Alpha Copper Corp.’s (ALCU:CSE;ALCUF:OTC) 2022 fieldwork and diamond drilling program at its Indata project in British Columbia brought a surprise for the company.

Assays are now available for 11 of 13 holes drilled over 2,140 meters. Samples from the remaining two holes are anticipated shortly.

While Alpha focuses on copper, one of the metals that will be needed in the new green economy, it’s not the only important metal the company has come across at Indata.

“We are excited to have stumbled upon a brand-new discovery of a molybdenum mineralized zone on the project,” Alpha President and Chief Executive Officer Darryl Jones said. “Our team is very familiar with molybdenum and have been closely following the global supply situation.”

Molybdenum is is used in many clean renewable energy generation and storage technologies, including wind, geothermal, solar, nuclear, and hydroelectric.

“Because of the demand for molybdenum, spot price activity has been quickly rising to current 14-year highs,” Jones said. “We look forward to receiving the final two drill hole results as we continue to develop an increasingly promising asset overview."

The discovery at hole IN22-74 has been named “Area 74.” It intersected 30.8 meters grading 0.1% molybdenum equivalent (0.16% MoS2, or molybdenum disulphide) starting at 113.7 meters, including 7.5 meters grading 0.32% molybdenum (0.51% MoS2 equivalent) starting at 113.7 meters.

The depth and lateral extent of the molybdenum mineralization, which occurs as without significant copper, is unknown, the company said. The final sample in the hole returned 0.043 percent molybdenum.

The Catalyst: Metals of the New Economy

Reuters senior metals columnist Andy Home said molybdenum has a much smaller market than copper with production of just 300,000 tonnes in 2018.

“Even though its average use in a wind turbine is just 0.15% of mineral composition, a surge in both wind and geothermal power generation would translate into cumulative demand growth of 800,000 tonnes over the same period,” Home said.

Through 2050, 47.3% of the molybdenum used by energy technology will go to wind power, 41.7% geothermal, 4.8% to nuclear, 3.2% to solar, 1.8% to coal, 1% to gas, and 0.3% to hydro.

“Molybdenum makes an important contribution to sustainable development as a metal, as an alloying element, and as a constituent of chemical products,” according to the International Molybdenum Association.

Another significant result from Indata was hole IN22-82, which targeted the site’s Lake copper zone. The hole intersected 173.6 meters grading 0.23% copper (Cu) starting at 2.9 meters, including 28.9 meters grading 0.47% Cu.

Copper and other elements are needed to help the world move from fossil fuel engines to electric vehicles (EVs), as well as for other parts of the green economy. EVs require at least three times as much copper as regular cars.

According to a recent report from S&P Global, copper demand is expected to double from about 25 million metric tons (Mmt) today to about 50 Mmt by 2035.

“The chronic gap between worldwide copper supply and demand projected to begin in the middle of this decade will have serious consequences across the global economy,” authors of “The Future of Copper,” wrote. “In the 21st century, copper scarcity may emerge as a key destabilizing threat to international security. Projected annual shortfalls will place unprecedented strain on supply chains.”

Okeover, CAVU Purchase

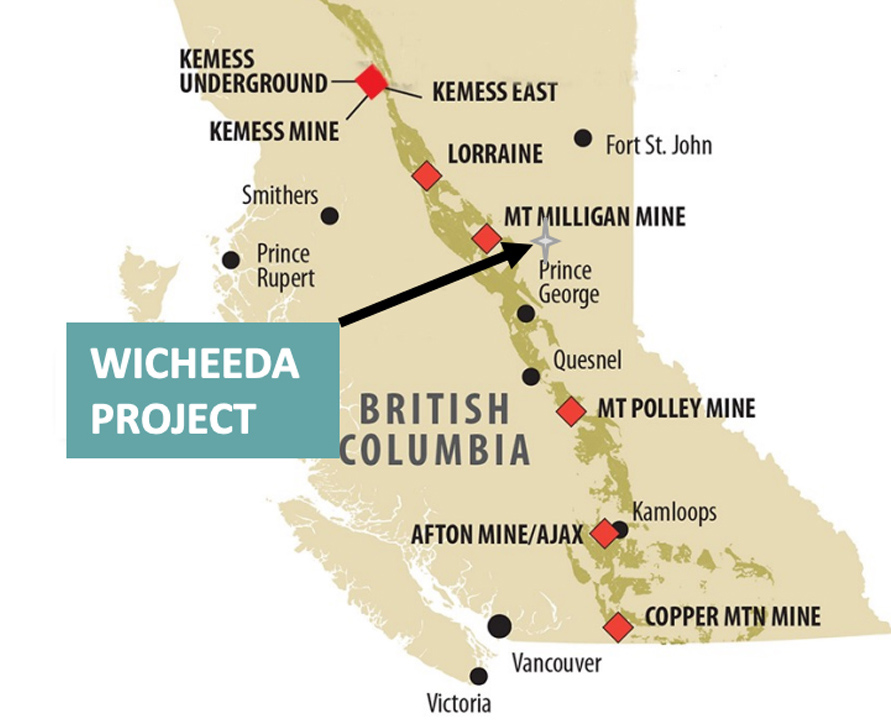

In December, Alpha also completed its drilling program at its Okeover project in British Columbia with the goal of reconfirming historical drilling data as the company pushes toward updating and publishing a new resource this year.

Assays are expected back for those drilling results as soon as February.

Just last month, Alpha closed on its acquisition of CAVU Energy Metals Corp. (CAVU:CSE; CAVVF:OTC; 5EO:FSE), which brought the Star and Hopper projects.

Star is a multi-target copper-gold porphyry project in the Golden Triangle with 106.98 meters graded at 0.77% Cu in one hole. Over 13,000 meters of modern drilling have been completed there, and it is fully permitted for 200 drill sites until 2026.

Hopper is a 74-kilometer multi-target porphyry copper-molybdenum project in the Yukon with “significant copper-gold-silver peripheral skarn mineralization,” Alpha said. The best intercept there has been 22.28 meters at 1.405% Cu.

“These could be multibillion-pound copper deposits,” Jones said.

CAVU was “well-positioned” before the purchase to make a significant copper discovery, Red Cloud Securities analyst Taylor Combaluzier wrote Aug. 11.

“We believe the company stands to benefit from the global trend toward electrification, which will require increased copper production to meet the demands of the worldwide green economy,” Combaluzier wrote about CAVU before the sale.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Alpha Copper Corp. (ALCU:CSE;ALCUF:OTC)

About 85% of the company is held by insiders and the rest is retail, Alpha said.

Top shareholders include Mango Research & Management Inc., which holds 2.49%; the CEO Jones, who holds 1.54%; and Daniel Matthews, who owns 1.11%, according to Reuters.

The company has about 52 million shares outstanding, 48.9 million of them free-floating, with a market cap of CA$11.7 million. It trades in a 52-week range of CA$1.09 and CA$0.19.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Alpha Copper Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.