With the increase in environmental interests, a mining company's ESG has become quite important. This has led Troilus Gold Corp. (TLG:TSX; CHXMF:OTC; CM5R:FRA) to present a yearly sustainability report, and on December 12, 2022, the 2021 report was released.

Troilus Gold Corp. is a Quebec-focused, advanced-stage exploration and development company based in Toronto, Canada. The company focuses on the mineral expansion and potential mine-restarting of the former gold and copper Troilus mine.

Why Gold?

With inflation on the rise, investors are searching for sectors that can weather the storm, and in the investing world, gold is seen as a hedge against inflation. This could be one of the reasons gold demand has risen in 2022.

According to Reuters, "gold demand (excluding OTC) in Q3 was 28% higher y-o-y at 1,181t. Year-to-date demand increased by 18% versus the same period in 2021, returning to pre-pandemic levels."

Looking forward, Investor Intent touched on the company. They said, "it sounds like nothing but good news past, present, and future," and they commented that they believe the company is currently undervalued.

December 12, 2022, Adrian Day of Adrian Day Asset Management said, "We are, then, entering the sweet spot for gold," and the Troilus Gold Project is one of the largest undeveloped gold resources in Canada, and according to the company, positive PEA results show the potential for Troilus to rank among the top gold-producing Canadian mines.

DoubleLine Capital CEO Gundlach spoke on gold during a webcast and said he thinks gold has done well this year. He went on to say, "We were looking at it in dollar terms, and the dollar is still up pretty substantially this year, although it is off its highs. But gold appears to be stabilizing around its 200-day moving average."

Why is ESG Important?

ESG stands for environmental, social, and corporate governance. It is data collected to examine and explain the effects on the environment, society, and to corporate governance caused by a company. According to NASDAQ, "strong ESG practices can benefit companies and investors."

Stifel analyst Parkinson said, "Troilus Gold remains the cheapest company in our coverage universe. We rate it as a Buy."

In a 2019 article, Wall Street veteran Vikram Gandhi pointed out that he recognizes "that ESG isn’t a fad — it’s part of a long-term trend."

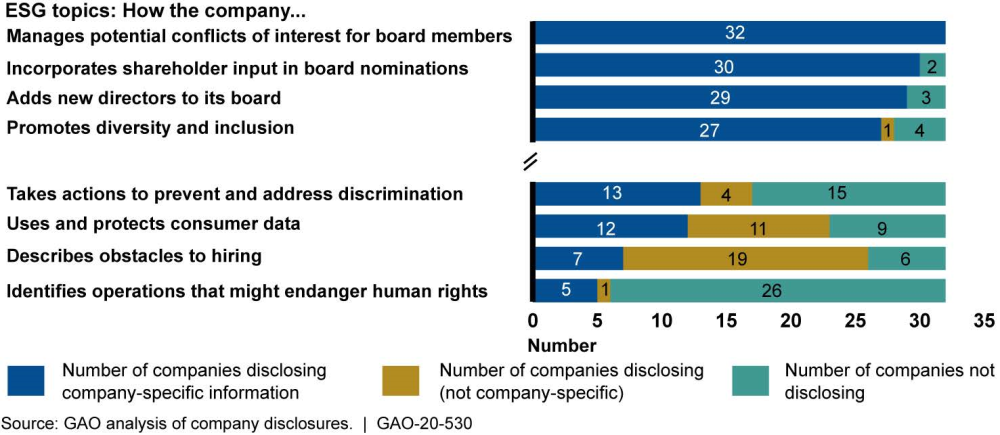

In 2020, the U.S. Government Accountability Office found that "most institutional investors GAO interviewed (12 of 14) said they seek information on environmental, social, and governance (ESG) issues to better understand risks that could affect company financial performance over time."

Now over 120 companies are currently using ESG. This is one of the reasons Troilus Gold Corp. implemented an annual sustainability report in 2020 and has continued to strive for ESG. The company's ESG Team releases this annual report with the leadership of the vice president of corporate affairs, Catherine Stretch.

Troilus Ahead of Peers

While ESG is being implemented by a lot of companies, Troilus is not simply jumping on the bandwagon.

In an April 2022 panel with The Crux Investor, Stretch pointed out the importance of ESG not just for the sake of public opinion or for a jump in Troilus' current stock, but for the longevity of mining.

She said when it comes to carbon neutrality, "it's not just looking for a blip in the market right now. We're looking ahead for potentially decades and how this will impact not only our shareholders but stakeholders in the region, how the land gets used."

Laurentian Bank's Jacques Wortman gave the company a Buy rating and a target price of CA$2.50, which was significantly higher than its CA$0.56 price at the time.

Stretch went on to point out that Troilus has easier access when implementing more sustainable policies as the mine is located in a more isolated region in Northern Quebec, and it is connected to the hydro grid to Hydro-Québec, which allows them current access to clean energy.

She said, "I think it puts us at a unique advantage compared to some of our peers." With this in mind, we can review the company's sustainability and prospects for the future.

2021 Sustainability Report

December 12, 2022, Troilus Gold Corp. officially released its 2021 Sustainability report.

Highlights of this report included:

- ~36% of full-time employees and 40% of the senior management team at Troilus were women.

According to Forbes, women currently only make up 15.7% of the mining industry workforce. This makes Troilus 129.299% above the average.

- 71% of the energy used at the Troilus site is derived from renewable hydroelectricity with the existing infrastructure to help power contemplated future production while minimizing GHG emissions and carbon footprint.

- 65% of Troilus’ total procurement spending went to suppliers from the local economy in Northern Quebec.

- Zero fatalities and zero work-related injuries resulted in lost time among employees and contractors at the site.

- Troilus had zero instances of non-compliance with environmental regulations.

CEO and Director of Troilus Justin Reid, commented, “We are pleased to share the positive progress of our ESG program as we continue to advance the Troilus project responsibly and upholding the highest standards when it comes to our corporate governance, our people, our communities, and the environment."

Catalyst: Feasibility Study

After discovering a new zone, hitting the highest grade yet, and returning with the best drill results yet at its Troilus gold project in Quebec's historic Val d'Or mining district, Troilus has decided to progress to the final feasibility study for the project due out in H2/23.

Troilus acquired the project in 2017. According to the company, since this acquisition, "the inherited indicated mineral resources have increased 142% to 4.96 Moz AuEq (177 Mt with an average grade of 0.87 g/t AuEq) and inferred mineral resources have increased 350% to 3.15 Moz AuEq (116.7 Mt with an average grade of 0.84 g/t AuEq)."

Stifel analyst Ian Parkinson commented on the upcoming feasibility study, saying it will include "the results of this drilling, which already points to a higher-grade profile for the project and will therefore likely affect mine sequencing decisions." This study will have the upcoming drill results as well.

Looking forward, Investor Intent touched on the company. They said, "it sounds like nothing but good news past, present, and future," and they commented that they believe the company is currently undervalued.

Analyst Coverage

Troilus is covered by a plethora of analysts, including Ian Parkinson, Jacques Wortman of Laurentian Bank, Brock Salier of Sprott Equity Research, and Pierre Vaillancourt of Haywood Securities.

On October 11, 2022, Parkinson said, "Troilus Gold remains the cheapest company in our coverage universe. We rate it as a Buy." Parkinson reiterated his Buy rating on November 16 after Troilus sold 1,824 noncore land claims in Northern Quebec to lithium miner Sayona Mining. Then Parkinson said he views "the transaction as a strong positive for Troilus as it gives them a significant cash injection and significantly reduces share dilution as they continue to explore and work towards a final feasibility study for the Troilus project expected in H2/23."

November 18, 2022, Jacques Wortman gave the company a Buy rating and a target price of CA$2.50, which was significantly higher than its CA$0.56 price at the time.

Click "See More Live Data" in the data box above to read more of what they are saying.

Ownership and Share Structure

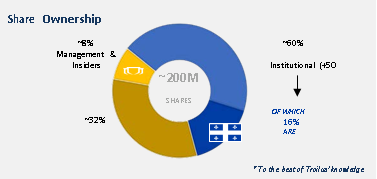

Approximentally 8% of Troilus' shares are owned by management and insiders. According to Reuters, CEO and Director Justin Reid owns 1.76% at 3.92 million shares.

60% are with institutions, and 32% are with retail. Of the institutions, the largest shareholder is Franklin Advisers Inc. at 12.18 million shares. Caisse de Depot et Placement du Quebec has 4.77% with 10.64 million shares. Sprott Asset Management LP has 3.34% at 7.45 million shares, and Ruffer LLP has 2.78% at 6.20 million shares.

As of FQ1 ending Oct 31, 2022, the company had CA$5.1 million in working capital and no debt.

Troilus has a market cap of CA$$115.78 million with 210,511,685 outstanding shares and 199.61 million in the public float.

It currently trades in the 52-week range between CA$0.34 and CA$0.93.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Katherine DeGilio wrote this article for Streetwise Reports LLC. They members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Troilus Gold Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Troilus Gold Corp., a company mentioned in this article.