One of the greatest examples of both tenacity and perseverance, not to mention drive, ambition, intellectual brilliance, and unabashed ruthlessness was and continues to be the career of Chicago-born billionaire entrepreneur Robert Friedland. Anecdotes about Friedland abound from almost everyone that has ever come across this 72-year-old wunderkind and while not all are completely flattering, not one that I ever heard has ever doubted his abilities in the area of “Carpe Diem” — “Seize the day!”

I first ran into the man in 1992 in the old Marine Building in Vancouver where I and four other partners were attempting to sell some diamond claims from the Molanosa Arch region of northern Saskatchewan to Friedland. Four friends and I had thrown some cash into a pot and staked 92 claims in an area believed to contain an abundance of indicator minerals commonly associated with the presence of diamondiferous kimberlite pipes.

We named the group “The Five of Diamonds Syndicate” and as I recall, Robert’s younger brother, Eric, took the initial meeting and proceeded to bludgeon us with exasperating reminders of just how powerful “The Friedland Group” was and how cash was to be considered trash when deciding on how we were to be compensated IF they decided to proceed.

You see, “Friedland paper” was way more valuable than cash and this went on and on for what felt like hours until one of the partners, a former La Ronge Prison guard from Prince Albert, interrupted Eric and said, “Mr. Friedland, I appreciate that you and your brother have the ability to “move paper” (market securities) but what we paid out to stake the claims was cash and what you are offering us is paper. The last time I looked, a share certificate is made out of newsprint which is paper, and as of last night, newsprint was selling for $1.86 a pound!”

If tension could ever have been broken in one thirty-second soliloquy, what followed was genuine laughter, first from Eric and then the rest of us. Coming from the lips of that burly prison guard clad only in jeans and a lumberjack shirt was not exactly what was expected. As the meeting wore on, it proceeded to devolve into a kind of schoolyard competition where the younger Friedland continued to remind us how strong they were and how we as a group had no clue what we were turning down.

Alas, it certainly did not improve much and I must confess that my remarks about the “Friedland Experience” in Colorado (where their company, Galactic Resource’s Summitville Mine emptied its tailings pond into the Alamosa River poisoning fish as far as seventeen miles downstream). Inquiring as to the plight of “Friedland paper” in Galactic was not exactly a bonafide point of negotiation but it sure quickly ended the use of the term “Friedland paper” because Galactic went bankrupt in 1992 and off the board within weeks of the court ruling.

We never did accept the Friedland offer because we had a cash-and-stock offer from another Vancouver group and here is where the term “serendipity” derives its true meaning. The Friedland boys were prepared to offer us 500,000 shares of a private entity called “KBK No.7” which was expected to be an IPO launching Friedland’s foray into diamonds which, up until 1993, had eluded the Friedland crosshairs.

If this man wants to get behind the electrification movement by promoting the “responsible mining” of all battery metals, then investments in this area must be included in any resource-centric portfolio which means lithium, copper, cobalt, nickel, and uranium are in list.

As it turned out, KBK No.7 was renamed “Diamondfields Resource Ltd.” and listed for trading in April 1993. Three years later after the discovery of massive sulfides containing wildly-economic grades of nickel-copper-cobalt at Voisey’s Bay, Labrador, Inco Ltd. bought Diamondfields for US$4.3 billion or US$163 per share after a 10:1 share split. To say that “The Five of Diamonds” left a few quid “on the table” will go down as the understatement of a lifetime. To be sure, if I had to do it over again, I would not trade that experience for all of that promised “Friedland paper” — well maybe I would . . .

The point of the story is that I am now following what Robert is doing after paying little or no attention since 1996. Once he made his billions, he retired from the limelight. We seldom saw him frequenting the high-end restaurants in downtown Toronto, a gaggle of bankers and analysts as part of his entourage, all fawning over him as if he were a rock star or famous athlete. It can never be said that he lacks charisma and even at his age today, he is a captivating speaker and visionary. What fascinates me is his late-career preoccupation with “responsible mining” which is closely aligned with his belief that the world is going to run out of all minerals that are needed to fulfill the electrification movement, and that includes copper.

If you sit through one of Friedland’s lectures, his command of the statistical necessities spell out a world bereft of the supply of battery metals required to transmit and store the electricity intended to replace the fossil fuels used today to power autos, buses, trains, and planes. What also leaps off the page is that even if – and it is a big “IF” — the global mining industry can locate and successfully deliver these new supplies, the world will need to undergo a massive upgrade in the production of electricity itself, and that means we will be turning once again to the safest, most reliable, and cleanest source of electricity and that mean nuclear. Once the kiddies stop gluing themselves to the Autobahn and tossing pea soup on priceless paintings because they are freezing to death in the dark, they will turn and embrace nuclear like a long-lost BFF.

Robert Friedland is touring the world with his latest presentation first given at the Minerals Futures Forum in Riyadh, Saudi Arabia, which I first picked up on Twitter. He has once again become the showman, the effervescent promoter that captivated entire ballrooms of greed-driven investors but this time, Friedland is bringing a message while backing a cause that has more to do with his preferred legacy rather than being strictly avarice-driven like in 1996 when he battered Inco’s poor Michael Sopko around an NYC boardroom, threatening, as only Friedland could, to turn Sudbury into a “ghost-town.”

I am paying very close attention to the workings of the 2023 reincarnation of Robert Friedland because Friedland is an “outlier” whose 10,000 hours of devotion to his craft have earned him the title of “master.” If this man wants to get behind the electrification movement by promoting the “responsible mining” of all battery metals, then investments in this area must be included in any resource-centric portfolio which means lithium, copper, cobalt, nickel, and uranium are in list.

In the end, I am making adjustments because having experienced first-hand the “Friedland Effect” you simply cannot bet against him.

Precious Metals

The precious metals markets are now in full retreat thanks to a perfectly-orchestrated takedown last week after the BLS reported that blow-out jobs number. It was not as if stocks were routed or that the U.S. dollar suddenly caught a short-squeeze bid; only gold and silver were hammered. Now that the top is in, the best I can hope for is that gold can find support at the first 38.2% Fibonacci retracement level at US$1,835. If that fails, then US$1,792 and US$1,749 come into play.

I elected to stay long this week in the hope that silver’s relatively low RSI reading could allow it to stay flat but it could not avoid the gravitational pull of the gold market and had a modestly negative week. The problem facing us right now is that silver is going to join gold with its own bearish MACD crossover which is a “SELL” signal on two fronts: directional price movement for silver and the acceleration of the uptick in the GSR (“gold-to-silver ratio) which portends lower prices in the entire PM complex.

It is emotionally deflating to have such a solid advance that was only just getting “legs” get rejected as soundly as it happened the day after Powell spoke and then even more violently

into the jobs number the next day. It is almost as if someone in the bullion bank community had the number a couple of days before the release. I am now forced to await a bullish MACD crossover for gold and silver amidst a backdrop of a descending RSI before committing to any new positions. The Fibonacci retracement levels will hopefully soften the corrective action and may in fact act as sufficient support to justify a near-term bottom.

I truly hate to sound like a broken record but it is thoroughly enraging to see these breathtaking advances in prices of food, shelter, and services without the equivalent advances for gold and silver. I used to read volumes upon volumes of gold and silver market commentary but have since refused their enlightenment largely because they all talk the same talk and all walk the same walk. The reality of gold and silver is that they have been abysmal investments since August 2020, residing squarely in the back seat during a period of accelerated inflation while other minerals not noted for their anti-inflationary applications have actually been far better venues for excess savings.

Lithium

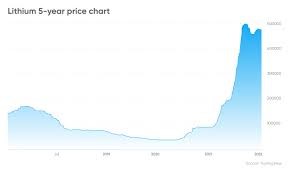

This chart of lithium is exactly how the charts of gold and silver should look, given the horrific increases in everything due to both monetary debasement and supply chain disruptions. Unfortunately, generations of new investors have avoided the stodgy, old traditional venues like precious metals and instead flocked to crypto and SPACs as their preferred means of insulating their savings from the ravages of government-sponsored currency debasement.

Prior to last week’s debacle, it appeared as though the newbies were beginning to come over the wall in favor of precious metals. Now, they have been frightened back into hiding by nothing simpler than bullion bank shenanigans and that is a legitimate tragedy.

I will be continuing to play defensively with the broader markets like the S&P 500, having turned from intermediate-term bull to neutral in late January but after the tape action this week, I instituted my first short position since September of last year.

I was fortunate enough to catch the bottom in late September when the Bank of England decided to bail out their pension funds but in all honesty, I cannot claim anything other than Divine Fortuity in the outcome of my decision because nobody (that I know of) paid any attention whatsoever to that abrupt reversal in monetary policy. Perhaps it was that it was in the U.K. that it happened to escape the crosshairs of the American financial media but other than deeply negative sentiment and an oversold condition, I could not find a single event between then and the October 13th bottom that would constitute a “tail” of sorts accounting for the end of the 2022 bear market. So I chalk it off to the fate-blessed ramblings of the “idiot savant” that takes a wrong turn on the highway avoiding a last-minute disappearance over the edge of the washed-out bridge.

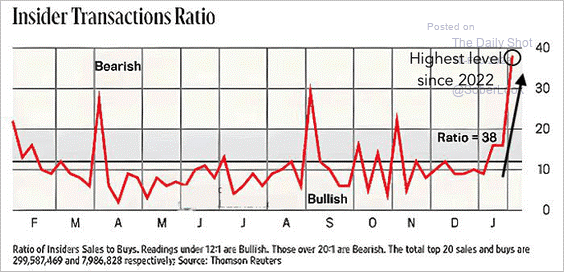

I leave you all with one chart over which to mull. This up-to-date report on “Insider Activity” is enough to send one scurrying to the safety of 100% cash and should not be taken lightly.

Insider sales are now higher than the two major tops in 202 in March and August. Caveat emptor.

Want to be the first to know about interesting Gold, Critical Metals, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, Bonaventure Explorations Ltd., has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.