Key points

Gold

- Gold trades above US$1880.

- Not long now before US$1900.

- Gold in Euros, Yen, and Pounds looking to move up sharply

- Could we see new all-time highs above US$2100 VERY early in 2023?

- Gold has started Wave 3

Gold Stocks

- XAU over 132

- 135 very soon

- 165, not far away.

- ASX gold stocks breaking out

Copper

- Breaking out above US$4/lb

- Exceeding that LT resistance at US$4/lb

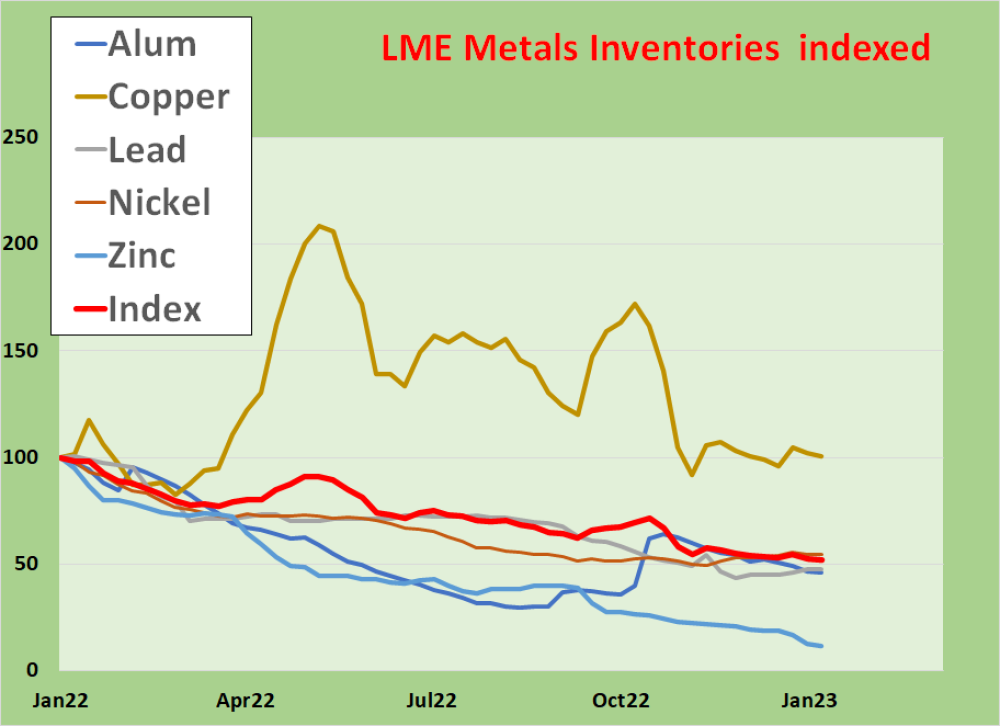

- NO INVENTORY!

- Copper back to 2022 inventory level lows

- Zinc LME inventories down by 87% in past year

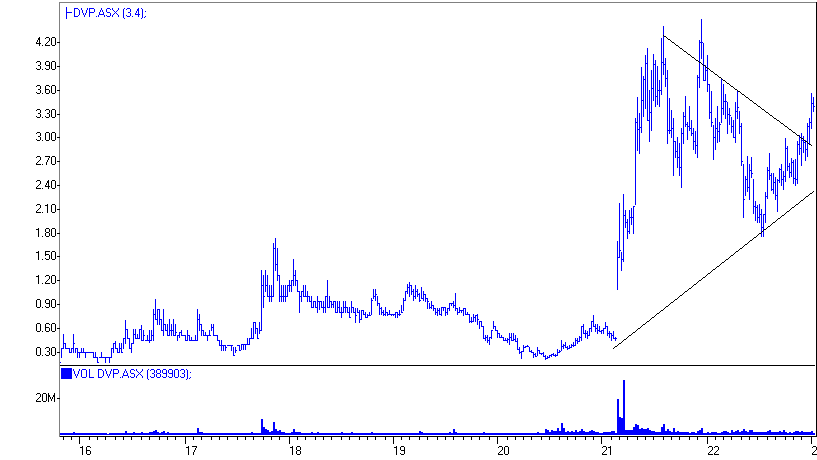

- Got DVP?

- Its got Copper

- And Zinc!

Bonds

- Yields down again

- Prices rally

DVP Copper and Zinc

- Woodlawn

- Sulphur Springs

- Mining contracting

- Market cap ~A$750m @ A$3.40 on 220m shares (diluted)

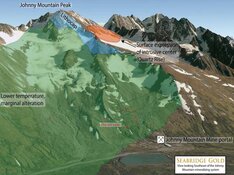

ICL – extraordinary WA explorer

- 8 major targets

- 14 >1000m geochem anomalies

- Gold nuggets confirm nearby sources

- Market cap A$ 24m @ A$0.115 on 208m shares

TBN - extraordinary NT gas developer

- Amungee AH2 horizontal well completed

- Fraccing to commence after current wet period

- Market cap A$ 353m @ A$0.25 on 1,416m shares

Gold

Gold traded higher through US$1880 and held US$1870.

US$1870 is important long term resistance should now be support. US$1900 is now very close so could be much higher over the next few weeks.

Gold Stocks

135 resistance is only 2% away. And it should not last long before gold stocks overcome it and head straight for 165.

Bonds

- Yields decline further.

- Bond rally to continue for a while yet.

ASX Gold's index is breaking.

Copper

- breaks out above US$4/lb

US$4/lb is important Long Term resistance. Breaking that brings much higher prices.

NO LME INVENTORY!

- Index at another 12 month low

- Copper near 12 month low

- Zinc down 88%!!!!

Zinc is about to break out.

Got DVP?

- Woodlawn

- Sulphur Springs

- Mining contracting

- Market cap ~A$750m @ A$3.40 on 220m shares (diluted)

- Copper and Zinc!!

4

4

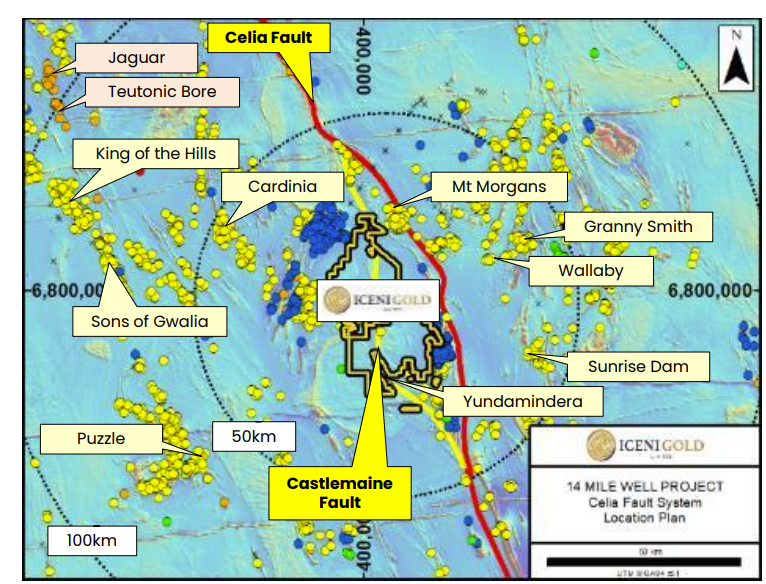

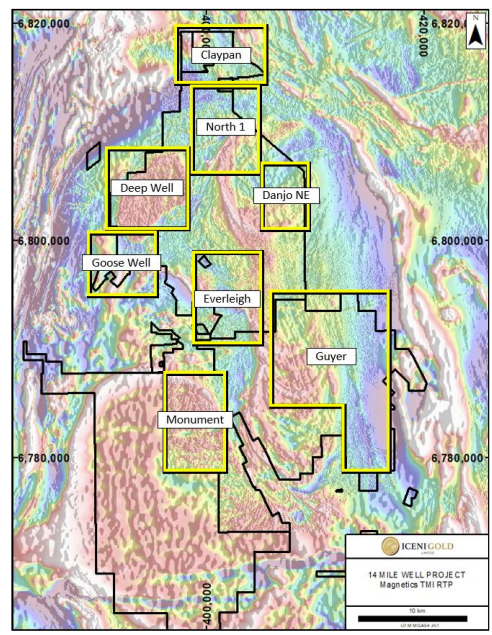

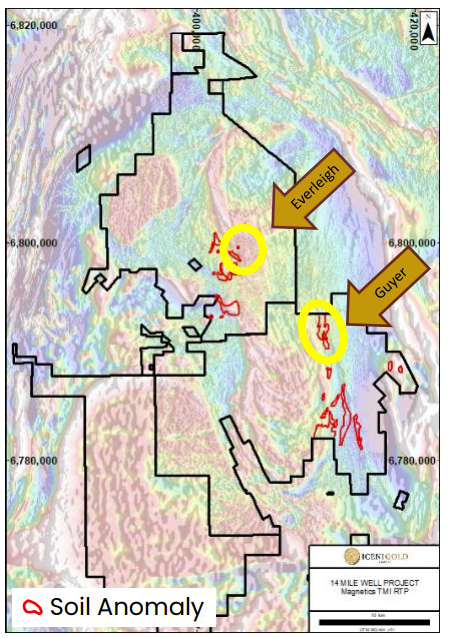

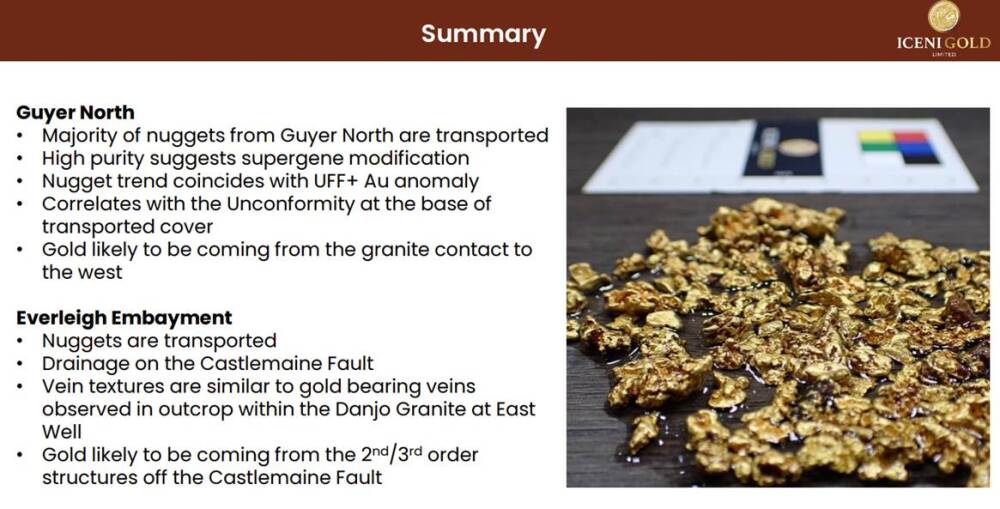

ICL Extraordinary Explorer

- 14 Mile Well Project - west of Laverton

- In elephant country

- Highlighting Celia Fault

- Castlemaine and Guyer Fault splays

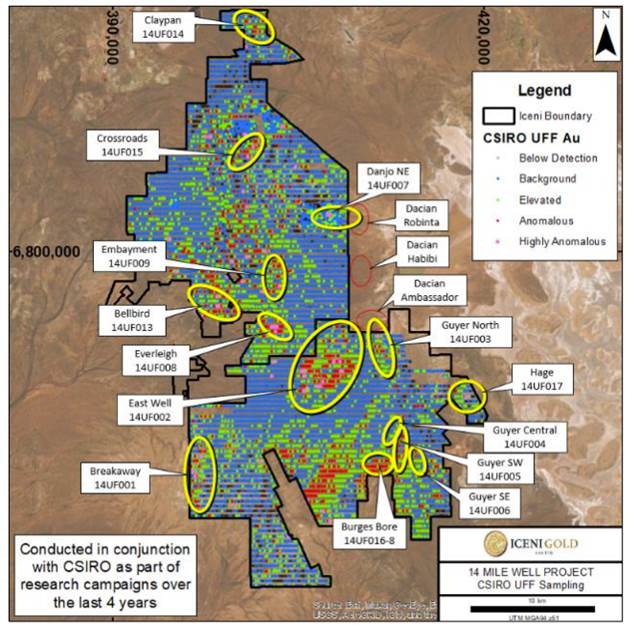

- Numerous CSIRO UFF+ geochem anomalies

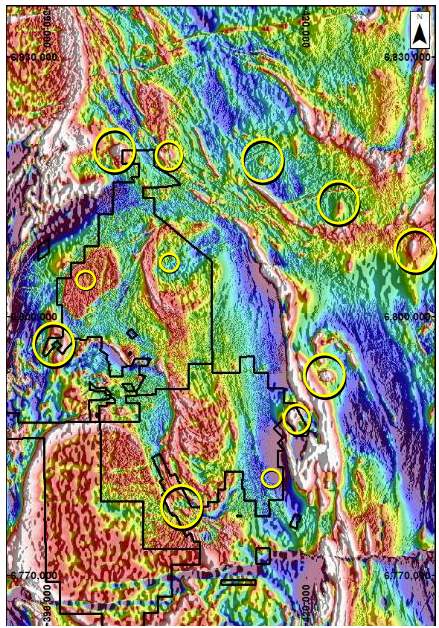

- Nuggets in paleochannels confirming gold potential.

- Syenite intrusions as gold conduits and hosts

- Yet another target found at Goose Well

- Market cap A$ 24m @ A$0.115 on 208m shares

14 Mile Well Project – On West Side of Celia Fault

- An early stage explorer with a difference

- Economic gold deposits will be found!

- >800km2 almost previously unexplored

Eight major target areas . . . and counting.

14 geochem anomalies identified using CSIRO UFF+ technology. All over 1000m - up to 5000m.

Syenite intrusions (host of several nearby major gold deposits/mines) identified on tenements.

Most advanced projects

- Everleigh Well

- Guyer

Drilling has confirmed gold presence. Numerous nuggets in paleochannels.

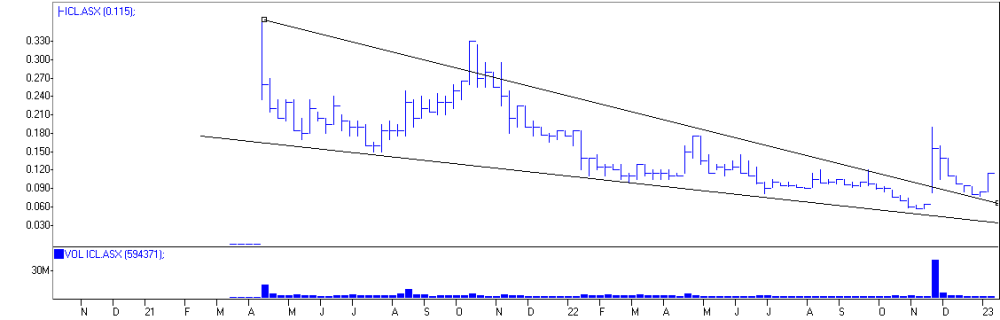

ICL

This is developing into something special

-

Downward sloping wedge

-

Break out

-

Backtest

- Surging

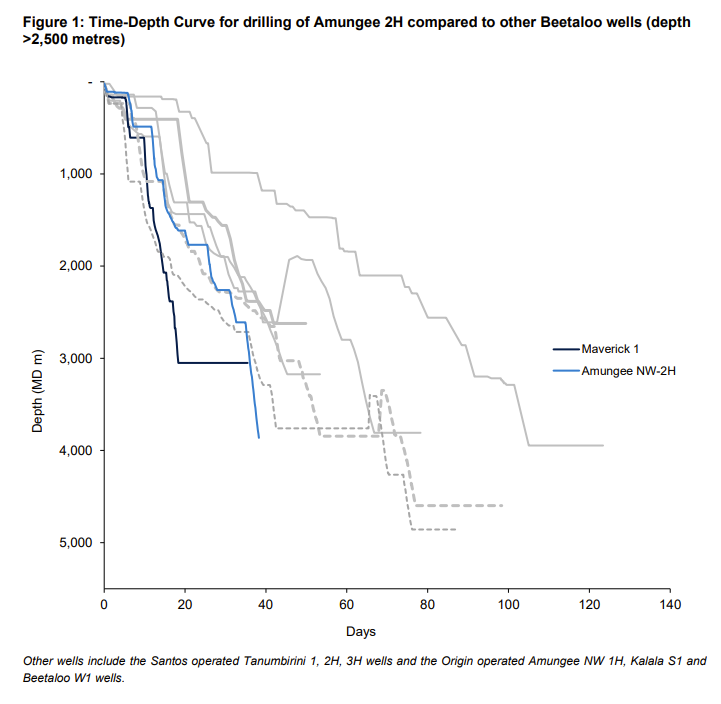

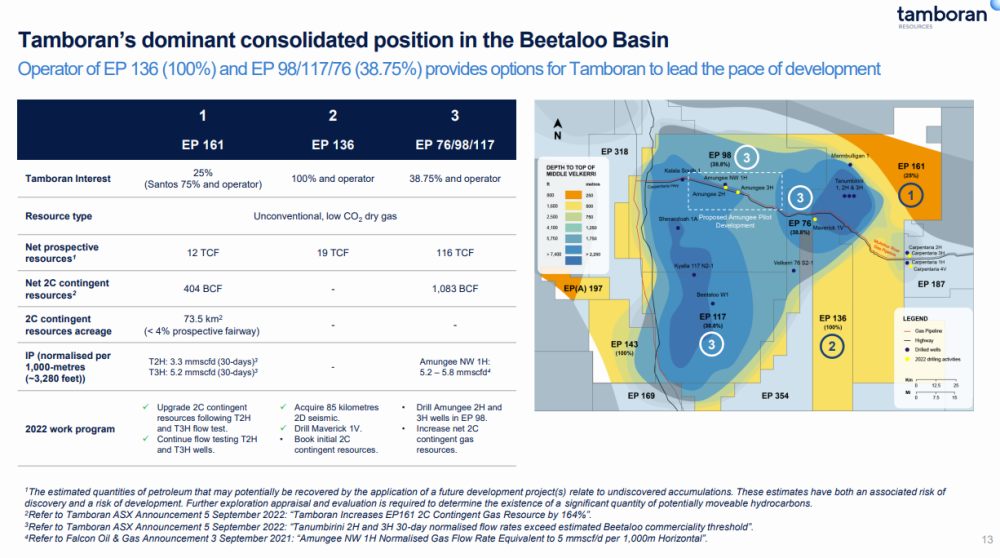

TBN - Tamboran Resources

Development of Beetaloo Basin

- Amungee 2H drilling complete

- 2413m vertical depth

- 1275m horizontal section

- Drilling completed in December in 38 days and under budgetted cost and time

- 5 1/2 inch casing will allow higher sand and fluid input rates and higher gas outflow volumes

- 24 stages planned for fraccing

- Awaiting weather clearing to mobilise fraccing fleet in March Qtr

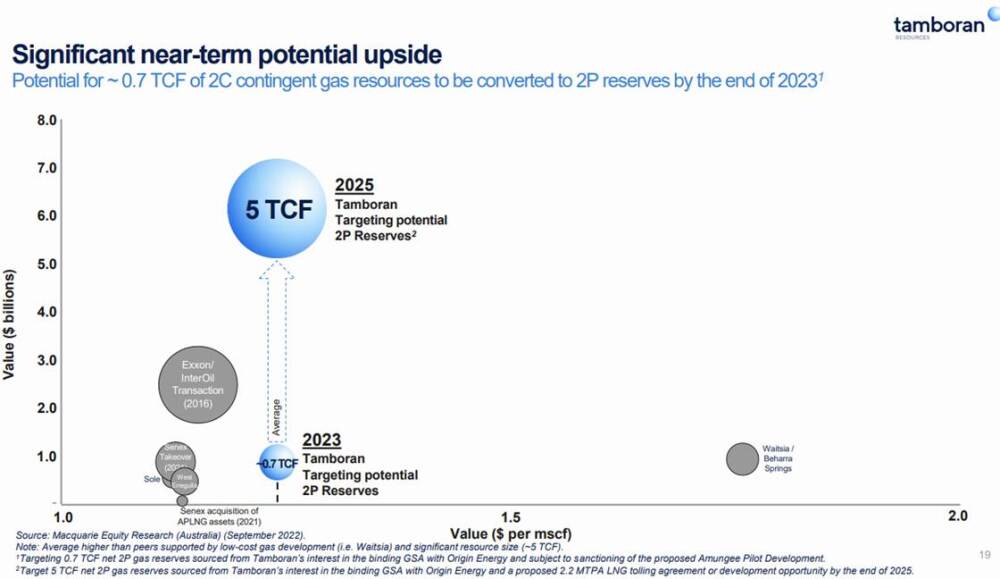

- 5TCF 2P reserves targeted for 2025 worth A$6bn

- Market cap A$ 353m @ A$0.25 on 1,416m shares

TBN has successfully drilled its two operated wells much faster than Santos and Origin. Faster wells are cheaper wells (daily rig rate cost)

- 5 1/2 inch casing will allow higher sand and fluid input rates and higher gas outflow volumes

- 5 1/2 inch casing has a 22% larger diameter than 4 1/2 inch but has a 50% higher diameter area.

Net undiscovered prospective resources 116TCF

TBN - Also developing into something special

- Downward sloping wedge

- Break out

- Backtest

- Moving higher

Opportunity is knocking. Timing is everything.