Key Points

Gold

- Gold trades above US$1880.

- Not long now before US$1900.

- Gold in Euros, Yen, and Pounds looking to move up sharply

- Could we see new all-time highs above US$2100 VERY early in 2023?

- Gold has started Wave 3

Gold Stocks

- XAU over 132

- 135 very soon

- 165, not far away.

- ASX gold stocks breaking out

Copper

- Breaking out above US$4/lb

- Exceeding that LT resistance at US$4/lb

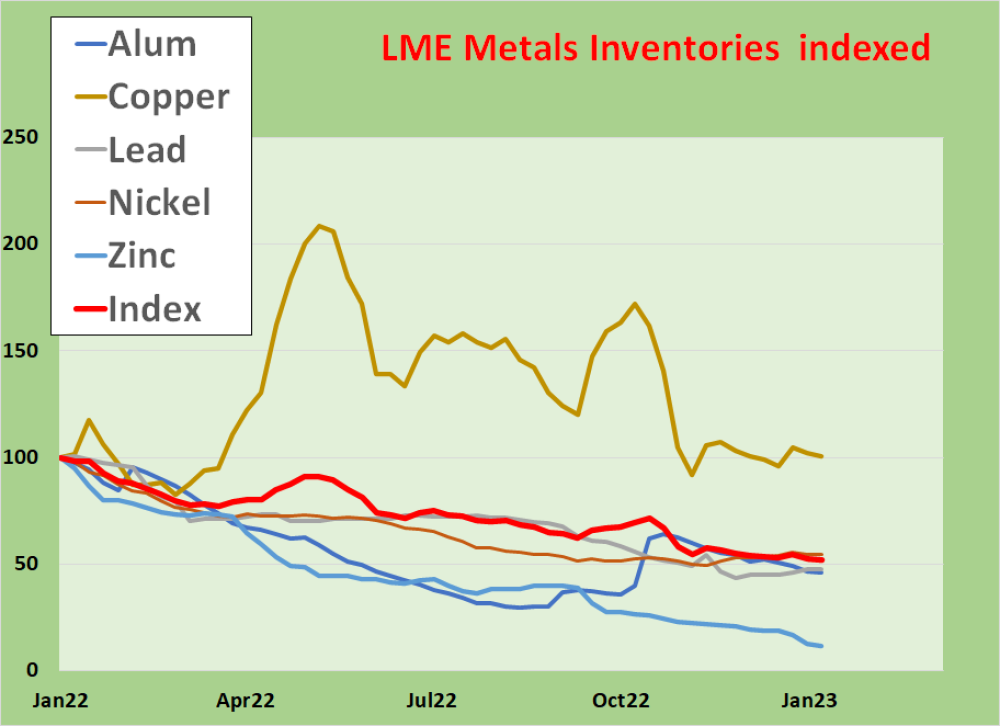

- NO INVENTORY!

- Copper back to 2022 inventory level lows

- Zinc LME inventories down by 87% in past year

- Got DVP?

- Its got Copper

- And Zinc!

Bonds

- Yields down again

- Prices rally

DVP Copper and Zinc

- Woodlawn

- Sulphur Springs

- Mining contracting

- Market cap ~A$750m @ A$3.40 on 220m shares (diluted)

ICL – Extraordinary WA Explorer

- 8 major targets

- 14 >1000m geochem anomalies

- Gold nuggets confirm nearby sources

- Market cap A$ 24m @ A$0.115 on 208m shares

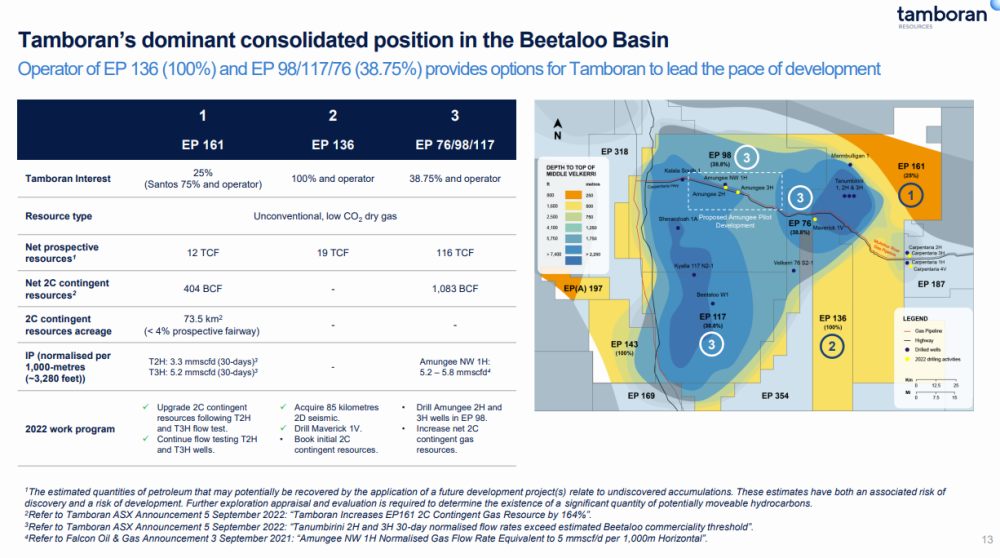

TBN - Extraordinary NT Gas Developer

- Amungee AH2 horizontal well completed

- Fraccing to commence after current wet period

- Market cap A$ 353m @ A$0.25 on 1,416m shares

Gold

Gold traded higher through US$1880 and held US$1870.

US$1870 is important long term resistance should now be support. US$1900 is now very close so could be much higher over the next few weeks.

Gold Stocks

135 resistance is only 2% away. And it should not last long before gold stocks overcome it and head straight for 165.

Bonds

- Yields decline further.

- Bond rally to continue for a while yet.

ASX Gold's index is breaking.

Copper

- breaks out above US$4/lb

US$4/lb is important Long Term resistance. Breaking that brings much higher prices.

NO LME INVENTORY!

- Index at another 12 month low

- Copper near 12 month low

- Zinc down 88%!!!!

Zinc is about to break out.

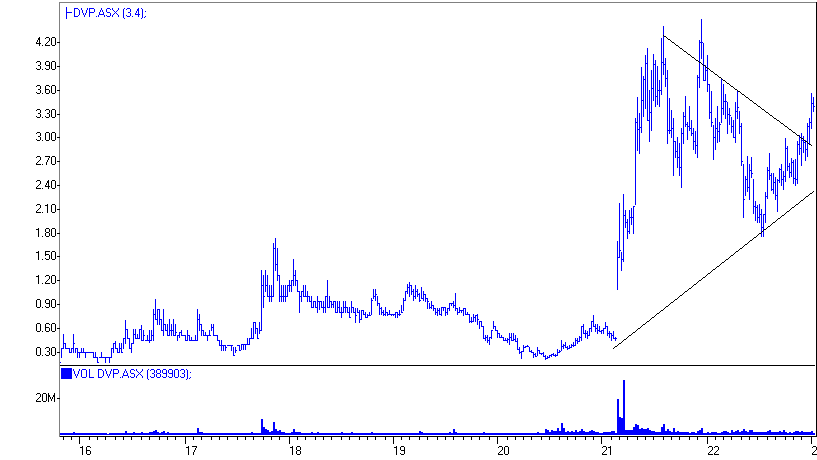

Got DVP?

- Woodlawn

- Sulphur Springs

- Mining contracting

- Market cap ~A$750m @ A$3.40 on 220m shares (diluted)

- Copper and Zinc!!

4

4

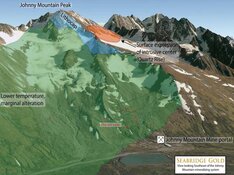

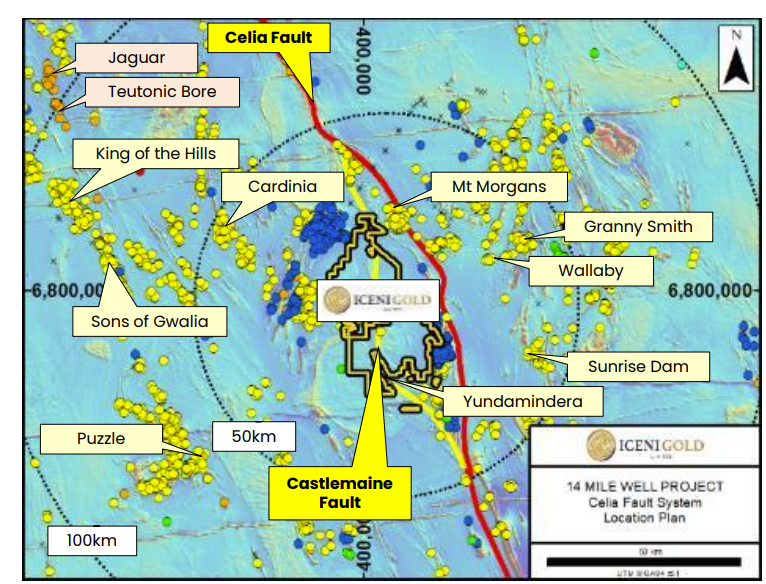

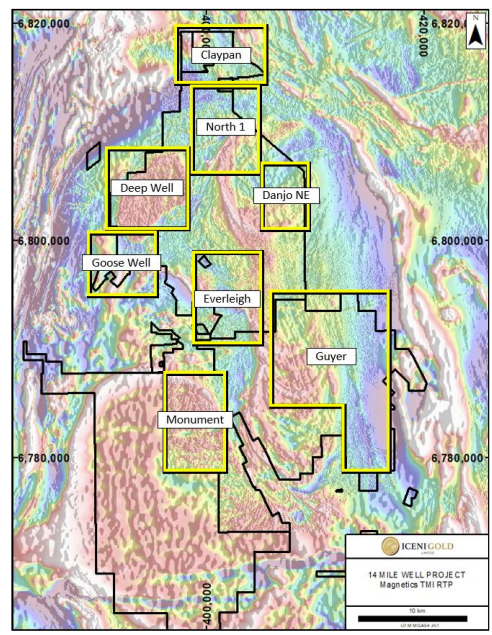

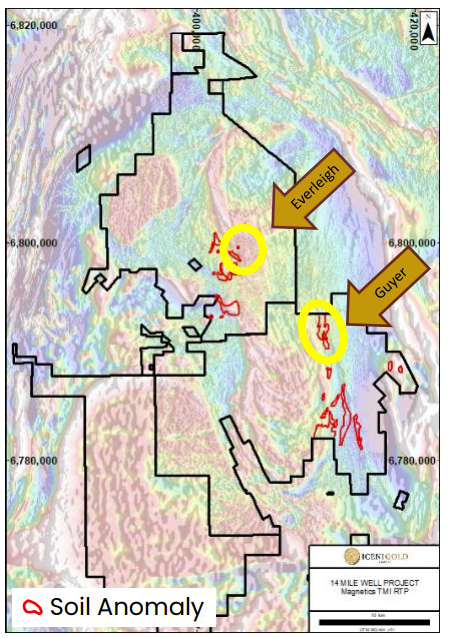

ICL Extraordinary Explorer

- 14 Mile Well Project - west of Laverton

- In elephant country

- Highlighting Celia Fault

- Castlemaine and Guyer Fault splays

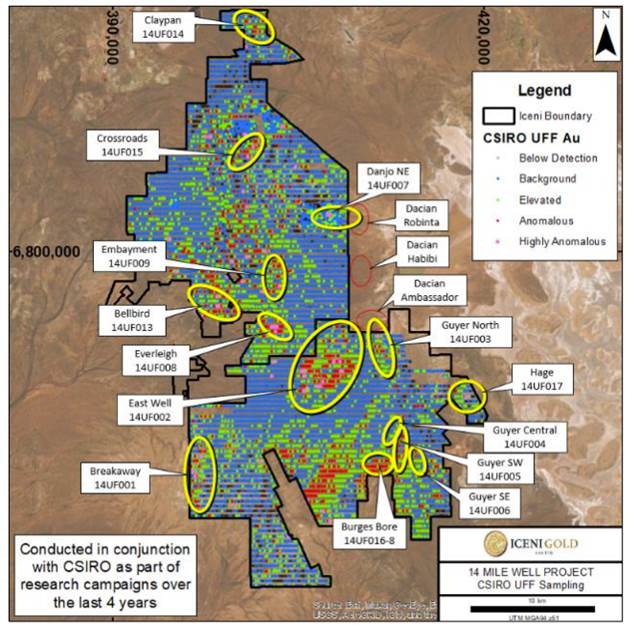

- Numerous CSIRO UFF+ geochem anomalies

- Nuggets in paleochannels confirming gold potential.

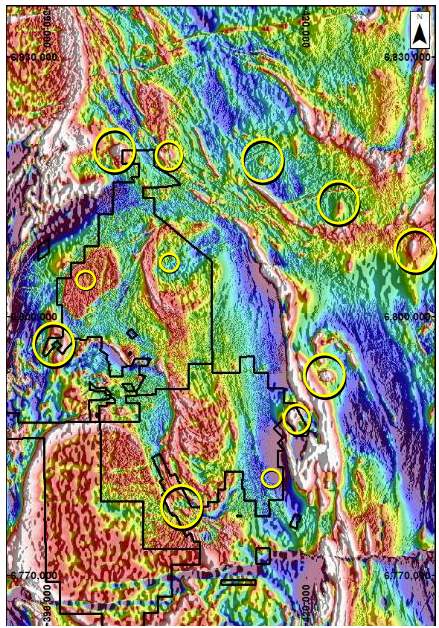

- Syenite intrusions as gold conduits and hosts

- Yet another target found at Goose Well

- Market cap A$ 24m @ A$0.115 on 208m shares

14 Mile Well Project – On West Side of Celia Fault

- An early stage explorer with a difference

- Economic gold deposits will be found!

- >800km2 almost previously unexplored

Eight major target areas . . . and counting.

14 geochem anomalies identified using CSIRO UFF+ technology. All over 1000m - up to 5000m.

Syenite intrusions (host of several nearby major gold deposits/mines) identified on tenements.

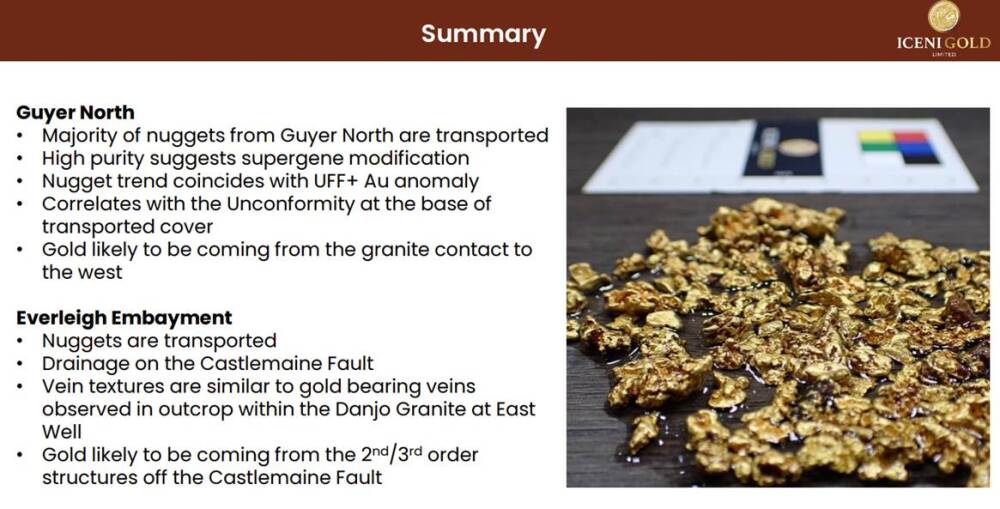

Most Advanced Projects

- Everleigh Well

- Guyer

Drilling has confirmed gold presence. Numerous nuggets in paleochannels.

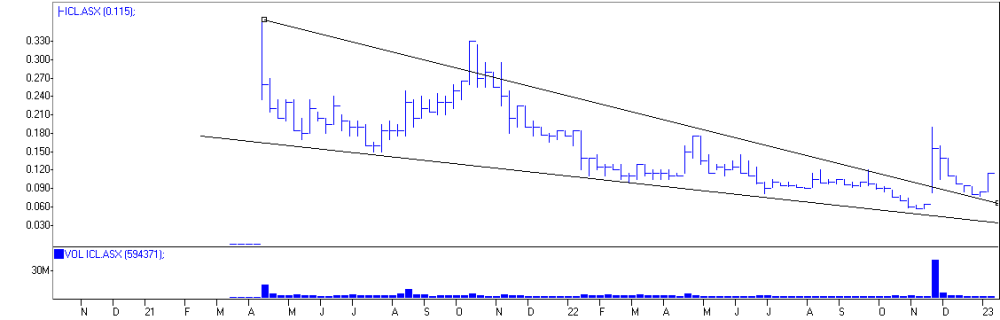

ICL

This is developing into something special

-

Downward sloping wedge

-

Break out

-

Backtest

- Surging

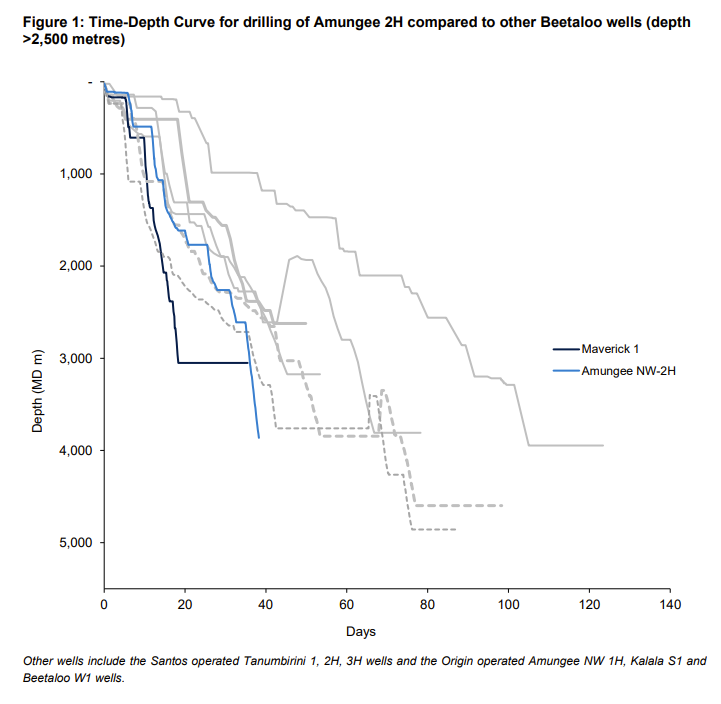

TBN - Tamboran Resources

Development of Beetaloo Basin

- Amungee 2H drilling complete

- 2413m vertical depth

- 1275m horizontal section

- Drilling completed in December in 38 days and under budgeted cost and time

- 5 1/2 inch casing will allow higher sand and fluid input rates and higher gas outflow volumes

- 24 stages planned for fraccing

- Awaiting weather clearing to mobilize fraccing fleet in March Qtr

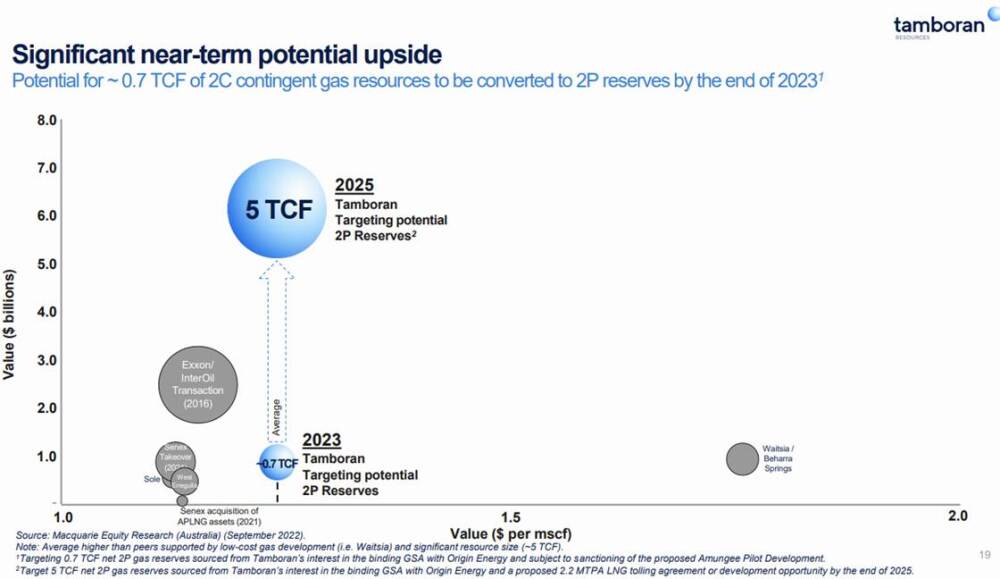

- 5TCF 2P reserves targeted for 2025 worth A$6bn

- Market cap A$ 353m @ A$0.25 on 1,416m shares

TBN has successfully drilled its two operated wells much faster than Santos and Origin. Faster wells are cheaper wells (daily rig rate cost)

- 5 1/2 inch casing will allow higher sand and fluid input rates and higher gas outflow volumes

- 5 1/2 inch casing has a 22% larger diameter than 4 1/2 inch but has a 50% higher diameter area.

Net Undiscovered Prospective Resources 116TCF

TBN - Also Developing into Something Special

- Downward sloping wedge

- Break out

- Backtest

- Moving higher

Opportunity is knocking. Timing is everything.

Want to be the first to know about interesting Gold, Critical Metals, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Disclosures:

1) Barry Dawes: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.