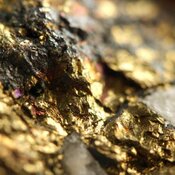

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) announced in a press release that it has several milestones to look forward to in 2024, as well as reflecting on the company’s performance in 2023. Perpetua reported that it is looking to continue development of Stibnite gold project, and that the company is looking to move forward with permitting considering the National Environmental Policy Act.

Perpetua reports several encouraging points of performance information, including no environmental spills or lost-time incidents, the appointment of a vice-president of projects, and the settlement under the Clean Water Act with the Nez Perce Tribe. Additionally, the company reports that it secured US$15.5 million in funding from the Department of Defense, and that it has completed preconstruction planning, scheduling, and early action restoration work on the project. Lastly, the company received 15,000 letters of support during a 75 day comment period regarding the environmental impact statement.

Laurel Sayer, the President and CEO of the project, commented, “Perpetua Resources accomplished several significant milestones in 2023 as we progress towards the next phase for the Stibnite gold project. We secured additional funding through the Department of Defence, completed preconstruction planning and scheduling for the project, strengthened our board and leadership team, and continued to advance our environmental goals. I believe our recent achievements further strengthen the Stibnite gold project’s strategic value to U.S. critical mineral development, and we look forward to a record of decision in 2024.”

Gold and Battery Metals Well Positioned for 2024

Rick Mills of Ahead of the Herd released a report on December 19, 2023, focused on battery metals. According to Mills, critical metals are seeing demand outpace supply as the world looks to transition to green energy infrastructure. Given that supply cannot currently meet the needs of the market, the industry is currently looking at recycling existing materials in addition to locating additional reserves and alternative sources.

In addition to antimony, Perpetua is also involved in gold exploration on the Stibnite gold project. Stewart Thomson of 321 Gold reports that 2024 might be a good year for gold; Thomson stated, “In the coming year, will positions bought now rise to a juicy profit or not? The answer is most likely a resounding yes.”

Potential 129% Return

Mike Niehuser with ROTH Capital Partners reviewed the company on August 30, 2023, and rated it as a “buy” for potential investors with a target share price of US$7.25 and a potential return on investment of 129%.

Niehuser cited a number of factors in his positive assessment of the company, including a settlement with the Nez Perce tribe, the hiring of a specialist in mining development, and the classification of antimony as a critical mineral.

The company also has a number of catalysts to report, according to its investor presentation, including a Final EIS and Record of Decision expected in Q2 and Q4 of 2024, along with ancillary permits and project financing at the end of 2024 or in early 2025, and a construction decision in 2025.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ)

Reuters provided a breakdown of the company’s ownership and share structure, where management and insiders own approximately 0.37% of the company. According to Reuters, CFO Jessica Marie Largent owns 0.09% of the company with 0.06 million shares, Director Christopher James Robinson owns 0.08% of the company with 0.05 million shares, President and CEO Laurel Sayer owns 0.08% of the company with 0.05 million shares, VP of Permitting Alan Douglas Haslam owns 0.05% of the company with 0.03 million shares, Director David L. Deisley owns 0.02% of the company with 0.01 million shares, General Counsel L. Michael Bogert owns 0.02% of the company with 0.01 million shares, VP of External Affairs Mckinsey Margaret Lyon owns 0.01% of the company with 0.01 million shares, Director Robert Alan Dean owns 0.01% of the company with 0.01 million shares, and Human Resources Manager Tanya Dawn Nelson owns 0.01% of the company with less than 0.01 million shares.

Reuters reports that institutional investors own approximately 66.09% of the company, as Paulson & Co. Inc. owns 39.14% of the company with 24.77 million shares, Kopernik Global Investors, LLC, owns 8.30% of the company with 5.25 million shares, Sun Valley Gold, LLC, owns 7.51% of the company with 4.75 million shares, BlackRock Institutional Trust Company, N.A., owns 2.57% of the company with 1.63 million shares, Krilogy Financial, Inc., owns 2.38% of the company with 1.51 million shares, B. Riley Financial, Inc., owns 2.32% of the company with 1.47 million shares, Eidelman Virant Capital owns 1.51% of the company with 0.96 million shares, Franklin Advisors, Inc., owns 0.86% of the company with 0.54 million shares, Russell Investments Trust Company owns 0.76% of the company with 0.48 million shares, and Earth Resource Investment Group owns 0.74% of the company with 0.47 million shares.

According to Reuters, there are 63.27 million shares outstanding with 63.06 million free float traded shares, while the company has a market cap of CA$207.93 million and trades in the 52 week period between CA$3.32 and CA$7.32.

Want to be the first to know about interesting Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.