Alpha Copper Corp. (ALCU:CSE;ALCUF:OTC) has finished its 2,000-meter drilling campaign to verify existing mineralization at its Okeover project in British Colombia, the company announced.

Alpha and other explorers are rushing to get new resources extracted as copper (Cu), “the metal of electrification,” is essential to the new green economy.

Copper Demand Rising

Technologies critical to this massive lane switch, such as electric vehicles (EVs), the infrastructure for charging them, solar cells, and batteries all require much more of the red metal than fossil fuel-based counterparts, according to a recent report from S&P Global, “The Future of Copper.”

“Meanwhile, copper continues to be a critical material for many other sectors of the economy not directly related to the energy transition but fundamental to overall economic growth and development, and from which copper consumption is projected to grow continuously,” the report said. “The result of the energy transition growth on top of traditional growth will be an overall more than doubling of copper demand by 2050.”

EVs, as they are now, wouldn’t exist without copper; they use at least three times as much of it as cars with internal combustion engines.

“The chronic gap between worldwide copper supply and demand projected to begin in the middle of this decade will have serious consequences across the global economy,” the report said. “In the 21st century, copper scarcity may emerge as a key destabilizing threat to international security. Projected annual shortfalls will place unprecedented strain on supply chains.”

The Catalyst: Pushing Toward a New Resource

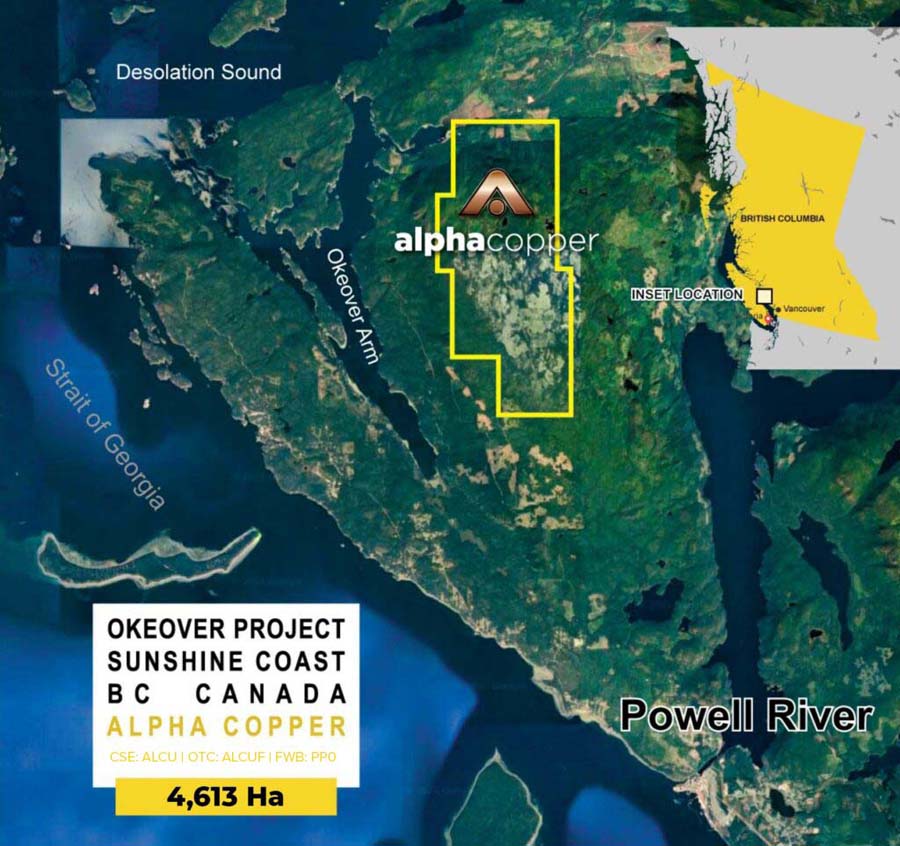

Alpha Copper President and Chief Executive Officer Darryl Jones said the drilling program at the 4,613-hectare Okeover project was finished in December 2022. Its goal was to reconfirm historical drilling data at the North Lake Zone as the company pushes toward updating and publishing a new resource this year.

“Hole 4 looked very promising from 330 meters to 600 meters, as it showed us a different type of mineralization which would set up for a deeper extension of the known historic resource,” Jones told Streetwise Reports.

Historically, the hole intercepted 76 meters grading 0.34% Cu and 0.020% molybdenum disulfide (MoS2), including 19 meters grading 0.42% CU and 0.020% MoS2.

North Lake is just one of seven zones of mineralization on the property, the company said.

Alpha also noted it had purchased 100% interest in an additional small Okeover claim in consideration for 20,000 common shares of the company.

Assays are expected back for the drilling results as soon as February.

‘We’re Going to Have Our Hands Full’

In addition to updating the NI 43-101 resource for Okeover, the company also has a big year ahead of it with its other projects, both old and new.

Its British Columbia properties also include Indata, which is close to Northwest Copper’s Kwanika and Stardust discoveries. Historical drilling includes 148 meters grading 0.20% Cu, including 24.1 meters grading 0.37% Cu, the company said. Assays from Indata are also expected soon.

Just last month, Alpha closed on its acquisition of CAVU Energy Metals Corp. (CAVU:CSE; CAVVF:OTC; 5EO:FSE), which brought the Star and Hopper projects.

Star is a multi-target copper-gold porphyry project in the Golden Triangle with 106.98 meters graded at 0.77% Cu in one hole. Over 13,000 meters of modern drilling have been completed there, and it is fully permitted for 200 drill sites until 2026.

Hopper is a 74-kilometer multi-target porphyry copper-molybdenum project in the Yukon with “significant copper-gold-silver peripheral skarn mineralization,” Alpha said. The best intercept there has been 22.28 meters at 1.405% Cu.

“These could be multibillion-pound copper deposits,” Jones said. “We’re obviously very excited . . . We’re going to have our hands full with all four of these projects.”

The new company will be “a large, well-funded new entity with four copper assets in B.C. and the Yukon (Territory),” Red Cloud Securities said in its Rocks Daily newsletter last month.

“We believe the company stands to benefit from the global trend toward electrification, which will require increased copper production to meet the demands of the worldwide green economy,” Combaluzier wrote about CAVU.

Even before the purchase, CAVU was “well positioned to potentially make a significant copper discovery,” wrote Red Cloud Securities analyst Taylor Combaluzier in a note on Aug. 11.

“We believe the company stands to benefit from the global trend toward electrification, which will require increased copper production to meet the demands of the worldwide green economy,” Combaluzier wrote about CAVU.

And it will require a lot of it, according to the S&P report. Global refined copper demand is projected to almost double from just over 25 million metric tons (Mmt) in 2021 to nearly 49 Mmt in 2035.

“The world has never produced anywhere close to this much copper in such a short time frame,” the report said.

Ownership and Share Structure

Top shareholders include Mango Research & Management Inc., which holds 2.49% or 1.3 million shares; the CEO Jones, who holds 1.54% or 800,000 shares, and Daniel Matthews, who owns 1.11% or 580,000 shares, according to Reuters.

The company has about 52 million shares outstanding, 48.9 million of them free-floating, with a market cap of CA$10.66 million. It trades in a 52-week range of CA$1.09 and CA$0.19.

| Want to be the first to know about interesting Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Alpha Copper Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.