Silver X Mining Corp. (AGX:TSX.V) is a Canadian silver developer and producer located in South America (Peru), focused on its 100% owned Tangana project within the Nueva Recuperada Silver District in Central Peru. The company is primarily a silver producer but has also produced gold, lead, and zinc at this project.

Why Silver?

Silver and precious metals, in general, have always been on investors' radars. According to United States Gold Bureau, “thanks to its dual nature as both a precious metal and an industrial metal, silver is both a strong hedge against inflation and a strong store of value."

Chen Lin also spoke with Streetwise Reports about the silver sector, saying, “I see potentially decades of a bull market in silver due to solar panel demand.”

In a March 2022 podcast for Gold Newsletter, Brien Lundin echoed this sentiment saying, "When people get concerned about the purchasing power of their currencies, they buy gold and they buy silver . . . silver moves more."

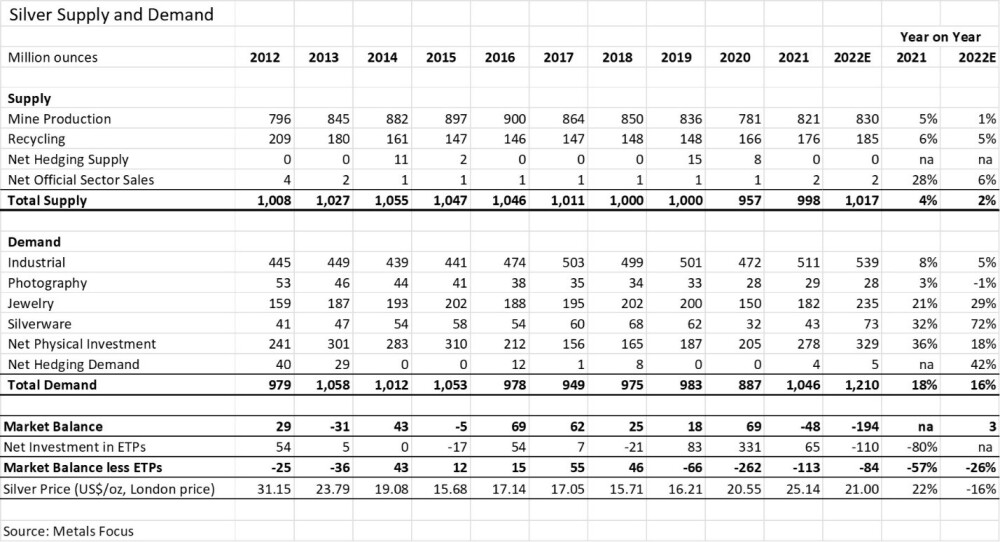

Silver has definitely taken off this past year. Last month, the Silver Institute pointed out that “global silver demand is expected to reach a new high of 1.21 billion ounces in 2022, up by 16% from 2021. Each key segment of demand, except photography, is set to post a new peak."

This isn't only due to silver's acclaim as an inflation hedge but also its use in solar panels.

Need for Silver for Solar

Silver is well-used in PV (photovoltaic) panel making as it is the most conductive metal.

As Resource World Magazine explained, "solar companies turn silver into a paste, loading it into each silicon wafer. When sunlight reaches a panel, silicon sets electrons free. Silver carries electricity through a current, reaching a building or battery for storage."

In a July 25, 2022, research report, Gabriel Gonzalez reiterated Silver X as Echelon's top pick for the third quarter of 2022.

In July of this year, the Biden Administration announced they would be funding a new solar initiative.

This includes the start of a Community Solar Subscription platform to connect families to solar energy and US$10 million under the bipartisan Infrastructure Law to kick off solar energy jobs in underserved communities.

The onslaught of the Ukraine War has also reinstated the need to move to clean energy. According to Reuters, "global clean energy investment is set to rise to more than US$2 trillion a year by 2030, up by half from current levels." This will occur as energy markets worldwide revaluate where their energy needs lie as they adjust to the break in Russia and Europe's previous energy flow.

September 14, 2022, Kitco reported, "the amount of silver used in solar cell production will exceed 3,900t (126Moz) this year, up 15% y/y. To put this into context, this will account for almost 25% of total silver industrial demand (forecast at 533Moz for this year).

Technical analyst Clive Maund believes in the company as well, saying in an August 26, 2022 post, “Silver X Mining Corp. is looking most attractive here after its reaction back of the past two weeks.”

In summation, we need more solar energy, and to do that, we need more silver. This could lead to a great increase in demand for silver, giving investors ample opportunity.

As Chen Lin of What is Chen Buying? What is Chen Selling? said during the Metal Investor’s Forum, "silver has so much room to run.”

Analysts and Newsletter Writers Believe in Silver X

A myriad of analysts and experts cover Silver X. In a July 25, 2022, research report, Gabriel Gonzalez reiterated Silver X as Echelon's top pick for the third quarter of 2022.

Gonzalez went on to say, "We believe that the company is well-positioned as an emerging, growing Americas-focused silver producer and trades at an attractive valuation given its growth potential."

Technical analyst Clive Maund believes in the company as well, saying in an August 26, 2022 post, “Silver X Mining Corp. is looking most attractive here after its reaction back of the past two weeks.”

Maund went on to reiterate his rating of the company as a Strong Speculative Buy in a September 9, 2022, release,

Chen Lin has also spoken extensively about the company. In an October 12, 2022 newsletter, he mentioned that he had visited the company site the previous year and was impressed.

He said, "AGX has had good production numbers lately, and it should break even if not make some money even at the current metal price. It has some very impressive drilling results lately, including some high-grade gold."

Lin also highlighted that part of his confidence in the company rests in the CEO owning many of the shares. This month, Lin told Streetwise Reports, "management owns like 20% of the share of the stock. So they have a lot of skin in the game."

You can view more of what analysts and newsletter writers are saying by clicking "See More Live Data" in the data box above.

New Discoveries

November 16, 2022, Silver X announced results from its Lily 19 mining concession across from its Tangana project. Lily 19 is a 1,000-hectare (ha) project with "515 ha of limestones with Ag-Pb-Zn mineralization and 485 ha of intensely altered subvolcanic rocks with vein and disseminated precious metal mineralization potential."

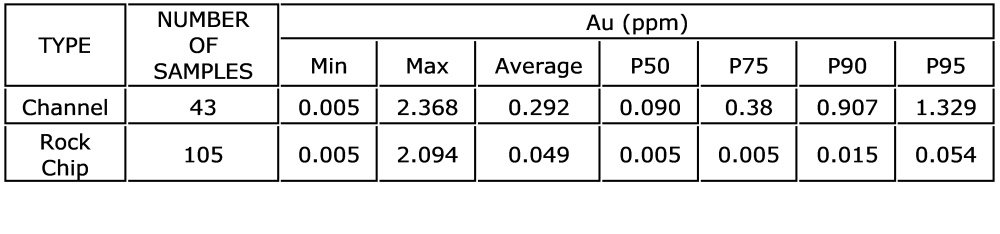

Then November 23, 2022, Silver X revealed it had discovered disseminated targets of gold and silver at Ccasahuasi (the "Ccasahuasi Project"). This project included five concessions, one of which was Lily 19. The others include Ichupata 11, Ichupata 13, Ichupata 14, and Karla 76. The results of the discovery can be seen in the chart provided below.

Chen Lin commented on the company already finding gold saying, "they found some gold right next to their silver deposit, then they're going to drill and find out. It's getting very exciting for the company going forward."

Catalyst: Silver X Announces Record Operating Earnings

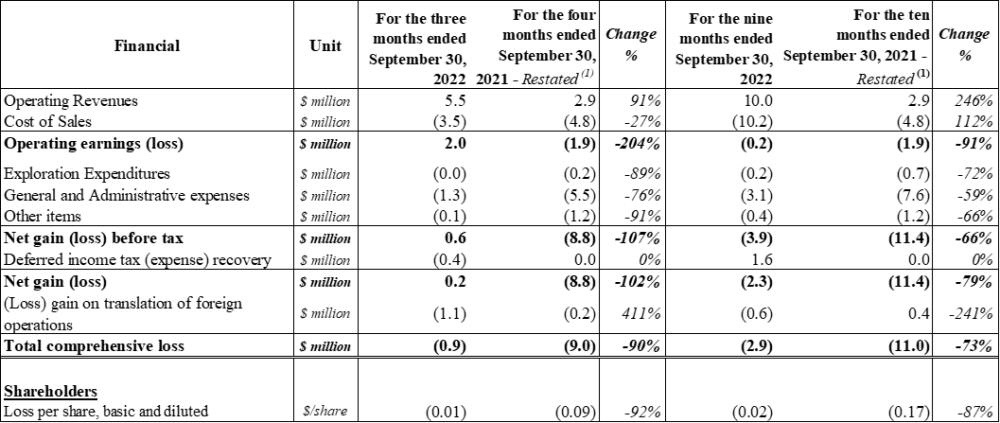

November 28, 2022, Silver X released "record operating earnings of US$2 million and all-in-sustaining cost per silver equivalent ounce produced of US$15.8 in the third quarter of 2022."

Highlights of this quarter included:

- Quarterly operating revenues of US$5.5 million, a 73% increase from the previous quarter.

- US$2.0 million in quarterly operating earnings attained.

- The company achieved a net gain in a quarter for the first time, with a net gain of US$0.2 million.

- Cash costs of US$11.0 per silver equivalent (AgEq) ounce produced and all-in-sustaining cost of US$15.8 per AgEq ounce produced.

- Record monthly AgEq ounces processed in August of 195,039.

- Record quarterly AgEq ounces processed and produced of 481,040 and 371,072, respectively.

1. Cash costs per AgEq ounce produced and AISC per AgEq ounce produced are non-IFRS financial ratios. These are based on non-IFRS financial measures that do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. Please refer to the “Non-IFRS Measures” section of this press release for further information.

2. AgEq ounces produced were calculated using the average sales prices of each metal for each month, and revenues from concentrate sales do not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

Timothy Lee of Red Cloud commented on these results, saying, "Overall, these are positive results, as they demonstrate continued quarterly production growth with higher grades and lower costs. While this is a good step, we urge investors to remain focused on AGX’s ramp-up to full production as opposed to bottom-line earnings at this stage."

Timothy Lee of Red Cloud commented on these results, saying, "Overall, these are positive results, as they demonstrate continued quarterly production growth with higher grades and lower costs.

Jose M. Garcia, CEO of Silver X, was also excited in light of these results. In the release, he stated, "Month-over-month production improvements were the hallmarks of the positive financial results during this quarter that we hope to see continue through the remainder of the year as we continue ramping up to commercial production."

Chen Lin also echoed this optimism in an interview with Streetwise Reports, saying that Silver X "has a very good track record. If you look at management, Jose Garcia has many successful projects . . . and they have already started earning money, which is not easy in this market." This is one of the reasons Lin recommends the company.

Ownership and Share Structure

Silver X Mining Corp.'s management owns approximately 17% of the company's shares. CEO Garcia has 8.71% with 13.64 million shares. Director and Vice President of Corporate Development Sebastian Wahl has 8.22% with 12.87 million shares. 18% of the shares belong to institutions. Baker Steel Capital Managers LLP is the institution with the most shares at 12.46%, with 19.50 million shares. and U.S. Global Investors is second at 5.34% with 8.36 million shares. 65% of the shares are in retail.

Silver X has a market cap of US$64.185 million and around 156.9 million outstanding shares. It has 175.5 million fully-diluted shares and 18.7 million warrants, stock options, and restricted stock units (RSU). Silver X trades in the 52-week range between US$0.17 and US$0.48.

Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Disclosures:

1) Katherine DeGilio wrote this article for Streetwise Reports LLC. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Silver X Mining Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp., a company mentioned in this article.