “profligate government spending” or “currency debasement” that would require they use gold and silver as protection. They represent the “yellow umbrellas” of the day for these youngsters and since liquidity is critical for institutional participation, you will never get the volumes required in yellow umbrellas to create the excitement that the “electrification metals” (including nuclear fuel) can generate.

Of course, over time, this all can change as trends are always cyclical and people’s attitudes and preferences will ebb and flow depending on the impact of the “Narrative of the Day.”

For now, however, I just want to find opportunities that will make money. Unfortunately, we cannot take a silver explorer and turn it into a copper or lithium explorer with a can of blue spray paint. Julius Westheimer taught me to avoid the habit of offering products that the investing public simply does not want so I will heed his advice and instead seek out exploration and development plays that focus on the generation, transmission, and storage of electricity while keeping large barbell positions in gold and silver as hedges.

It was the last week of September when I executed my own personal “pivot” jumping off the bear bandwagon and into the neutral camp after the Bank of England decided to buy $5 billion worth of gilts. A couple of weeks later, I went from neutral to bullish but technically, I was about two weeks early in my “bottom” call as the 3,600 S&P level in late September gave way to the October 13th low at 3,491.

In a similar fashion, I went from bull to neutral on February 8th and then full bearish this week having put on a small put option position in the SPY:US. I did so because I got two sell signals within a week of each other with the major one being the bearish MACD crossover. It took Thursday’s 43-point drubbing to convincingly send the MACD into “sell” mode so just as I was a tad early back in September, I was again early in getting short. There is a line in the sand at the 4,050 level for the S&P but if it closes below that, I see 3,900 (100-dma) then the December low at 3,764.

Want to be the first to know about interesting Cobalt / Lithium / Manganese, Gold, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, Bonaventure Explorations Ltd., has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.