Huge news came out from Bion Environmental Technologies Inc. (BNET:OTCQB) last Monday! They announced a letter of intent to develop a 45,000- head sustainable beef project with Olson Farms/TD Angus. I was in the middle of writing an article about Bion and why I think they are a great buy when this news came out. So, I am going to carry on, but now with even higher expectations.

Bion Technologies and Walmart

What really sticks out to me about their latest announcement is how it ties Bion to Walmart. The company has been careful with its words, but you don’t have to look very deep to see the connection.

Bion is now planning a 45k head project with Olson Farms/TD Angus. It is worth noting that Olson Farms/TD Angus is a founding member of Sustainable Beef, LLC, with a rancher-owned, US$325 million packing plant being developed in North Platte, NE. Walmart Inc. (WMT:NYSE) just announced an equity investment to buy a minority stake in Sustainable Beef, LLC.

Connecting the dots seems pretty easy here. It looks like Walmart is showing that they have sufficient demand for a premium product and want to secure its distribution.

In late September, Bion added Bill Rupp to its Advisory Group; he also happens to be a principle of Sustainable Beef, LLC., a former president at Cargill and JBS, two of the world’s top three meat packers.

Demand

Fun Fact: In 2021, Walmart US did US$4.1 billion in beef sales, and Walmart Mexico did US$321 million in beef sales. That is just under 6 million cattle being sold through Walmart alone.

Before the announcement, Bion already had plans for one 15,000-head sustainable beef project with Ribbonwire Ranch, and the economics of it are impressive!

Most investors are familiar with the meteoric rise (and subsequent fall) of plant-based meat companies over 2021 and 2022.

I believe the lesson to be learned from it is two-fold, there is a great demand for alternatives to current farming practices, and there is still a massive demand for animal proteins. A recent survey by Midan Marketing showed that 62% of American consumers purchase premium beef.

The global demand for beef cattle is 1.1 billion, with 90 million of that being in the U.S.

BION is effectively creating a new premium niche, sustainable beef. Their system turns environmental liabilities into agricultural assets. It greatly reduces environmental damage, provides economic benefits to farmers, and also provides benefits to the end consumer.

The Problem

The problem with traditional feedlot systems is the intensity. They place cows in massive outdoor feedlots for up to 3 months of ‘finishing.’ The waste from these cows is spread untreated onto fields and leads to nitrate contamination in groundwater, toxic algae blooms, and increases phosphorus in the soil. The methane, ammonia, and NOX from the cattle is also released into the air. This is an environmental disaster on its own, but the practice also increases pathogens and antibiotic resistance in cattle.

Bion has the Solution

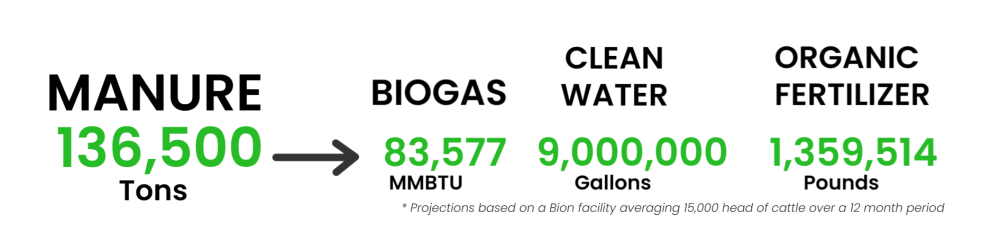

Bion Environmental Technologies specializes in developing advanced technology for treating livestock waste. In plain English, they take animal poop and turn it into money. They process the waste back into biogas, clean water, and fertilizer. The image below shows what the annual waste from 15,000 cattle becomes with their process.

The BION system can work will all sorts of livestock, but since their current agreements are cattle based, that is what I’ll focus on.

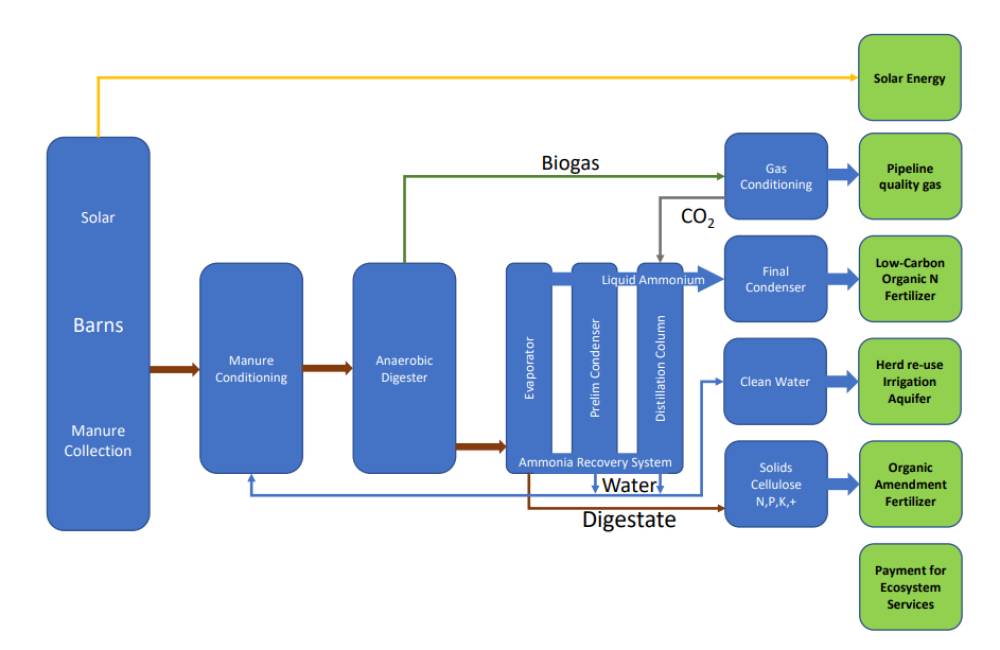

Their system includes large, covered barns that protect the animals from the elements. The system utilizes with solar-powered lighting, manure conditioning and collection, biogas upgrading and recovery, ammonia capture and manufacturing of organic fertilizer products, and clean water recovery.

All operations will be third-party validated, USDA-certified, and blockchain-recorded, resulting in a premium product that is transparent, sustainable, and has significantly lower environmental impacts on air, water, and land.

Project Economics

Before the announcement, Bion already had plans for one 15,000-head sustainable beef project with Ribbonwire Ranch, and the economics of it are impressive! (The Ribbonwire agreement is for one 15k head module, with an option for another three. The following numbers are based on one module.)

Clive Maund suggested that Bion was building up to a major bull market.

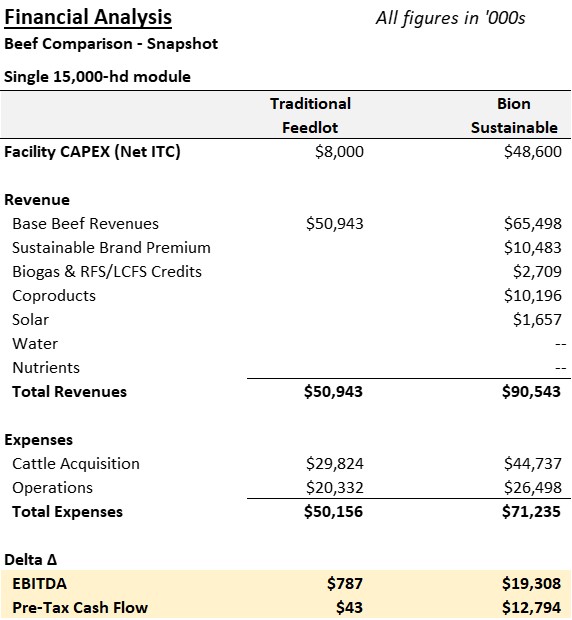

The following image is taken from their investor deck. It shows the breakdown for a 15,000-head system, including both organic and sustainable beef. The capital costs are much higher for the BION system, coming in at 42.9 million dollars each, compared to US$8 million for an outdoor feedlot.

It does not take long for a return on the investment due to the multiple income streams and higher margins.

A traditional feedlot is estimated to bring in less than half the revenue. The beef industry is a low-margin world and doubling your revenue is a dream come true for farmers.

Projects and Partnerships

Take that last analysis and triple it! Three of Bion's 15,000-head modules will make up the Olson Farms/TD project.

Construction is expected to start in the second half of 2023, with a definitive joint venture in early 2023. By the end of 2024, early beef and coproduct earnings are anticipated, and in 2025, production might reach up to 135,000 head annually.

Showcase

Both the Ribbonwire Ranch and Olson Farms projects will serve as a sort of showroom for other cattle farmers. I expect to see significantly increased demand for their systems after a successful launch of either project.

Blockchain

Another element that I think is worth reviewing is the blockchain tracking system. I will admit to not being a fan of cryptocurrency, but if there is one good thing to come out of crypto, it is the blockchain.

I see BION being a steady grower over the next few years.

The ability to store information immutably on the blockchain provides a number of food safety protections and allows consumers to know that if they are buying organic or sustainable products, they are really getting what they paid for.

In the event of a food recall, there will be no doubt as to what products are potentially bad. This is a huge cost savings for retailers. Often there is a recall, and they just offer refunds for anything bought between certain dates. With blockchain, they could simply say, “products ending in 4232 need to be returned,” or something of the like.

Analyst Targets

Back in July, Clive Maund suggested that Bion was building up to a major bull market. It was trading at US$1.05 when he said that, and today’s price of US$1.45 seems to point to the same thing. This technology is gaining traction. The stock price is gaining traction.

A few months ago, I was able to find a report by Jeff Campbell, former analyst with Alliance Global, who gave a price target of US$3 back in August. This price target was only included the Ribbonwire deal and did not include the recent deals.

I have not given enough time or words to the environmental benefits or potential tax credits that could be involved. I see BION being a steady grower over the next few years. These projects take time to develop, but it is hard to deny that they are gaining momentum. I am hoping to see additional deals in the coming months.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

PennyQueen Disclosures

I have not and will not be compensated for this report in any way. I write reports on my favorite picks; this is meant to be educational and not investment advice, as I am not an investment advisor, just a mom on a mission to make the world better and make money along the way.

Disclosures

1) PennyQueen: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Bion Environmental Technologies Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Bion Environmental Technologies Inc. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Bion Environmental Technologies Inc., a company mentioned in this article.