Vanadium company Largo Inc. (TSX:LGO;NASDAQ:LGO) has released its fourth quarter and full-year operational and sales results for 2022. The company reported production of 10,436 tonnes (23 million pounds) of vanadium pentoxide (V2O5) in 2022. It also sold 11,091 tonnes of V2O5 equivalent from its Maracás Menchen mine, located in Brazil’s eastern Bahia State.

Largo, which is the world’s largest, highest-grade primary producer of vanadium with one of the lowest costs, produces around 7% of the global vanadium supply. It’s one of only two large producers that supply to the aerospace industry.

The results showed that, though V2O5 production was up slightly from 2,003 tonnes in Q4 2021 to 2,004 tonnes in Q4 2022, annual V2O5 recovery was down from 79.7% in 2021 to 79.1% in 2022.

The company reported has also announced plans for exciting growth through 2025.

Vanadium Demand Rising

Vanadium can also be used in the production of vanadium electrolyte, which is used in Vanadium redox batteries as these batteries store renewable solar and wind power.

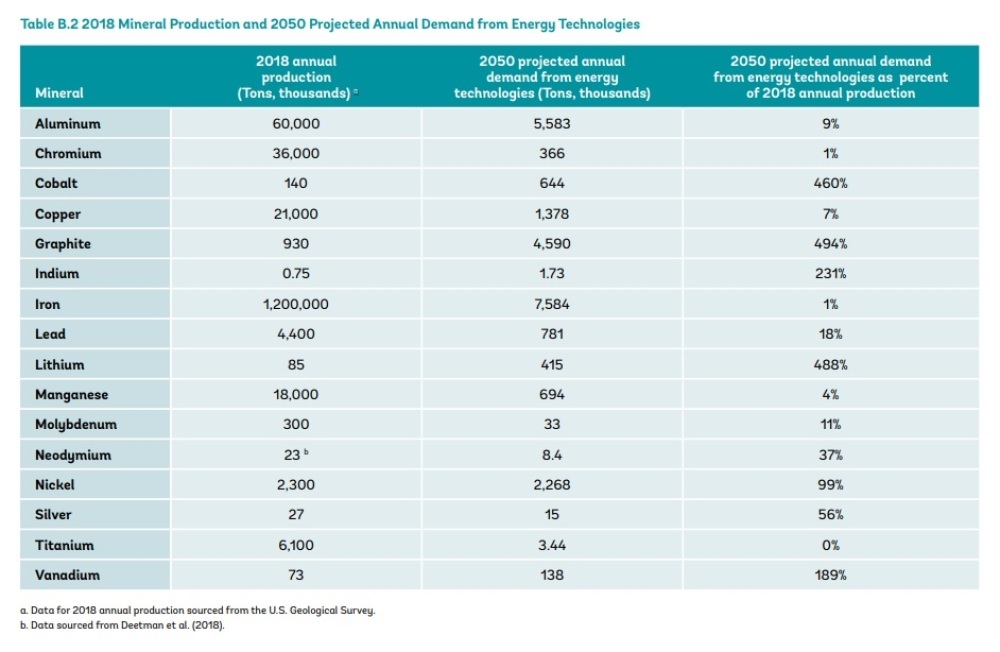

It’s expected that the demand for vanadium from energy companies will increase by 189% by 2050, according to the World Bank Group.

As such, and as the demand for sustainable energy sources increases, it’s expected that the demand for vanadium from energy companies will increase by 189% by 2050, according to the World Bank Group’s report "The Mineral Intensity of the Clean Energy Transition."

V2O5 production in Q4 was impacted by a lower quality of available mined material, which coincided with a change in the company’s mining contractor. As such, this decreased amount of material available was not enough to lessen the blow from maintenance work in November 2022 and heavy rain in December.

The Catalyst: New Revenue Stream

President and CEO of Largo Paulo Misk mentioned "operational challenges" faced in 2022 that might have had a part to play in the lower-than-expected results for the year. He went on to state that the company is looking forward to "prioritize and focus" on the Maracás Menchen mine and mentioned "mitigation efforts to rectify rain-related impacts and preventive maintenance measures during the operational downtime in December 2022 and January 2023."

CIBC reported that "heavy rainfall" had impacted open pit production and had led to lower-than-estimated results after 16 days of operational downtime between December and January. The results were below CIBC’s expectations in terms of production and CapEx but above expectations on costs.

February 3, 2022, Bryce Adams of CIBC Capital Markets rated Largo Outperform with a target price of CA$18. Largo is currently trading at CA$7.99.

Largo has also made progress in the construction of its ilmenite concentration plant at the Maracás Menchen mine in the last quarter of 2022 and expects commissioning to be completed by Q2 of this year. It expects a new revenue stream in 2024 from ilmenite sales.

Vanadium is ideal for energy storage, as well as high-quality alloy applications, and as demand for low-carbon technology increases, a 173% increase in vanadium production is expected. It includes non-degrading, recyclable electrolyte and carbon-reducing steel alloying applications, meaning it’s a win-win for companies and institutions looking for sustainable, low-carbon solutions.

Largo intends to continue production through its operations in Brazil and through an energy storage business based in the U.S., working towards the goal of supporting a carbon-neutral future. It expects to deliver its inaugural vanadium redox batteries (VRFB) for Enel Spain in Q2 of this year.

February 3, 2022, Bryce Adams of CIBC Capital Markets rated Largo Outperform with a target price of CA$18. Largo is currently trading at CA$7.99.

Analysts that have given Largo Buy or Outperform ratings include H.C. Wainwright’s Heiko F Ihle and Gordon Lawson et al. at Paradigm Capital. You can read more of what they are saying by clicking “See More Live Data” in the data box above.

Largo Clean Energy (LCE) will also continue negotiations with Ansaldo Green Tech with the purpose of creating a joint venture, which would focus on the manufacture and commercial distribution of VRFBs throughout the European, African, and Middle Eastern markets.

Ownership & Share Structure

With headquarters in Toronto, Largo Inc. has a market cap of CA$542.76 million, with 64 million shares outstanding, and is operating in a 52-week range between CA$6.34 and CA$18.20.

25.1% of shares are held by institutions, with 43.81%. Arias Resources Capital Management LP has the most shares at 43.81%, with 28 million shares. West Family Investments is at 8.71%, with a little over 5 million shares, and Grantham Mayo Van Otterloo & Co. LLC is at 7.66%, with 4.9 million. BNY Asset Management has 1.84%, with a little over a million shares, and Baker Steel Capital Managers LLP has 1.27%, with 800,000 shares.

Other notable institutions and firms include Dolefin SA, Legal & General Investment Management Ltd., Konwave AG, Go ETF Solutions LLP, Rezco Investment Council, Blackrock Inc. ETFS Management, Russell Investment Management LLC, Mid-Continent Capital LLC, and BTG Pactual Asset Management SA.

30.31% of shares are in retail.

0.67% are held by management and insiders.

| Want to be the first to know about interesting Clean Energy and Battery Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Lauren Rickard wrote this article for Streetwise Reports LLC as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Largo Inc. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Largo Inc., a company mentioned in this article.